3 Issuing costs of state guaranteed bonds - Financial Risk and ...

3 Issuing costs of state guaranteed bonds - Financial Risk and ...

3 Issuing costs of state guaranteed bonds - Financial Risk and ...

Create successful ePaper yourself

Turn your PDF publications into a flip-book with our unique Google optimized e-Paper software.

4 Impact <strong>of</strong> <strong>state</strong> <strong>guaranteed</strong> <strong>bonds</strong> on bank lending, funding <strong>and</strong> pr<strong>of</strong>itability performance<br />

In regard to <strong>state</strong> guarantees, there is some consistency between this framework <strong>and</strong> the<br />

framework relating to the influence <strong>of</strong> capital regulation on capital structure. Namely, there may<br />

exist some element <strong>of</strong> 'moral hazard' ins<strong>of</strong>ar as banks may be motivated to hold smaller capital<br />

buffers in the knowledge that missed SG bond payments are covered by <strong>state</strong> guarantors.<br />

However, banks may also be aware that missing SG bond payments would signal that they are<br />

ailing, causing the cost <strong>of</strong> raising funds to increase, meaning that they may hold additional capital<br />

buffers to guard themselves against this possibility.<br />

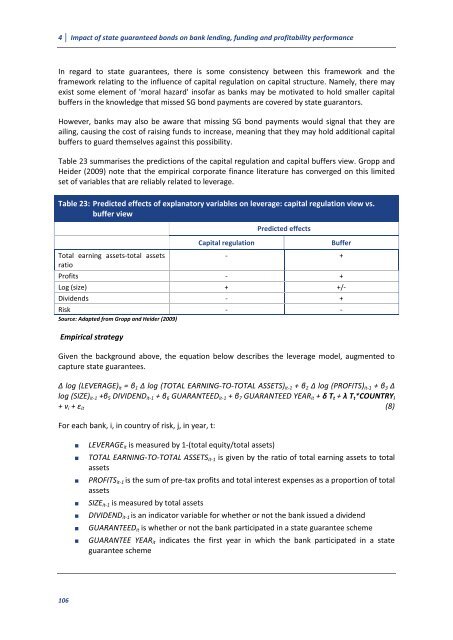

Table 23 summarises the predictions <strong>of</strong> the capital regulation <strong>and</strong> capital buffers view. Gropp <strong>and</strong><br />

Heider (2009) note that the empirical corporate finance literature has converged on this limited<br />

set <strong>of</strong> variables that are reliably related to leverage.<br />

Table 23: Predicted effects <strong>of</strong> explanatory variables on leverage: capital regulation view vs.<br />

buffer view<br />

Total earning assets-total assets<br />

ratio<br />

106<br />

Predicted effects<br />

Capital regulation Buffer<br />

- +<br />

Pr<strong>of</strong>its - +<br />

Log (size) + +/-<br />

Dividends - +<br />

<strong>Risk</strong> - -<br />

Source: Adapted from Gropp <strong>and</strong> Heider (2009)<br />

Empirical strategy<br />

Given the background above, the equation below describes the leverage model, augmented to<br />

capture <strong>state</strong> guarantees.<br />

log (LEVERAGE)it 1 log (TOTAL EARNING-TO-TOTAL ASSETS)it-1 2 log (PROFITS)it-1 3 <br />

log (SIZE)it-1 5 DIVIDENDit-1 6 GUARANTEEDit-1 7 GUARANTEED YEARit t t*i<br />

vi it<br />

(8)<br />

For each bank, i, in country <strong>of</strong> risk, j, in year, t:<br />

LEVERAGEit is measured by 1-(total equity/total assets)<br />

TOTAL EARNING-TO-TOTAL ASSETSit-1 is given by the ratio <strong>of</strong> total earning assets to total<br />

assets<br />

PROFITSit-1 is the sum <strong>of</strong> pre-tax pr<strong>of</strong>its <strong>and</strong> total interest expenses as a proportion <strong>of</strong> total<br />

assets<br />

SIZEit-1 is measured by total assets<br />

DIVIDENDit-1 is an indicator variable for whether or not the bank issued a dividend<br />

GUARANTEEDit is whether or not the bank participated in a <strong>state</strong> guarantee scheme<br />

GUARANTEE YEARit indicates the first year in which the bank participated in a <strong>state</strong><br />

guarantee scheme