TESTING INTERNATIONAL PRICE TRANSMISSION UNDER ...

TESTING INTERNATIONAL PRICE TRANSMISSION UNDER ...

TESTING INTERNATIONAL PRICE TRANSMISSION UNDER ...

Create successful ePaper yourself

Turn your PDF publications into a flip-book with our unique Google optimized e-Paper software.

Annexes<br />

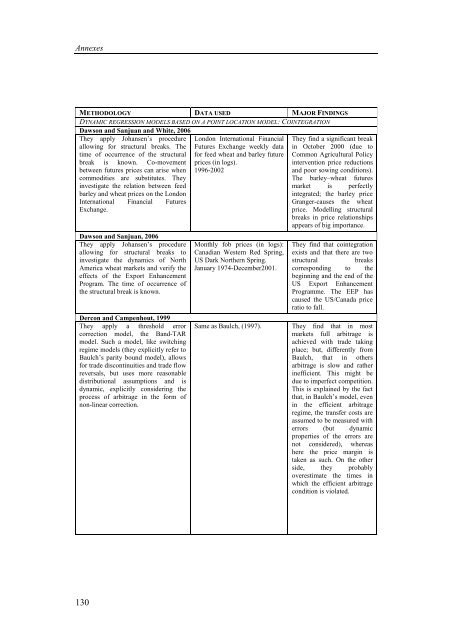

METHODOLOGY DATA USED MAJOR FINDINGS<br />

DYNAMIC REGRESSION MODELS BASED ON A POINT LOCATION MODEL: COINTEGRATION<br />

Dawson and Sanjuan and White, 2006<br />

They apply Johansen’s procedure<br />

allowing for structural breaks. The<br />

time of occurrence of the structural<br />

break is known. Co-movement<br />

between futures prices can arise when<br />

commodities are substitutes. They<br />

investigate the relation between feed<br />

barley and wheat prices on the London<br />

International Financial Futures<br />

Exchange.<br />

Dawson and Sanjuan, 2006<br />

They apply Johansen’s procedure<br />

allowing for structural breaks to<br />

investigate the dynamics of North<br />

America wheat markets and verify the<br />

effects of the Export Enhancement<br />

Program. The time of occurrence of<br />

the structural break is known.<br />

Dercon and Campenhout, 1999<br />

They apply a threshold error<br />

correction model, the Band-TAR<br />

model. Such a model, like switching<br />

regime models (they explicitly refer to<br />

Baulch’s parity bound model), allows<br />

for trade discontinuities and trade flow<br />

reversals, but uses more reasonable<br />

distributional assumptions and is<br />

dynamic, explicitly considering the<br />

process of arbitrage in the form of<br />

non-linear correction.<br />

130<br />

London International Financial<br />

Futures Exchange weekly data<br />

for feed wheat and barley future<br />

prices (in logs).<br />

1996-2002<br />

Monthly fob prices (in logs):<br />

Canadian Western Red Spring,<br />

US Dark Northern Spring.<br />

January 1974-December2001.<br />

Same as Baulch, (1997).<br />

They find a significant break<br />

in October 2000 (due to<br />

Common Agricultural Policy<br />

intervention price reductions<br />

and poor sowing conditions).<br />

The barley–wheat futures<br />

market is perfectly<br />

integrated; the barley price<br />

Granger-causes the wheat<br />

price. Modelling structural<br />

breaks in price relationships<br />

appears of big importance.<br />

They find that cointegration<br />

exists and that there are two<br />

structural breaks<br />

corresponding to the<br />

beginning and the end of the<br />

US Export Enhancement<br />

Programme. The EEP has<br />

caused the US/Canada price<br />

ratio to fall.<br />

They find that in most<br />

markets full arbitrage is<br />

achieved with trade taking<br />

place; but, differently from<br />

Baulch, that in others<br />

arbitrage is slow and rather<br />

inefficient. This might be<br />

due to imperfect competition.<br />

This is explained by the fact<br />

that, in Baulch’s model, even<br />

in the efficient arbitrage<br />

regime, the transfer costs are<br />

assumed to be measured with<br />

errors (but dynamic<br />

properties of the errors are<br />

not considered), whereas<br />

here the price margin is<br />

taken as such. On the other<br />

side, they probably<br />

overestimate the times in<br />

which the efficient arbitrage<br />

condition is violated.