3 Issuing costs of state guaranteed bonds - Financial Risk and ...

3 Issuing costs of state guaranteed bonds - Financial Risk and ...

3 Issuing costs of state guaranteed bonds - Financial Risk and ...

Create successful ePaper yourself

Turn your PDF publications into a flip-book with our unique Google optimized e-Paper software.

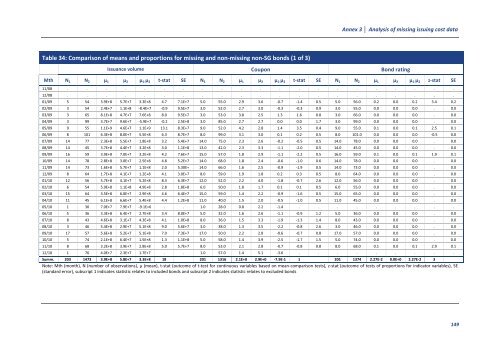

Table 34: Comparison <strong>of</strong> means <strong>and</strong> proportions for missing <strong>and</strong> non-missing non-SG <strong>bonds</strong> (1 <strong>of</strong> 3)<br />

Annex 3 Analysis <strong>of</strong> missing issuing cost data<br />

Issuance volume Coupon Bond rating<br />

Mth N 1 N 2 1 2 1- 2 t-stat SE N 1 N 2 1 2 1- 2 t-stat SE N 1 N 2 1 2 1- 2 z-stat SE<br />

11/08 . . . . . . . . . . . . . . . . . . . . .<br />

12/08 . . . . . . . . . . . . . . . . . . . . .<br />

01/09 5 54 3.9E+8 5.7E+7 3.3E+8 4.7 7.1E+7 5.0 55.0 2.9 3.6 -0.7 -1.4 0.5 5.0 56.0 0.2 0.0 0.2 3.4 0.2<br />

02/09 3 54 2.4E+7 1.1E+8 -8.4E+7 -0.9 9.5E+7 3.0 52.0 2.7 3.0 -0.3 -0.3 0.9 3.0 55.0 0.0 0.0 0.0 . 0.0<br />

03/09 3 65 8.1E+8 4.7E+7 7.6E+8 8.0 9.5E+7 3.0 53.0 3.8 2.5 1.3 1.6 0.8 3.0 66.0 0.0 0.0 0.0 . 0.0<br />

04/09 3 99 3.7E+7 9.6E+7 -5.9E+7 -0.2 2.5E+8 3.0 85.0 2.7 2.7 0.0 0.0 1.7 3.0 99.0 0.0 0.0 0.0 . 0.0<br />

05/09 9 55 1.1E+9 4.6E+7 1.1E+9 13.1 8.3E+7 9.0 52.0 4.2 2.8 1.4 3.5 0.4 9.0 55.0 0.1 0.0 0.1 2.5 0.1<br />

06/09 8 101 6.3E+8 8.0E+7 5.5E+8 6.3 8.7E+7 8.0 99.0 3.1 3.0 0.1 0.2 0.5 8.0 101.0 0.0 0.0 0.0 -0.5 0.0<br />

07/09 14 77 2.3E+8 5.5E+7 1.8E+8 3.2 5.4E+7 14.0 75.0 2.3 2.6 -0.2 -0.5 0.5 14.0 78.0 0.0 0.0 0.0 . 0.0<br />

08/09 14 45 3.7E+8 4.4E+7 3.2E+8 3.0 1.1E+8 13.0 42.0 2.3 3.3 -1.1 -2.0 0.5 14.0 45.0 0.0 0.0 0.0 . 0.0<br />

09/09 16 59 3.9E+8 7.0E+7 3.2E+8 4.2 7.6E+7 15.0 57.0 1.8 2.9 -1.1 -2.2 0.5 16.0 59.0 0.1 0.0 0.1 1.9 0.1<br />

10/09 14 78 2.8E+8 3.0E+7 2.5E+8 4.8 5.2E+7 14.0 68.0 1.8 2.4 -0.6 -1.0 0.6 14.0 78.0 0.0 0.0 0.0 . 0.0<br />

