GAMMON INDIA LIMITED

GAMMON INDIA LIMITED

GAMMON INDIA LIMITED

You also want an ePaper? Increase the reach of your titles

YUMPU automatically turns print PDFs into web optimized ePapers that Google loves.

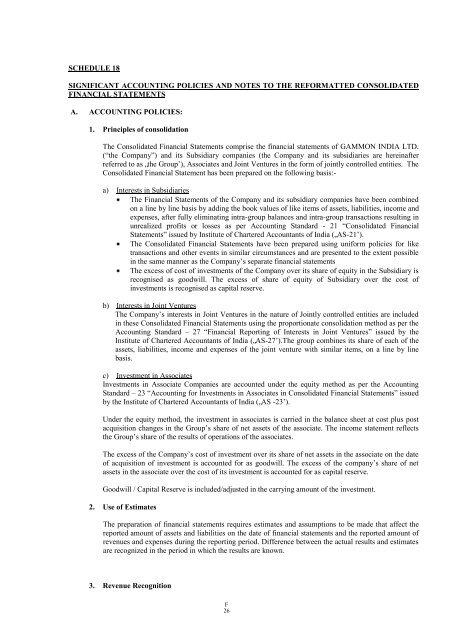

SCHEDULE 18<br />

SIGNIFICANT ACCOUNTING POLICIES AND NOTES TO THE REFORMATTED CONSOLIDATED<br />

FINANCIAL STATEMENTS<br />

A. ACCOUNTING POLICIES:<br />

1. Principles of consolidation<br />

The Consolidated Financial Statements comprise the financial statements of <strong>GAMMON</strong> <strong>INDIA</strong> LTD.<br />

(“the Company”) and its Subsidiary companies (the Company and its subsidiaries are hereinafter<br />

referred to as „the Group‟), Associates and Joint Ventures in the form of jointly controlled entities. The<br />

Consolidated Financial Statement has been prepared on the following basis:-<br />

a) Interests in Subsidiaries<br />

The Financial Statements of the Company and its subsidiary companies have been combined<br />

on a line by line basis by adding the book values of like items of assets, liabilities, income and<br />

expenses, after fully eliminating intra-group balances and intra-group transactions resulting in<br />

unrealized profits or losses as per Accounting Standard - 21 “Consolidated Financial<br />

Statements” issued by Institute of Chartered Accountants of India („AS-21‟).<br />

The Consolidated Financial Statements have been prepared using uniform policies for like<br />

transactions and other events in similar circumstances and are presented to the extent possible<br />

in the same manner as the Company‟s separate financial statements<br />

The excess of cost of investments of the Company over its share of equity in the Subsidiary is<br />

recognised as goodwill. The excess of share of equity of Subsidiary over the cost of<br />

investments is recognised as capital reserve.<br />

b) Interests in Joint Ventures<br />

The Company‟s interests in Joint Ventures in the nature of Jointly controlled entities are included<br />

in these Consolidated Financial Statements using the proportionate consolidation method as per the<br />

Accounting Standard – 27 “Financial Reporting of Interests in Joint Ventures” issued by the<br />

Institute of Chartered Accountants of India („AS-27‟).The group combines its share of each of the<br />

assets, liabilities, income and expenses of the joint venture with similar items, on a line by line<br />

basis.<br />

c) Investment in Associates<br />

Investments in Associate Companies are accounted under the equity method as per the Accounting<br />

Standard – 23 “Accounting for Investments in Associates in Consolidated Financial Statements” issued<br />

by the Institute of Chartered Accountants of India („AS -23‟).<br />

Under the equity method, the investment in associates is carried in the balance sheet at cost plus post<br />

acquisition changes in the Group‟s share of net assets of the associate. The income statement reflects<br />

the Group‟s share of the results of operations of the associates.<br />

The excess of the Company‟s cost of investment over its share of net assets in the associate on the date<br />

of acquisition of investment is accounted for as goodwill. The excess of the company‟s share of net<br />

assets in the associate over the cost of its investment is accounted for as capital reserve.<br />

Goodwill / Capital Reserve is included/adjusted in the carrying amount of the investment.<br />

2. Use of Estimates<br />

The preparation of financial statements requires estimates and assumptions to be made that affect the<br />

reported amount of assets and liabilities on the date of financial statements and the reported amount of<br />

revenues and expenses during the reporting period. Difference between the actual results and estimates<br />

are recognized in the period in which the results are known.<br />

3. Revenue Recognition<br />

F<br />

26