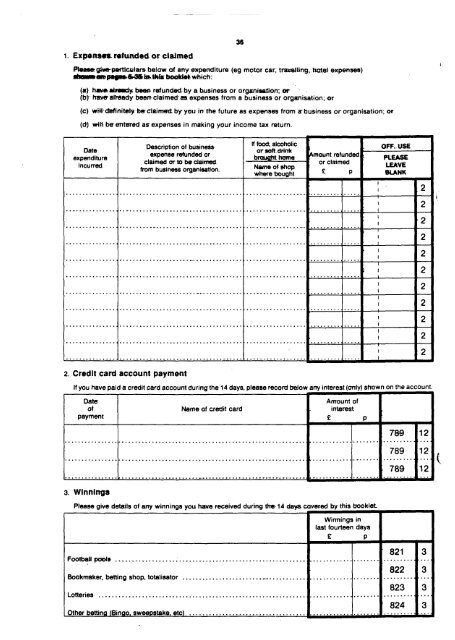

1. Expansea- wfwtded or clalmed Pfueae~paftkulers below of any’ expenditure (eg motor car; trsmeiling,. hotel expenses) ~a8~~luL.thh ~ which: (8) h&ve~y beet? refunded. by & business or orgami~on or (b)’ h’aw alPeedy beem claimed” = expenses from a business or organisation; or 36 (c) will’ definitdybe - claimed by yau in the future as expenses from z business or organisation; or (d) wilt be entered as expenses in making your income tax return. ~ Date expenditure incurr~ Description of busineSs expenaa refunded or claimed or m be CJaimecl from buainees orgeWaation. If food, alcoholic or soft.drink brou@t home, Name of chop where bought maunt refunded \ ? or claimed f P aff. uaE PLEAaE LE&VE 8LANK ....................................................................... .................. I 1“ 2 I 2 ........................................................................ .........,..... I II ‘2 ........................................................................ ............... 1 I 2 .....................................................,.,..-.

-. ( ( . ... . . ---- ___ ...—-... ->.- ..——.. . REFERENCE LIST OF IMPORTANT ITEMS OF EXPENDITURE 37 Of the hundreds of different things which it is possible to buy, the following is only a list of examples. Please look through this list in case it reminds you of any purchase which you have forgotten to record. Food- Bread, cakes, buns, biscuits, chocolate biscuits, flour. Breakfast cereals, rice, spaghetti, custard powders. Beef, veal, mutton, lamb, pork, bacon, ham, poultry, sausages, tinned meat, rabbit, offal (hearts, liver, kidney etc). Fresh or smoked cod, haddock, plaice, herrings, tinned salmon, sardines. Milk (fresh, dried, condensed). Margarine, lard, suet, cooking fat. Eggs, butter, cheese. Tea, coffee, instant coffee, cocoa. Sugar, syrup, jam, marmalade, honey, lemon curd. Fresh, dried, frozen or tinned potatoes, chips, crisps, tomatoes, peas, beans, carrots. Fresh, dried, frozen or tinned apples, oranges, plums, pears, peaches, pineapples, apricots. Bottled or tinned tomato juice, grapefruit juice, orange juice. Pickles, sauces, soups, jellies, salt, pepper. Mustard, vinegar, spices. Lemonade, lemon squash, fruit cordials, soda water. Food for animals and pets. Take-away mea18- Fish and chips, Chinese food, Indian food, Fried chicken, Meals on wheels. Meals, snacks and non-alcoholic drtnks bought ●nd consumed ●way from home- Tea, coffee, snacks, sandwiches and meals bought and consumed at work, in restaurants, cafes, hotels, public houses, in parks, in cinemas. Ice cream, soft drinks, sweets and chocolate. Alcoholic drlnks:- Beer, ale, stout, wines, spirits, cider. Cigarettes and Tobacco, Newapapera, Magazines, Books, Poatago- Cigarettes, tobacco, cigarette papers, cigars, pipes, pouches, lighters, lighter fuel, cigarette cases. Books, newspapers, magazines, stationery. Stamps, postal orders, poundage, telegrams, telephone calls. Fuel and light, Household gooda, Claanlng matarlals, Furnltura:- Coal, coke, gas, electricity, paraffin and other fuel oil, firewood, candles, nightlights, matches. Soap, soda, cleaning powders, detergents, polishes. Paint, distemper, wallpaper. Dustbins, pails, brushes, brooms, tools, screws, nails. China, glass, bowls, kettles, saucepans. Suites or separate articles of furniture. Radio, television sets or parts, hi-fi, cassettes, pianos, music. Mattresses, pillows, sheets, blankets, tablecloths, towels, curtains, teacloths. Carpets, rugs, linoleum, mats, floor covering. Fires, cookers, vacuum cleaners, refrigerators, wringers, washing machines, spin-driers, sewing machines, irons, electric lamps, bulbs and fittings. Clocks, watches, jewellery, cutlery, suit-cases, handbags, sports goods. Repairs to furniture, radio, TV and watches. Travel:- Journeys by rail, bus, air, taxi, including fares to and from work. Purchase, repairs and running costs of cars, motorcycles, prams, pushchairs, carry cots. Clothing, Clothing materlais, Footwear+ Overcoats, raincoats, suits, costumes, skirts, sports coats, trousers, blazers, slipovers, overalls, aprons, dresses, blouses, hats, gloves. Vests, pants, pyjamas, shirts, knickers, slips, corsets, brassieres, nightdresses, socks, stockings, tights. Dress material, knitting wool, thread, braces, ribbons, scarves, patterns, handkerchiefs. Boots, shoes, slippers~sandals. Payments to clothing clubs. Other payments:- Video rental, hire of cassettes, TV rental. Home computer, TV games. Cameras, photographic materials, developing and printing of films. Flowers, seeds, plants, garden tools, Iawnmowers. Animals and pets. Toys, games, playing cards. Shoe repairs, laundry, dyeing and cleaning, domestic help. Football pools and other betting, Bingo, etc. Children’s pocket money, birthday presents, money given to charities, raffle tickets. Payments to chemists, doctors, dentists, opticians, chiropodists. Holiday expenses. Purchase of Savings Certificates, Premium Bonds, etc. House purchase, repairs and improvements. Cinemas, theatres, concerts, football, cricket, dog-racing, dances. face face cream mascara talc sanitaw towels deodorant 1

