GAMMON INDIA LIMITED

GAMMON INDIA LIMITED

GAMMON INDIA LIMITED

Create successful ePaper yourself

Turn your PDF publications into a flip-book with our unique Google optimized e-Paper software.

the issue of shares to the trust, the Investments in ATSL are shown as GIL shares Suspense<br />

account under Investments. When issued these shares shall be suitably disclosed in the<br />

accounts.<br />

f) The excess of assets over liabilities accounted in the company representing Amalgamation<br />

Reserve is treated as part of the General Reserve shall form part of the free reserves<br />

available for distribution of dividend and shall be reckoned for Net Wealth purposes in<br />

accordance with the scheme approved by the Honourable High Court. Had this treatment<br />

not been presented in the scheme, the said reserve would have been Capital reserve.<br />

g) The transaction of the business of ATSL with effect from 1 st April ,2008 have been<br />

incorporated in the accounts on the basis of the Audited Financial Statements of the<br />

business, which is treated as a Branch, as audited by M/s M.G.Shah & Associates and M/s<br />

Vinod Modi & Associates, the statutory auditors of the erstwhile ATSL before its<br />

amalgamation with the company, who have been appointed by the Board of Directors of the<br />

Company as Branch Auditors.<br />

h) All equity inter group transactions have been eliminated on incorporation of the accounts of<br />

ATSL in the company.<br />

B. In view of the Amalgamation of the business of ATSL in these financial statements the figures<br />

for the 2008-09 year are not comparable with that of the previous year.<br />

C. The preference capital to be issued to the holders of the preference share capital in the erstwhile<br />

ATSL as aforesaid are convertible optionally at the option of the preference share holder at the<br />

end of 18 months from the date of issue of the preference shares by ATSL which is 14 th July<br />

2009 into 2 equity shares of the Company. The provision for the dividends on the preference<br />

shares are made pending the issue of the preference shares. In the event of the preference<br />

shareholder not exercising the option, the preference shares become non-convertible and are<br />

redeemable at par at the end of five years from the date of allotment of the original optionally<br />

convertible preference shares.<br />

D. In the year 2008-09 the dividends received by the Company of Rs. 2.90 Millions from the<br />

erstwhile ATSL relating to the proposed dividend of ATSL for the year ended 31 st March 2008<br />

has been adjusted in the retained earnings. Similarly during the year the one line profit<br />

accounted in accordance with AS 23 in the earlier periods as an Associate by the Company has<br />

been reversed in the Appropriation account aggregating to Rs. 352.90 Millions.<br />

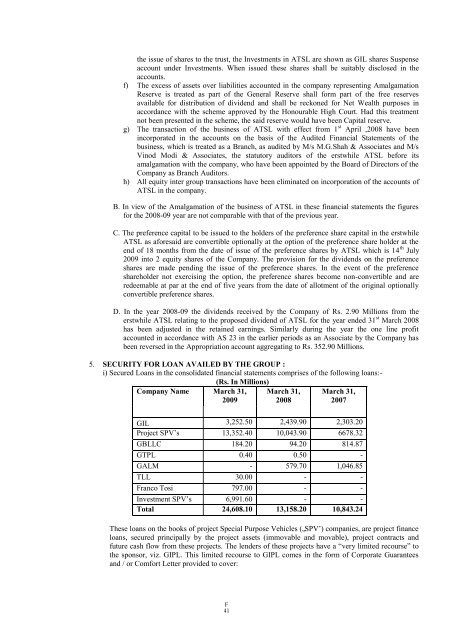

5. SECURITY FOR LOAN AVAILED BY THE GROUP :<br />

i) Secured Loans in the consolidated financial statements comprises of the following loans:-<br />

(Rs. In Millions)<br />

Company Name March 31,<br />

2009<br />

March 31,<br />

2008<br />

March 31,<br />

2007<br />

GIL 3,252.50 2,439.90 2,303.20<br />

Project SPV‟s 13,352.40 10,043.90 6678.32<br />

GBLLC 184.20 94.20 814.87<br />

GTPL 0.40 0.50 -<br />

GALM - 579.70 1,046.85<br />

TLL 30.00 - -<br />

Franco Tosi 797.00 - -<br />

Investment SPV‟s 6,991.60 - -<br />

Total 24,608.10 13,158.20 10,843.24<br />

These loans on the books of project Special Purpose Vehicles („SPV‟) companies, are project finance<br />

loans, secured principally by the project assets (immovable and movable), project contracts and<br />

future cash flow from these projects. The lenders of these projects have a “very limited recourse” to<br />

the sponsor, viz. GIPL. This limited recourse to GIPL comes in the form of Corporate Guarantees<br />

and / or Comfort Letter provided to cover:<br />

F<br />

41