OPEN - ESDS

OPEN - ESDS

OPEN - ESDS

Create successful ePaper yourself

Turn your PDF publications into a flip-book with our unique Google optimized e-Paper software.

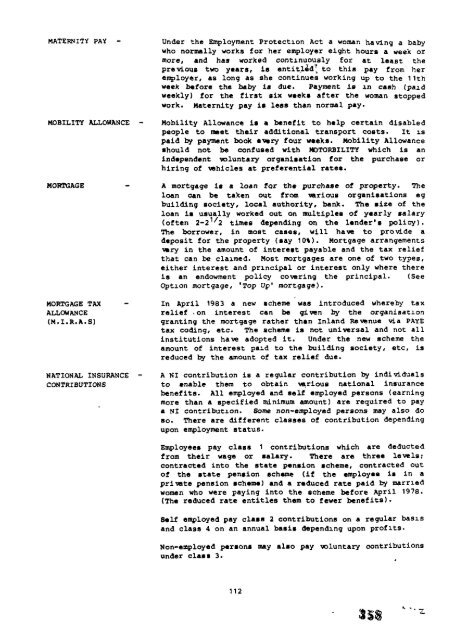

MATERNITY PAY - Under the Employment Protection Act a woman having a baby<br />

MOBILITY ALLOWANCE -<br />

MORTGAGE TA5 -<br />

ALLCW~CE<br />

(M. I. R.A. S)<br />

NATIONAL INSURANCE -<br />

CONTRIBUTIONS<br />

who normally works for her employer eight hours a week or<br />

more, and has worked contLnuOusly fOr at leest the<br />

previous two years, is entit.l~d~ tO this pay from her<br />

employer, as long as she continues working up to the 1 Ith<br />

week before the hby is due. Peyment ia An cash (paid<br />

weekly) for the first six weeks after the woman stopped<br />

work. Maternity pay is lese than norn!a 1 pay.<br />

Mobility Allowance is a benefit to help certain disabled<br />

people to maet their additional tranBport costs. It 1s<br />

paid ~ payment tiok ● WV four weeks. Mobility Allowance<br />

should not be confused with ~TORBILITY which is an<br />

independent mluntarj organisation for the purchaee or<br />

hiring of Whicles at preferential rates.<br />

A mortgage is a loan for the purchase of property. The<br />

loan can be taken out from vsrioum organisations eg<br />

building society, local authority, bank. The size of the<br />

loan is usually worked out on multipIes of yaarly selary<br />

( often 2-2 1/2 timen depending on the lander”s policy) .<br />

The borrower, in most cases, will have to protide a<br />

daposit for the property ( say 10%). Mortgage arrangements<br />

wry in the amount of interest payable and the tax relief<br />

that can be claimed. Heat mortgages are ona of two types,<br />

either interest and principal or interest only where there<br />

ia an endowment policy cow?ring the principal. (See<br />

Optxon mortgage, ‘Top Up’ mOXtgage).<br />

In April 19S 3 a new scheme was introduced whereby tax<br />

reliaf . on interest can be giw$n by the organisatzon<br />

granting the mortgage rather than Inland Re u!nue via PAYE<br />

tax coding, etc. The scheme ia not uninrsal and not al 1<br />

institutions have adopted it. Under tha new scheme the<br />

amount of intereat paLd to the building society, etc, ia<br />

reduced by the amount of tax relief due.<br />

A NI contribution is a regular contribution by indi vlduals<br />

to ● nable them to obtain ~rioua national insurance<br />

banef its. All employed and aelf employed persons (earning<br />

more than a apecif ied minimum amount) are required to pay<br />

a NI contribut~on. sane non-employed persons may alao do<br />

ao. There are different clasaea of contribution depending<br />

upon employment status.<br />

Employees pay claaa 1 contributions which are deducted<br />

f rorn their wage or salary. There are three lewls;<br />

contracted into the atate pension scheme, contracted out<br />

of the rotate pension achame (if the employ-e is in a<br />

pri ~ta pension ● chemo) and a raduced rate paid bq married<br />

woman who were paying into the scheme bafora April 1978.<br />

(The reduced rate entitles them to fewer banef its).<br />

Self employed pay claaa 2 contributions on a regular basis<br />

and claaa 4 on an annual baaia depand~ng upon prof lta.<br />

Non-employed pmraona may almo pay ~luntary contributions<br />

under clasa 3.<br />

112