Gudiyattam Gudiyattam Town - Municipal

Gudiyattam Gudiyattam Town - Municipal

Gudiyattam Gudiyattam Town - Municipal

You also want an ePaper? Increase the reach of your titles

YUMPU automatically turns print PDFs into web optimized ePapers that Google loves.

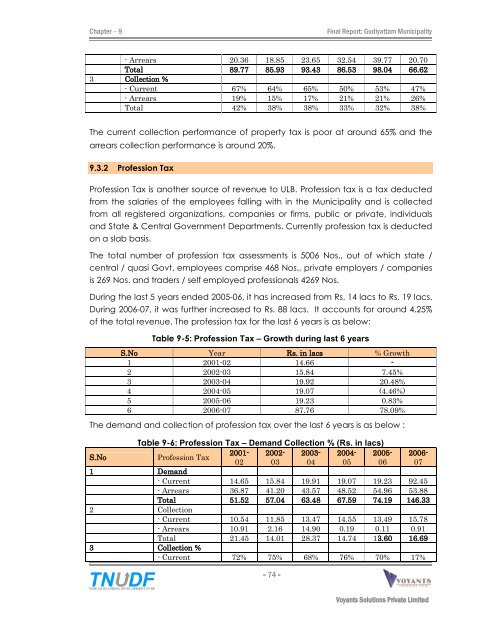

Chapter ñ 9 Final Report: <strong>Gudiyattam</strong> <strong>Municipal</strong>ity<br />

- Arrears 20.36 18.85 23.65 32.54 39.77 20.70<br />

Total 89.77 85.93 93.43 86.53 98.04 66.62<br />

3 Collection %<br />

- Current 67% 64% 65% 50% 53% 47%<br />

- Arrears 19% 15% 17% 21% 21% 26%<br />

Total 42% 38% 38% 33% 32% 38%<br />

The current collection performance of property tax is poor at around 65% and the<br />

arrears collection performance is around 20%.<br />

9.3.2 Profession Tax<br />

Profession Tax is another source of revenue to ULB. Profession tax is a tax deducted<br />

from the salaries of the employees falling with in the <strong>Municipal</strong>ity and is collected<br />

from all registered organizations, companies or firms, public or private, individuals<br />

and State & Central Government Departments. Currently profession tax is deducted<br />

on a slab basis.<br />

The total number of profession tax assessments is 5006 Nos., out of which state /<br />

central / quasi Govt. employees comprise 468 Nos., private employers / companies<br />

is 269 Nos. and traders / self employed professionals 4269 Nos.<br />

During the last 5 years ended 2005-06, it has increased from Rs. 14 lacs to Rs. 19 lacs.<br />

During 2006-07, it was further increased to Rs. 88 lacs. It accounts for around 4.25%<br />

of the total revenue. The profession tax for the last 6 years is as below:<br />

Table 9-5: Profession Tax ñ Growth during last 6 years<br />

S.No Year Rs. in lacs % Growth<br />

1 2001-02 14.66 -<br />

2 2002-03 15.84 7.45%<br />

3 2003-04 19.92 20.48%<br />

4 2004-05 19.07 (4.46%)<br />

5 2005-06 19.23 0.83%<br />

6 2006-07 87.76 78.09%<br />

The demand and collection of profession tax over the last 6 years is as below :<br />

Table 9-6: Profession Tax ñ Demand Collection % (Rs. in lacs)<br />

S.No Profession Tax<br />

2001-<br />

02<br />

2002-<br />

03<br />

- 74 -<br />

2003-<br />

04<br />

2004-<br />

05<br />

2005-<br />

06<br />

2006-<br />

07<br />

1 Demand<br />

- Current 14.65 15.84 19.91 19.07 19.23 92.45<br />

- Arrears 36.87 41.20 43.57 48.52 54.96 53.88<br />

Total 51.52 57.04 63.48 67.59 74.19 146.33<br />

2 Collection<br />

- Current 10.54 11.85 13.47 14.55 13.49 15.78<br />

- Arrears 10.91 2.16 14.90 0.19 0.11 0.91<br />

Total 21.45 14.01 28.37 14.74 13.60 16.69<br />

3 Collection %<br />

- Current 72% 75% 68% 76% 70% 17%<br />

Voyants Solutions Private Limited