- Page 1 and 2:

GENSML INDEX Sampling Instructions

- Page 3 and 4:

CZI~S AND PUDOSES 1.1 Of all the mn

- Page 5 and 6:

SECTION INDEX PAGES 4-10 PROCEDURES

- Page 7 and 8:

Fieldwork in each area continues fo

- Page 9 and 10:

I Adjustment to placing Pattern To

- Page 11 and 12:

Checking calls 5.7 First checking c

- Page 13 and 14:

SECTION INDEX PAGES 11-14 GENERAL P

- Page 15 and 16:

a. Q56 b. Questions where precise w

- Page 17 and 18:

16. 17. There are a number Of Colum

- Page 19 and 20:

EOUSESO~ SCHEDULE- INTRODUCTION A T

- Page 21 and 22:

Applying the Definition of Spander

- Page 23 and 24:

d. e. f. 9. Spender lea ves unexpec

- Page 25 and 26:

I Non-rm2ati rn contributory to hou

- Page 27 and 28:

P.00ms in rateable unit not yet acc

- Page 29 and 30:

Last rent paymant Q. 18 NOTE CHANGE

- Page 31 and 32:

Mains sewerage/14ains water supply

- Page 33 and 34:

Interest only mortgage paymant Qs.

- Page 35 and 36:

Electricity and gas payments Q51-70

- Page 37 and 38:

Life assurance death/endowmsnt poli

- Page 39 and 40:

Tax or insurance can covsr any peri

- Page 41 and 42:

3. Qs 85 and 86 relate to instalmen

- Page 43 and 44:

Other mail order organisations dire

- Page 45 and 46:

Wtrosps.cti = questions Q 88-102 NO

- Page 47 and 48:

TYPC of holiday Q 97 A Package hOli

- Page 49 and 50:

Trawel to school - state school chi

- Page 51 and 52:

Visits to local authority office Q

- Page 53 and 54:

SECTION INDEX PAGES 50-7 GENERAL PO

- Page 55 and 56:

ExaMpleS Of ordering of Person Numb

- Page 57 and 58:

Residents employees eg, Au pair, do

- Page 59 and 60:

Rstired (code 6) Q. l(b) It is diff

- Page 61 and 62:

