GAMMON INDIA LIMITED

GAMMON INDIA LIMITED

GAMMON INDIA LIMITED

You also want an ePaper? Increase the reach of your titles

YUMPU automatically turns print PDFs into web optimized ePapers that Google loves.

The Board of Directors,<br />

Gammon India Limited,<br />

Gammon House,<br />

Veer savarkar Marg,<br />

Mumbai - 400025<br />

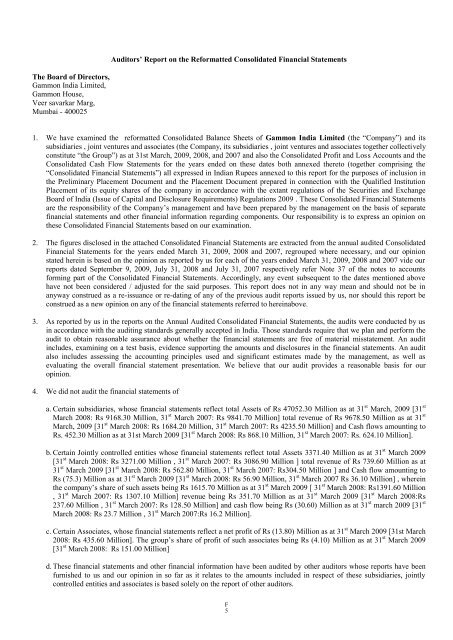

Auditors’ Report on the Reformatted Consolidated Financial Statements<br />

1. We have examined the reformatted Consolidated Balance Sheets of Gammon India Limited (the “Company”) and its<br />

subsidiaries , joint ventures and associates (the Company, its subsidiaries , joint ventures and associates together collectively<br />

constitute “the Group”) as at 31st March, 2009, 2008, and 2007 and also the Consolidated Profit and Loss Accounts and the<br />

Consolidated Cash Flow Statements for the years ended on these dates both annexed thereto (together comprising the<br />

“Consolidated Financial Statements”) all expressed in Indian Rupees annexed to this report for the purposes of inclusion in<br />

the Preliminary Placement Document and the Placement Document prepared in connection with the Qualified Institution<br />

Placement of its equity shares of the company in accordance with the extant regulations of the Securities and Exchange<br />

Board of India (Issue of Capital and Disclosure Requirements) Regulations 2009 . These Consolidated Financial Statements<br />

are the responsibility of the Company‟s management and have been prepared by the management on the basis of separate<br />

financial statements and other financial information regarding components. Our responsibility is to express an opinion on<br />

these Consolidated Financial Statements based on our examination.<br />

2. The figures disclosed in the attached Consolidated Financial Statements are extracted from the annual audited Consolidated<br />

Financial Statements for the years ended March 31, 2009, 2008 and 2007, regrouped where necessary, and our opinion<br />

stated herein is based on the opinion as reported by us for each of the years ended March 31, 2009, 2008 and 2007 vide our<br />

reports dated September 9, 2009, July 31, 2008 and July 31, 2007 respectively refer Note 37 of the notes to accounts<br />

forming part of the Consolidated Financial Statements. Accordingly, any event subsequent to the dates mentioned above<br />

have not been considered / adjusted for the said purposes. This report does not in any way mean and should not be in<br />

anyway construed as a re-issuance or re-dating of any of the previous audit reports issued by us, nor should this report be<br />

construed as a new opinion on any of the financial statements referred to hereinabove.<br />

3. As reported by us in the reports on the Annual Audited Consolidated Financial Statements, the audits were conducted by us<br />

in accordance with the auditing standards generally accepted in India. Those standards require that we plan and perform the<br />

audit to obtain reasonable assurance about whether the financial statements are free of material misstatement. An audit<br />

includes, examining on a test basis, evidence supporting the amounts and disclosures in the financial statements. An audit<br />

also includes assessing the accounting principles used and significant estimates made by the management, as well as<br />

evaluating the overall financial statement presentation. We believe that our audit provides a reasonable basis for our<br />

opinion.<br />

4. We did not audit the financial statements of<br />

a. Certain subsidiaries, whose financial statements reflect total Assets of Rs 47052.30 Million as at 31 st March, 2009 [31 st<br />

March 2008: Rs 9168.30 Million, 31 st March 2007: Rs 9841.70 Million] total revenue of Rs 9678.50 Million as at 31 st<br />

March, 2009 [31 st March 2008: Rs 1684.20 Million, 31 st March 2007: Rs 4235.50 Million] and Cash flows amounting to<br />

Rs. 452.30 Million as at 31st March 2009 [31 st March 2008: Rs 868.10 Million, 31 st March 2007: Rs. 624.10 Million].<br />

b. Certain Jointly controlled entities whose financial statements reflect total Assets 3371.40 Million as at 31 st March 2009<br />

[31 st March 2008: Rs 3271.00 Million , 31 st March 2007: Rs 3086.90 Million ] total revenue of Rs 739.60 Million as at<br />

31 st March 2009 [31 st March 2008: Rs 562.80 Million, 31 st March 2007: Rs304.50 Million ] and Cash flow amounting to<br />

Rs (75.3) Million as at 31 st March 2009 [31 st March 2008: Rs 56.90 Million, 31 st March 2007 Rs 36.10 Million] , wherein<br />

the company‟s share of such assets being Rs 1615.70 Million as at 31 st March 2009 [ 31 st March 2008: Rs1391.60 Million<br />

, 31 st March 2007: Rs 1307.10 Million] revenue being Rs 351.70 Million as at 31 st March 2009 [31 st March 2008:Rs<br />

237.60 Million , 31 st March 2007: Rs 128.50 Million] and cash flow being Rs (30.60) Million as at 31 st march 2009 [31 st<br />

March 2008: Rs 23.7 Million , 31 st March 2007:Rs 16.2 Million].<br />

c. Certain Associates, whose financial statements reflect a net profit of Rs (13.80) Million as at 31 st March 2009 [31st March<br />

2008: Rs 435.60 Million]. The group‟s share of profit of such associates being Rs (4.10) Million as at 31 st March 2009<br />

[31 st March 2008: Rs 151.00 Million]<br />

d. These financial statements and other financial information have been audited by other auditors whose reports have been<br />

furnished to us and our opinion in so far as it relates to the amounts included in respect of these subsidiaries, jointly<br />

controlled entities and associates is based solely on the report of other auditors.<br />

F 5