TESTING INTERNATIONAL PRICE TRANSMISSION UNDER ...

TESTING INTERNATIONAL PRICE TRANSMISSION UNDER ...

TESTING INTERNATIONAL PRICE TRANSMISSION UNDER ...

Create successful ePaper yourself

Turn your PDF publications into a flip-book with our unique Google optimized e-Paper software.

Empirical Analysis: Cointegration Models Accounting for Policy Regime Changes<br />

α<br />

LM test<br />

ARCH(13)<br />

84<br />

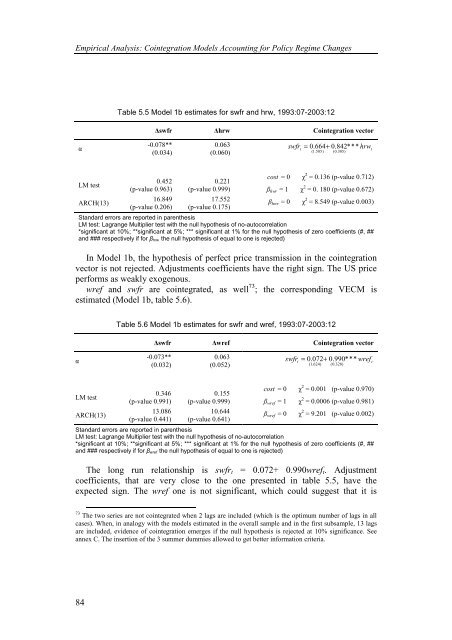

Table 5.5 Model 1b estimates for swfr and hrw, 1993:07-2003:12<br />

∆swfr ∆hrw Cointegration vector<br />

-0.078**<br />

(0.034)<br />

0.452<br />

(p-value 0.963)<br />

16.849<br />

(p-value 0.206)<br />

0.063<br />

(0.060)<br />

0.221<br />

(p-value 0.999)<br />

17.552<br />

(p-value 0.175)<br />

swfr = 0.<br />

664+<br />

0.<br />

842*<br />

* * hrw<br />

t<br />

( 1.<br />

505)<br />

( 0.<br />

305)<br />

cost = 0 χ 2 = 0.136 (p-value 0.712)<br />

β hwr = 1 χ 2 = 0. 180 (p-value 0.672)<br />

β hwr = 0 χ 2 = 8.549 (p-value 0.003)<br />

Standard errors are reported in parenthesis<br />

LM test: Lagrange Multiplier test with the null hypothesis of no-autocorrelation<br />

*significant at 10%; **significant at 5%; *** significant at 1% for the null hypothesis of zero coefficients (#, ##<br />

and ### respectively if for βhrw the null hypothesis of equal to one is rejected)<br />

In Model 1b, the hypothesis of perfect price transmission in the cointegration<br />

vector is not rejected. Adjustments coefficients have the right sign. The US price<br />

performs as weakly exogenous.<br />

wref and swfr are cointegrated, as well 73 ; the corresponding VECM is<br />

estimated (Model 1b, table 5.6).<br />

α<br />

LM test<br />

ARCH(13)<br />

Table 5.6 Model 1b estimates for swfr and wref, 1993:07-2003:12<br />

∆swfr ∆wref Cointegration vector<br />

-0.073**<br />

(0.032)<br />

0.346<br />

(p-value 0.991)<br />

13.086<br />

(p-value 0.441)<br />

0.063<br />

(0.052)<br />

0.155<br />

(p-value 0.999)<br />

10.644<br />

(p-value 0.641)<br />

swfr = 0.<br />

072+<br />

0.<br />

990*<br />

* * wref<br />

t<br />

( 1.<br />

624)<br />

( 0.<br />

328)<br />

cost = 0 χ 2 = 0.001 (p-value 0.970)<br />

β wref = 1 χ 2 = 0.0006 (p-value 0.981)<br />

β wref = 0 χ 2 = 9.201 (p-value 0.002)<br />

Standard errors are reported in parenthesis<br />

LM test: Lagrange Multiplier test with the null hypothesis of no-autocorrelation<br />

*significant at 10%; **significant at 5%; *** significant at 1% for the null hypothesis of zero coefficients (#, ##<br />

and ### respectively if for βwref the null hypothesis of equal to one is rejected)<br />

The long run relationship is swfrt = 0.072+ 0.990wreft. Adjustment<br />

coefficients, that are very close to the one presented in table 5.5, have the<br />

expected sign. The wref one is not significant, which could suggest that it is<br />

73 The two series are not cointegrated when 2 lags are included (which is the optimum number of lags in all<br />

cases). When, in analogy with the models estimated in the overall sample and in the first subsample, 13 lags<br />

are included, evidence of cointegration emerges if the null hypothesis is rejected at 10% significance. See<br />

annex C. The insertion of the 3 summer dummies allowed to get better information criteria.<br />

t<br />

t