GAMMON INDIA LIMITED

GAMMON INDIA LIMITED

GAMMON INDIA LIMITED

You also want an ePaper? Increase the reach of your titles

YUMPU automatically turns print PDFs into web optimized ePapers that Google loves.

Employee Retirement Benefits<br />

Retirement benefits in the form of a defined contribution scheme and contributions are charged to the Profit<br />

and Loss Account for the year/period when the contributions are due.<br />

Other retirement benefits being in the nature of a defined benefit obligation is provided on the basis of an<br />

actuarial valuation made at the end of each year/period on projected Unit Credit Method.<br />

Actuarial gains/losses are immediately taken to the Profit and Loss Account and are not deferred.<br />

In case of certain subsidiaries and a joint venture the entitlement of employee’s retirement benefit is based<br />

upon the employee’s final salary and length of service, subject to the completion of a minimum service<br />

period based on the laws of the respective country. The expected costs of these benefits are accrued over the<br />

period of employment. The terminal benefits are paid to employees’ on their termination or leaving<br />

employment. Accordingly, our Company does not expect settlement against terminal benefit obligation in<br />

the near future.<br />

Fixed Assets<br />

Fixed Assets are valued and stated at cost of acquisition less accumulated depreciation thereon. Revalued<br />

assets are stated at the revalued amount. Cost comprises the purchase price and any attributable cost of<br />

bringing the asset to its working condition of its intended use. Borrowing costs relating to acquisition of<br />

fixed assets which take a substantial period of time to get ready for its intended use are also included to the<br />

extent they relate to the period till such assets are ready to be put to use.<br />

Depreciation and Amortization<br />

Indian Operations<br />

Depreciation for the accounting period is provided on:<br />

(a) Straight Line Method, for assets purchased after April 2, 1987, at the rates and in the manner specified<br />

in Schedule XIV to the Companies Act, 1956.<br />

(b) Written Down Value Method, for assets acquired on or prior to April 2, 1987, at the rates as specified<br />

in Schedule XIV to the Companies Act, 1956.<br />

(c) Depreciation on revalued component of the assets is withdrawn from the Revaluation Reserve.<br />

(d) The depreciation on assets used for construction has been treated as period cost.<br />

(e) The Infrastructure Projects Assets are amortized over a period of the rights given under the various<br />

Concession Agreements to which they relate.<br />

(f) Expenses incurred by our Company on periodic maintenance are capitalized on the completion of said<br />

activity. These costs are amortized over the period up to which the next periodic maintenance is due.<br />

The periodic maintenance of 5 th and 10 th year is amortized over a period of 5 years from completion of<br />

the activity. The periodic maintenance of 15 th year is written off over the balance concession period of<br />

1 year.<br />

Overseas Operations<br />

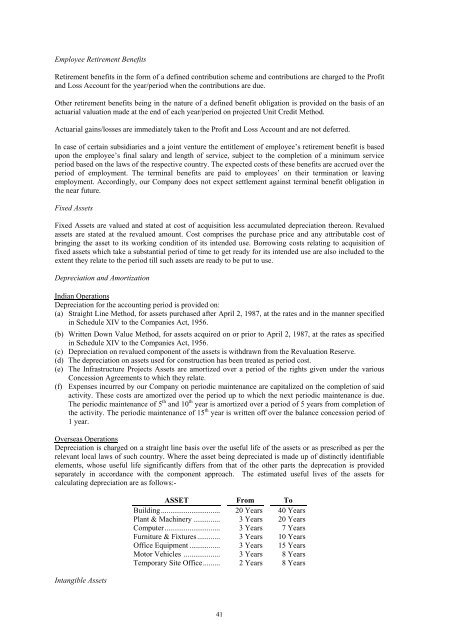

Depreciation is charged on a straight line basis over the useful life of the assets or as prescribed as per the<br />

relevant local laws of such country. Where the asset being depreciated is made up of distinctly identifiable<br />

elements, whose useful life significantly differs from that of the other parts the deprecation is provided<br />

separately in accordance with the component approach. The estimated useful lives of the assets for<br />

calculating depreciation are as follows:-<br />

Intangible Assets<br />

ASSET From To<br />

Building............................... 20 Years 40 Years<br />

Plant & Machinery .............. 3 Years 20 Years<br />

Computer............................. 3 Years 7 Years<br />

Furniture & Fixtures............ 3 Years 10 Years<br />

Office Equipment ................ 3 Years 15 Years<br />

Motor Vehicles ................... 3 Years 8 Years<br />

Temporary Site Office......... 2 Years 8 Years<br />

41