Most remunerate - and subsidiary em

- Page 63 and 64:

O-eductions from pay for charities

- Page 65 and 66:

USUal hours Q. 22 usual hours are n

- Page 67 and 68:

Total turrio=r Q. 46 Is asked of al

- Page 69 and 70:

The initials will need to be referr

- Page 71 and 72:

Statutoxy Sick Pay, N.1. Sickness B

- Page 73 and 74:

oTHER STATE OR NI BENEFITS Q. 58(d)

- Page 75 and 76:

Allowance recei vad from or bills p

- Page 77 and 78:

Only money aCtUally sent abroad sho

- Page 79 and 80:

Amount in Sa tinga Accounts Q86 Thi

- Page 81 and 82:

SECTION INDEX Diary record booklet

- Page 83 and 84:

ALL EXPENDITURE SHOULD BE RECORDED

- Page 85 and 86:

d. Bread bill: Itemise cakes and br

- Page 87 and 88:

Ssers, wines, spirits and other alc

- Page 89 and 90:

d. Play schools/Nursery Schools Fee

- Page 91 and 92:

. Holidays outside UK (including Ch

- Page 93 and 94:

CHECKING SCHEDULE K AND GSNENAL CHE

- Page 95 and 96:

I Do Posting Diaries in lieu of Fin

- Page 97 and 98:

RSTUNN OF WORK - INTRODUCTION 8.1 S

- Page 99 and 100:

Form J - Deapatch note ,, , 8.4 NOT

- Page 101 and 102:

Action CODE 4 ActIon CODE 5 CODE 6

- Page 103 and 104:

Administration and checking tima 8.

- Page 105 and 106:

Refusals If you get 2 refusals in o

- Page 107 and 108:

SECTION INDEX Copy of advance lette

- Page 109 and 110:

Dear Sir/Madam, Housing Benefit Reg

- Page 111 and 112:

GLOSSARY ACCIDENT INSUFW4CE - ADDIT

- Page 113 and 114:

CHECK TWL)ER - CHEQUE GUARANTEE CAP

- Page 115 and 116:

CURRENT ACCOUNT - See Bank Current

- Page 117 and 118:

I HOUSING BENEFIT - HOUSING BENEFIT

- Page 119 and 120:

MATERNITY PAY - Under the Employmen

- Page 121 and 122:

POST OFFICE GIRO PRIVATE SICKNESS S

- Page 123 and 124:

STANDING OP.DERS - STATUTORY NATEP.

- Page 125 and 126:

WAR LOAN - WAR DISABILITY PENSION W

- Page 127 and 128:

THE SAMPLE Conwsrslon to PAF FES SA

- Page 129 and 130:

),” SECOND LINE Area Number Post

- Page 131 and 132:

77 75b 76 ;.% ●.* ● 75 74 73 72

- Page 133 and 134:

ADDRSSS LABELS In adtitlon to your

- Page 135 and 136:

2. Upper flat, 7 Mandells Road’ a

- Page 137 and 138:

cONCEALED MULTI-HOUSEHOLD PROCEDURE

- Page 139 and 140:

GHS/FES EXAMPLE TO BE RETURNED TO F

- Page 141 and 142:

2. PRE-SAMPLED MULTI -HOUSEHOLD PRO

- Page 143 and 144:

ns/FES , (FOR USE IN SCOTLAND PATEA

- Page 145 and 146:

B HoUSEHOLD SELECTION PROCEDURE Jsc

- Page 147 and 148:

GHs/FES EXAMPLE TO BE RSTURNED TO F

- Page 149 and 150:

.. .... 1 .-,..:.. ,-.._ .4-- ----

- Page 151 and 152:

. —. (Ask hoh or wife) s I I 15 I

- Page 153 and 154:

— .——. 5 -. .—. -— To ●

- Page 155 and 156:

To ●u hooscholds (Ask hoh or wife

- Page 157 and 158:

To ●ll who own with mortgage, loa

- Page 159 and 160:

-.— .-...— To all =ho o- with m

- Page 161 and 162:

—. . To ●ll households (Ask hoh

- Page 163 and 164:

those pay~g by board bodgcting =hem

- Page 165 and 166:

I I I I I I 0 Q To 66 67 68 69 7(

- Page 167 and 168:

To W households ~“ 72 Do (any of)

