OPEN - ESDS

OPEN - ESDS

OPEN - ESDS

You also want an ePaper? Increase the reach of your titles

YUMPU automatically turns print PDFs into web optimized ePapers that Google loves.

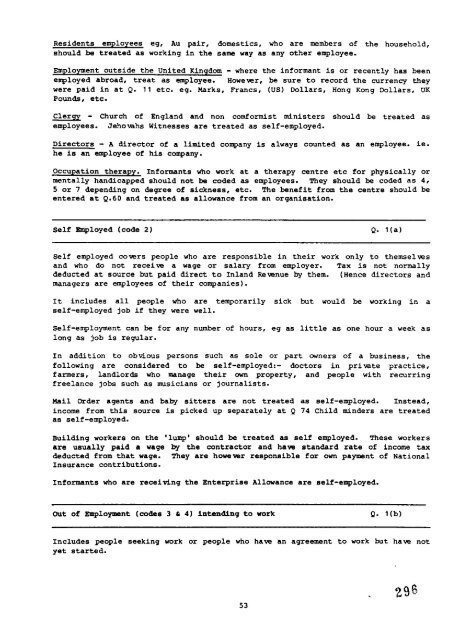

Residents employees eg, Au pair, domestics, who are metiers of the household,<br />

should bs treated as working in the same way as any other employee.<br />

Employment outside the United Kingdom - where the informant is or recently has been<br />

e~loyed abroad, treat as employee. However, ha sure to record the m.mrency they<br />

were paid in at Q. 11 etc. eg. Marks, Francs, (US) Dollars, Hong Kong Dollars, UK<br />

Pounds, etc.<br />

w - Church of England and non conformist ministers should be treated as<br />

employees. Jehovahs Witnesses are treated as self-employed.<br />

Directors - A director of a limited company is always counted as an employee. ie.<br />

he is an employee of his company.<br />

Occupation therapy. Informants who work at a therapy centre etc for physically or<br />

mentally handicapped should not bs coded as employees. They should bs coded as 4,<br />

5 or 7 depending on degree of sickness, etc. The benefit from the centre should bs<br />

entered at Q.60 and treated as allowance from an organisation.<br />

Self Smployed (cods 2 ) Q. l(a)<br />

Self employed covers people who are responsible in their work only to themsel YSS<br />

and who do not receive a wage or salary from employer. Tax is not normally<br />

deducted at source but paid direct to Inland Rsvenue by them. (Hence directors and<br />

managers are smployees of their companies).<br />

It includes all people who are temporarily sick but would ha working in a<br />

self-employed job if they were well.<br />

Self-emplopnent can bs for any number of hours, eg as little as one hour a week as<br />

long as job is regular.<br />

In addition to obvious persons such as sole or part owners of a business, the<br />

followinq are considered to be self -employed:- doctors in uri vate Dracti ce,<br />

farmers, landlords who manage their own property, and people with recurring<br />

freelance jobs such aa musicians or journalists.<br />

mail order agents and baby sitters are not treated<br />

income from this source ia picked up separately at Q<br />

as self-employed.<br />

as self-employed. Instead,<br />

74 Child minders are treated<br />

Building workers on the *lump’ should ba treated as self employed. These workers<br />

are usually paid a wage by the contractor and hava standard rate of income tax<br />

&ducted frornthat wage. They are bowevsr responsible for own payment of National<br />

Insurance contributions.<br />

Informants who are receiving the Enterprise Allowance are self-employed.<br />

Out of Employment (codes 3 & 4) intending to work Q. l(b)<br />

Includes people seeking work or people who have an agreemsnt to work but ha w not<br />

yet started.<br />

53<br />

29$