GAMMON INDIA LIMITED

GAMMON INDIA LIMITED

GAMMON INDIA LIMITED

You also want an ePaper? Increase the reach of your titles

YUMPU automatically turns print PDFs into web optimized ePapers that Google loves.

long-term capital gains. Balance loss, if any, could be carried forward for eight years for claiming<br />

set-off against subsequent years’ long-term capital gains.<br />

7. As per Section 111A of the ITA, short term capital gains arising from the sale of Equity Shares<br />

transacted through a recognised stock exchange in India, where such transaction is chargeable to<br />

securities transaction tax, will be taxable at the rate of 15% (plus applicable surcharge and<br />

education cess).<br />

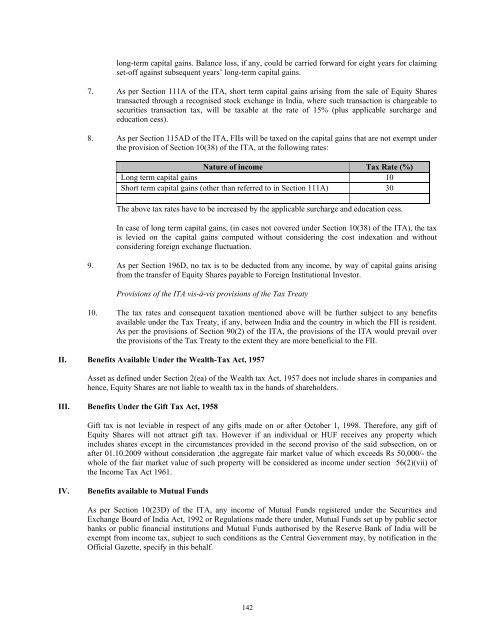

8. As per Section 115AD of the ITA, FIIs will be taxed on the capital gains that are not exempt under<br />

the provision of Section 10(38) of the ITA, at the following rates:<br />

Nature of income Tax Rate (%)<br />

Long term capital gains 10<br />

Short term capital gains (other than referred to in Section 111A) 30<br />

The above tax rates have to be increased by the applicable surcharge and education cess.<br />

In case of long term capital gains, (in cases not covered under Section 10(38) of the ITA), the tax<br />

is levied on the capital gains computed without considering the cost indexation and without<br />

considering foreign exchange fluctuation.<br />

9. As per Section 196D, no tax is to be deducted from any income, by way of capital gains arising<br />

from the transfer of Equity Shares payable to Foreign Institutional Investor.<br />

Provisions of the ITA vis-à-vis provisions of the Tax Treaty<br />

10. The tax rates and consequent taxation mentioned above will be further subject to any benefits<br />

available under the Tax Treaty, if any, between India and the country in which the FII is resident.<br />

As per the provisions of Section 90(2) of the ITA, the provisions of the ITA would prevail over<br />

the provisions of the Tax Treaty to the extent they are more beneficial to the FII.<br />

II. Benefits Available Under the Wealth-Tax Act, 1957<br />

Asset as defined under Section 2(ea) of the Wealth tax Act, 1957 does not include shares in companies and<br />

hence, Equity Shares are not liable to wealth tax in the hands of shareholders.<br />

III. Benefits Under the Gift Tax Act, 1958<br />

Gift tax is not leviable in respect of any gifts made on or after October 1, 1998. Therefore, any gift of<br />

Equity Shares will not attract gift tax. However if an individual or HUF receives any property which<br />

includes shares except in the circumstances provided in the second proviso of the said subsection, on or<br />

after 01.10.2009 without consideration ,the aggregate fair market value of which exceeds Rs 50,000/- the<br />

whole of the fair market value of such property will be considered as income under section 56(2)(vii) of<br />

the Income Tax Act 1961.<br />

IV. Benefits available to Mutual Funds<br />

As per Section 10(23D) of the ITA, any income of Mutual Funds registered under the Securities and<br />

Exchange Board of India Act, 1992 or Regulations made there under, Mutual Funds set up by public sector<br />

banks or public financial institutions and Mutual Funds authorised by the Reserve Bank of India will be<br />

exempt from income tax, subject to such conditions as the Central Government may, by notification in the<br />

Official Gazette, specify in this behalf.<br />

142