3 Issuing costs of state guaranteed bonds - Financial Risk and ...

3 Issuing costs of state guaranteed bonds - Financial Risk and ...

3 Issuing costs of state guaranteed bonds - Financial Risk and ...

You also want an ePaper? Increase the reach of your titles

YUMPU automatically turns print PDFs into web optimized ePapers that Google loves.

3 <strong>Issuing</strong> <strong>costs</strong> <strong>of</strong> <strong>state</strong> <strong>guaranteed</strong> <strong>bonds</strong><br />

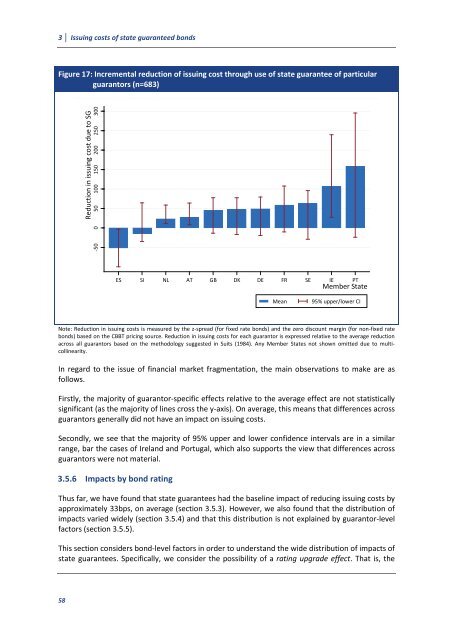

Figure 17: Incremental reduction <strong>of</strong> issuing cost through use <strong>of</strong> <strong>state</strong> guarantee <strong>of</strong> particular<br />

guarantors (n=683)<br />

58<br />

Reduction in issuing cost due to SG<br />

-50 0 50 100 150 200 250 300<br />

ES SI NL AT GB DK DE FR SE IE PT<br />

Member State<br />

Mean 95% upper/lower CI<br />

Note: Reduction in issuing <strong>costs</strong> is measured by the z-spread (for fixed rate <strong>bonds</strong>) <strong>and</strong> the zero discount margin (for non-fixed rate<br />

<strong>bonds</strong>) based on the CBBT pricing source. Reduction in issuing <strong>costs</strong> for each guarantor is expressed relative to the average reduction<br />

across all guarantors based on the methodology suggested in Suits (1984). Any Member States not shown omitted due to multicollinearity.<br />

In regard to the issue <strong>of</strong> financial market fragmentation, the main observations to make are as<br />

follows.<br />

Firstly, the majority <strong>of</strong> guarantor-specific effects relative to the average effect are not statistically<br />

significant (as the majority <strong>of</strong> lines cross the y-axis). On average, this means that differences across<br />

guarantors generally did not have an impact on issuing <strong>costs</strong>.<br />

Secondly, we see that the majority <strong>of</strong> 95% upper <strong>and</strong> lower confidence intervals are in a similar<br />

range, bar the cases <strong>of</strong> Irel<strong>and</strong> <strong>and</strong> Portugal, which also supports the view that differences across<br />

guarantors were not material.<br />

3.5.6 Impacts by bond rating<br />

Thus far, we have found that <strong>state</strong> guarantees had the baseline impact <strong>of</strong> reducing issuing <strong>costs</strong> by<br />

approximately 33bps, on average (section 3.5.3). However, we also found that the distribution <strong>of</strong><br />

impacts varied widely (section 3.5.4) <strong>and</strong> that this distribution is not explained by guarantor-level<br />

factors (section 3.5.5).<br />

This section considers bond-level factors in order to underst<strong>and</strong> the wide distribution <strong>of</strong> impacts <strong>of</strong><br />

<strong>state</strong> guarantees. Specifically, we consider the possibility <strong>of</strong> a rating upgrade effect. That is, the