GAMMON INDIA LIMITED

GAMMON INDIA LIMITED

GAMMON INDIA LIMITED

Create successful ePaper yourself

Turn your PDF publications into a flip-book with our unique Google optimized e-Paper software.

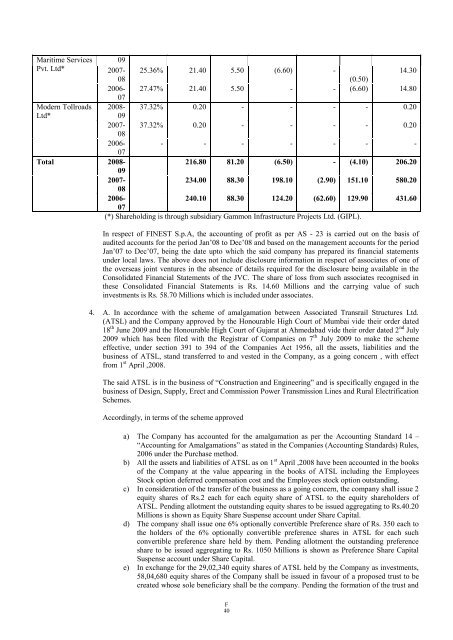

Maritime Services<br />

Pvt. Ltd*<br />

Modern Tollroads<br />

Ltd*<br />

09<br />

2007-<br />

08<br />

2006-<br />

07<br />

2008-<br />

09<br />

2007-<br />

08<br />

2006-<br />

07<br />

25.36% 21.40 5.50 (6.60) -<br />

14.30<br />

27.47% 21.40 5.50 - -<br />

(0.50)<br />

(6.60) 14.80<br />

37.32% 0.20 - - - - 0.20<br />

37.32% 0.20 - - - - 0.20<br />

- - - - - - -<br />

Total 2008-<br />

09<br />

216.80 81.20 (6.50) - (4.10) 206.20<br />

2007-<br />

08<br />

234.00 88.30 198.10 (2.90) 151.10 580.20<br />

2006-<br />

07<br />

240.10 88.30 124.20 (62.60) 129.90 431.60<br />

(*) Shareholding is through subsidiary Gammon Infrastructure Projects Ltd. (GIPL).<br />

In respect of FINEST S.p.A, the accounting of profit as per AS - 23 is carried out on the basis of<br />

audited accounts for the period Jan‟08 to Dec‟08 and based on the management accounts for the period<br />

Jan‟07 to Dec‟07, being the date upto which the said company has prepared its financial statements<br />

under local laws. The above does not include disclosure information in respect of associates of one of<br />

the overseas joint ventures in the absence of details required for the disclosure being available in the<br />

Consolidated Financial Statements of the JVC. The share of loss from such associates recognised in<br />

these Consolidated Financial Statements is Rs. 14.60 Millions and the carrying value of such<br />

investments is Rs. 58.70 Millions which is included under associates.<br />

4. A. In accordance with the scheme of amalgamation between Associated Transrail Structures Ltd.<br />

(ATSL) and the Company approved by the Honourable High Court of Mumbai vide their order dated<br />

18 th June 2009 and the Honourable High Court of Gujarat at Ahmedabad vide their order dated 2 nd July<br />

2009 which has been filed with the Registrar of Companies on 7 th July 2009 to make the scheme<br />

effective, under section 391 to 394 of the Companies Act 1956, all the assets, liabilities and the<br />

business of ATSL, stand transferred to and vested in the Company, as a going concern , with effect<br />

from 1 st April ,2008.<br />

The said ATSL is in the business of “Construction and Engineering” and is specifically engaged in the<br />

business of Design, Supply, Erect and Commission Power Transmission Lines and Rural Electrification<br />

Schemes.<br />

Accordingly, in terms of the scheme approved<br />

a) The Company has accounted for the amalgamation as per the Accounting Standard 14 –<br />

“Accounting for Amalgamations” as stated in the Companies (Accounting Standards) Rules,<br />

2006 under the Purchase method.<br />

b) All the assets and liabilities of ATSL as on 1 st April ,2008 have been accounted in the books<br />

of the Company at the value appearing in the books of ATSL including the Employees<br />

Stock option deferred compensation cost and the Employees stock option outstanding.<br />

c) In consideration of the transfer of the business as a going concern, the company shall issue 2<br />

equity shares of Rs.2 each for each equity share of ATSL to the equity shareholders of<br />

ATSL. Pending allotment the outstanding equity shares to be issued aggregating to Rs.40.20<br />

Millions is shown as Equity Share Suspense account under Share Capital.<br />

d) The company shall issue one 6% optionally convertible Preference share of Rs. 350 each to<br />

the holders of the 6% optionally convertible preference shares in ATSL for each such<br />

convertible preference share held by them. Pending allotment the outstanding preference<br />

share to be issued aggregating to Rs. 1050 Millions is shown as Preference Share Capital<br />

Suspense account under Share Capital.<br />

e) In exchange for the 29,02,340 equity shares of ATSL held by the Company as investments,<br />

58,04,680 equity shares of the Company shall be issued in favour of a proposed trust to be<br />

created whose sole beneficiary shall be the company. Pending the formation of the trust and<br />

F<br />

40