GAMMON INDIA LIMITED

GAMMON INDIA LIMITED

GAMMON INDIA LIMITED

You also want an ePaper? Increase the reach of your titles

YUMPU automatically turns print PDFs into web optimized ePapers that Google loves.

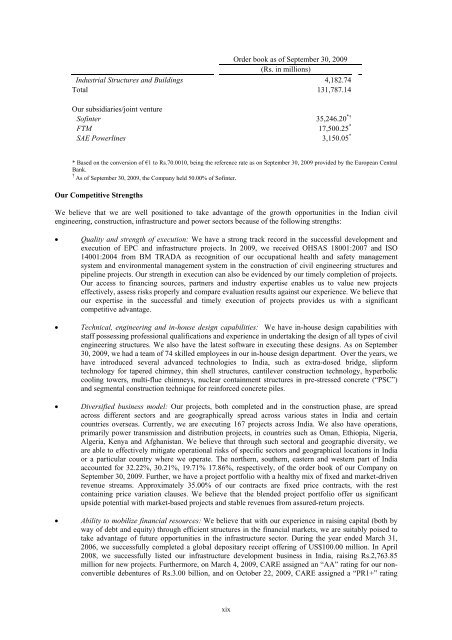

Order book as of September 30, 2009<br />

(Rs. in millions)<br />

Industrial Structures and Buildings 4,182.74<br />

Total 131,787.14<br />

Our subsidiaries/joint venture<br />

Sofinter 35,246.20 *†<br />

FTM 17,500.25 *<br />

SAE Powerlines 3,150.05 *<br />

* Based on the conversion of €1 to Rs.70.0010, being the reference rate as on September 30, 2009 provided by the European Central<br />

Bank.<br />

† As of September 30, 2009, the Company held 50.00% of Sofinter.<br />

Our Competitive Strengths<br />

We believe that we are well positioned to take advantage of the growth opportunities in the Indian civil<br />

engineering, construction, infrastructure and power sectors because of the following strengths:<br />

Quality and strength of execution: We have a strong track record in the successful development and<br />

execution of EPC and infrastructure projects. In 2009, we received OHSAS 18001:2007 and ISO<br />

14001:2004 from BM TRADA as recognition of our occupational health and safety management<br />

system and environmental management system in the construction of civil engineering structures and<br />

pipeline projects. Our strength in execution can also be evidenced by our timely completion of projects.<br />

Our access to financing sources, partners and industry expertise enables us to value new projects<br />

effectively, assess risks properly and compare evaluation results against our experience. We believe that<br />

our expertise in the successful and timely execution of projects provides us with a significant<br />

competitive advantage.<br />

Technical, engineering and in-house design capabilities: We have in-house design capabilities with<br />

staff possessing professional qualifications and experience in undertaking the design of all types of civil<br />

engineering structures. We also have the latest software in executing these designs. As on September<br />

30, 2009, we had a team of 74 skilled employees in our in-house design department. Over the years, we<br />

have introduced several advanced technologies to India, such as extra-dosed bridge, slipform<br />

technology for tapered chimney, thin shell structures, cantilever construction technology, hyperbolic<br />

cooling towers, multi-flue chimneys, nuclear containment structures in pre-stressed concrete (“PSC”)<br />

and segmental construction technique for reinforced concrete piles.<br />

Diversified business model: Our projects, both completed and in the construction phase, are spread<br />

across different sectors and are geographically spread across various states in India and certain<br />

countries overseas. Currently, we are executing 167 projects across India. We also have operations,<br />

primarily power transmission and distribution projects, in countries such as Oman, Ethiopia, Nigeria,<br />

Algeria, Kenya and Afghanistan. We believe that through such sectoral and geographic diversity, we<br />

are able to effectively mitigate operational risks of specific sectors and geographical locations in India<br />

or a particular country where we operate. The northern, southern, eastern and western part of India<br />

accounted for 32.22%, 30.21%, 19.71% 17.86%, respectively, of the order book of our Company on<br />

September 30, 2009. Further, we have a project portfolio with a healthy mix of fixed and market-driven<br />

revenue streams. Approximately 35.00% of our contracts are fixed price contracts, with the rest<br />

containing price variation clauses. We believe that the blended project portfolio offer us significant<br />

upside potential with market-based projects and stable revenues from assured-return projects.<br />

Ability to mobilize financial resources: We believe that with our experience in raising capital (both by<br />

way of debt and equity) through efficient structures in the financial markets, we are suitably poised to<br />

take advantage of future opportunities in the infrastructure sector. During the year ended March 31,<br />

2006, we successfully completed a global depositary receipt offering of US$100.00 million. In April<br />

2008, we successfully listed our infrastructure development business in India, raising Rs.2,763.85<br />

million for new projects. Furthermore, on March 4, 2009, CARE assigned an “AA” rating for our nonconvertible<br />

debentures of Rs.3.00 billion, and on October 22, 2009, CARE assigned a “PR1+” rating<br />

xix