3 Issuing costs of state guaranteed bonds - Financial Risk and ...

3 Issuing costs of state guaranteed bonds - Financial Risk and ...

3 Issuing costs of state guaranteed bonds - Financial Risk and ...

You also want an ePaper? Increase the reach of your titles

YUMPU automatically turns print PDFs into web optimized ePapers that Google loves.

2 Overview <strong>of</strong> <strong>state</strong> guarantee schemes<br />

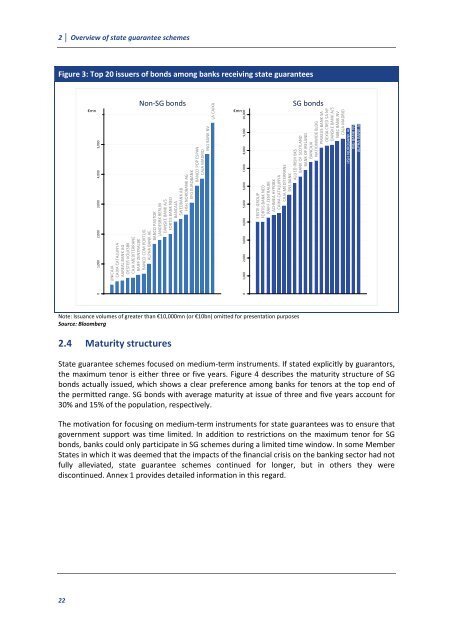

Figure 3: Top 20 issuers <strong>of</strong> <strong>bonds</strong> among banks receiving <strong>state</strong> guarantees<br />

22<br />

€mn<br />

0 1,000 2,000 3,000 4,000 5,000<br />

Non-SG <strong>bonds</strong><br />

UNICAJA<br />

CAIXA CATALUNYA<br />

AAREAL BANK AG<br />

OESTER VOLKSBK<br />

CAJA MEDITERRANE<br />

RAIFF ZENTRALBK<br />

BANCO COM PORTUG<br />

ALPHA BANK AE<br />

BANCO PASTOR<br />

LANDESBK BERLIN<br />

DANSKE BANK A/S<br />

FORTIS BANK NED<br />

BANCAJA<br />

SWEDBANK AB<br />

HSH NORDBANK AG<br />

EFG EUROBANK<br />

BANCO POP ESPAN<br />

CAJA MADRID<br />

ING BANK NV<br />

Note: Issuance volumes <strong>of</strong> greater than €10,000mn (or €10bn) omitted for presentation purposes<br />

Source: Bloomberg<br />

2.4 Maturity structures<br />

LA CAIXA<br />

€mn<br />

0 1,000 2,000 3,000 4,000 5,000 6,000 7,000 8,000 9,000 10,000<br />

SG <strong>bonds</strong><br />

ERSTE GROUP<br />

FORTIS BANK NED<br />

RAIFF ZENTRALBK<br />

ACHMEA HYPOBK<br />

CAIXA CATALUNYA<br />

CAJA MEDITERRANE<br />

SNS BANK<br />

ALLIED IRISH BKS<br />

BANK OF SCOTLAND<br />

BANK OF IRELAND<br />

BANCAJA<br />

NATIONWIDE BLDG<br />

PIRAEUS BANK SA<br />

DEXIA CRED SA NY<br />

DANSKE BANK A/S<br />

NIBC BANK NV<br />

CAJA MADRID<br />

HSH NORDBANK AG<br />

ING BANK NV<br />

ALPHA BANK AE<br />

State guarantee schemes focused on medium-term instruments. If <strong>state</strong>d explicitly by guarantors,<br />

the maximum tenor is either three or five years. Figure 4 describes the maturity structure <strong>of</strong> SG<br />

<strong>bonds</strong> actually issued, which shows a clear preference among banks for tenors at the top end <strong>of</strong><br />

the permitted range. SG <strong>bonds</strong> with average maturity at issue <strong>of</strong> three <strong>and</strong> five years account for<br />

30% <strong>and</strong> 15% <strong>of</strong> the population, respectively.<br />

The motivation for focusing on medium-term instruments for <strong>state</strong> guarantees was to ensure that<br />

government support was time limited. In addition to restrictions on the maximum tenor for SG<br />

<strong>bonds</strong>, banks could only participate in SG schemes during a limited time window. In some Member<br />

States in which it was deemed that the impacts <strong>of</strong> the financial crisis on the banking sector had not<br />

fully alleviated, <strong>state</strong> guarantee schemes continued for longer, but in others they were<br />

discontinued. Annex 1 provides detailed information in this regard.