- Page 169 and 170:

PME A21 To all households Ask ●ll

- Page 171 and 172:

23 ‘Blank page’ . 23

- Page 173 and 174:

To ●u who h8ve COlltiUOUS use Of

- Page 175 and 176:

To 8U households I Aak all apcndcrs

- Page 177 and 178:

—- . 81 (cent’d) DNA 29 LI__J-G

- Page 179 and 180:

To all houschohls Ask ●ll apcndcr

- Page 181 and 182:

To alJ spenders with instdnents (co

- Page 183 and 184:

To all households EEiiEEl 35 l?E.@R

- Page 185 and 186:

To all households Ask ●ll spender

- Page 187 and 188:

B\ . ) / To all households Ask all

- Page 189 and 190:

O . t- List of examples shown on Pr

- Page 191 and 192:

i) (3 List of’ examples shown on

- Page 193 and 194:

To all households I Ask ●ll apcnd

- Page 195 and 196:

To all households .0 EEEl ‘5 ~GCO

- Page 197 and 198:

To all households 103 Do (any of) y

- Page 199 and 200:

TO ●u households . l=G==l 105 106

- Page 201 and 202:

To 8U hOuhOkis 54 ~ RGCOI?D 25 110

- Page 203 and 204:

To au households &E!!&_l 112 In the

- Page 205 and 206:

115 116 . 58 =uationa] kome ●nd C

- Page 207 and 208:

. TO III households 1===1 ‘0 120

- Page 209 and 210:

TO all households l=G==l 123 Do (an

- Page 211 and 212:

TO U households ●t end of t~rd-ka

- Page 213 and 214:

IN CONFIDENCE FasniiyExpessdtire In

- Page 215 and 216:

To all unemployed intending to work

- Page 217 and 218:

Question 9(a) (continued) 5 Per No.

- Page 219 and 220:

,. t) To all employees (coded 1 at

- Page 221 and 222:

Most rcmunmtive job (continued) 9 1

- Page 223 and 224:

11 Most remunerative pb as employee

- Page 225 and 226:

Most rcmu.nemtivc job as employee (

- Page 227 and 228:

Most remunerative job as employee (

- Page 229 and 230:

——. .— Subsidiary employment

- Page 231 and 232:

To all SCMemployed (coded 2 at l(a)

- Page 233 and 234: I ...—-— --- - ——~— --- T

- Page 235 and 236: To all self employed except those w

- Page 237 and 238: ● To all Refer Informant to Promp

- Page 239 and 240: To all 28 Refer Informant to Prompt

- Page 241 and 242: 53 (mnt’d) Prompt Card O (coat’

- Page 243 and 244: Refer Informant to Prompt Card P 56

- Page 245 and 246: To women aged under 51 only / ~ ...

- Page 247 and 248: To all 36 WqE B36 Refer i.nfo~nt to

- Page 249 and 250: To all Refer informant to Prompt Ca

- Page 251 and 252: 64 Pa (a) To all Prompt Card S (com

- Page 253 and 254: . * 63 (UMM’d) Prompt &d T (cent

- Page 255 and 256: . % 3( Q66 (cent’d) R’OmPt @& U

- Page 257 and 258: 46 Q67, (Cent’d) per No. Prompt C

- Page 259 and 260: 48 To all / per No. per No. per No.

- Page 261 and 262: To sI1 — 72 — —!- =. -- --- .

- Page 263 and 264: To all men under 66 and all women u

- Page 265 and 266: To all Per No. Per No. Per No. 80 D

- Page 267 and 268: % Ask about each dependant under 16

- Page 269 and 270: RECORD110 fF)~E B58 58 To all spend

- Page 271 and 272: RECOI?J) 115 60 To all with gurrcn~

- Page 273 and 274: 62 #VNE BG2 To all with Building So

- Page 275 and 276: To all Stockq 93. (8) (b) (c) ST QO

- Page 277 and 278: FAMILY RECORD I13 Off. Use. AREA NU

- Page 279 and 280: ——... .. - 3 1T.Wharoalaohdhdrh

- Page 281 and 282: 5 EXAMPLE PAGE Phase write each ite

- Page 283: ( ( FOURTEENTH DAY (corrtinued) 35

- Page 287 and 288: INTERVIEWER USE ASK INFORMANTS 1.)