11/09 14 73 1.6E+8 5.7E+7 1.1E+8 2.0 5.30E+ 14.0 66.0 1.6 2.5 -0.9 -1.9 0.5 14.0 73.0 0.0 0.0 0.0 . 0.0<br />

12/09 8 64 1.7E+8 4.1E+7 1.2E+8 4.1 3.0E+7 8.0 59.0 1.9 1.8 0.2 0.3 0.5 8.0 64.0 0.0 0.0 0.0 . 0.0<br />

01/10 12 56 5.7E+8 4.1E+7 5.2E+8 8.3 6.3E+7 12.0 52.0 2.2 4.0 -1.8 -0.7 2.6 12.0 56.0 0.0 0.0 0.0 . 0.0<br />

02/10 6 54 5.9E+8 1.1E+8 4.9E+8 2.8 1.8E+8 6.0 50.0 1.8 1.7 0.1 0.1 0.5 6.0 55.0 0.0 0.0 0.0 . 0.0<br />

03/10 15 64 3.5E+8 6.0E+7 2.9E+8 4.6 6.4E+7 15.0 59.0 1.4 2.2 -0.9 -1.6 0.5 15.0 65.0 0.0 0.0 0.0 . 0.0<br />

04/10 11 45 6.1E+8 6.6E+7 5.4E+8 4.4 1.2E+8 11.0 40.0 1.5 2.0 -0.5 -1.0 0.5 11.0 45.0 0.0 0.0 0.0 . 0.0<br />

05/10 1 30 7.0E+7 7.9E+7 -9.1E+6 . . 1.0 28.0 0.8 2.2 -1.4 . . . . . . . . .<br />

06/10 5 36 3.3E+8 6.4E+7 2.7E+8 3.4 8.0E+7 5.0 32.0 1.6 2.6 -1.1 -0.9 1.2 5.0 36.0 0.0 0.0 0.0 . 0.0<br />

07/10 8 43 4.6E+8 3.1E+7 4.3E+8 4.1 1.0E+8 8.0 36.0 1.5 3.3 -1.9 -1.3 1.4 8.0 43.0 0.0 0.0 0.0 . 0.0<br />

08/10 3 46 5.4E+8 2.9E+7 5.1E+8 9.0 5.6E+7 3.0 38.0 1.3 3.5 -2.2 -0.8 2.6 3.0 46.0 0.0 0.0 0.0 . 0.0<br />

09/10 17 57 5.6E+8 5.2E+7 5.1E+8 7.0 7.3E+7 17.0 50.0 2.2 2.8 -0.6 -0.7 0.8 17.0 57.0 0.0 0.0 0.0 . 0.0<br />

10/10 5 74 2.1E+8 6.4E+7 1.5E+8 1.3 1.1E+8 5.0 58.0 1.4 3.9 -2.5 -1.7 1.5 5.0 74.0 0.0 0.0 0.0 . 0.0<br />

11/10 8 68 3.2E+8 3.9E+7 2.8E+8 5.0 5.7E+7 8.0 53.0 2.1 2.8 -0.7 -0.8 0.8 8.0 68.0 0.1 0.0 0.1 2.9 0.1<br />

12/10 1 76 4.0E+7 2.3E+7 1.7E+7 . . 1.0 57.0 1.4 5.1 -3.6 . . . . . . . . .<br />

Summ. 203 1473 3.9E+8 5.8E+7 3.3E+8 18 201 1316 2.1E+0 2.9E+0 -7.9E-1 1 201 1374 2.27E-2 0.0E+0 2.27E-2 3<br />

-stat (outcome <strong>of</strong> t-test for continuous variables based on mean-comparison tests), z-stat (outcome <strong>of</strong> tests <strong>of</strong> proportions for indicator variables), SE<br />

(st<strong>and</strong>ard error), subscript 1 indicates statistic relates to included <strong>bonds</strong> <strong>and</strong> subscript 2 indicates statistic relates to excluded <strong>bonds</strong><br />

149