GAMMON INDIA LIMITED

GAMMON INDIA LIMITED

GAMMON INDIA LIMITED

Create successful ePaper yourself

Turn your PDF publications into a flip-book with our unique Google optimized e-Paper software.

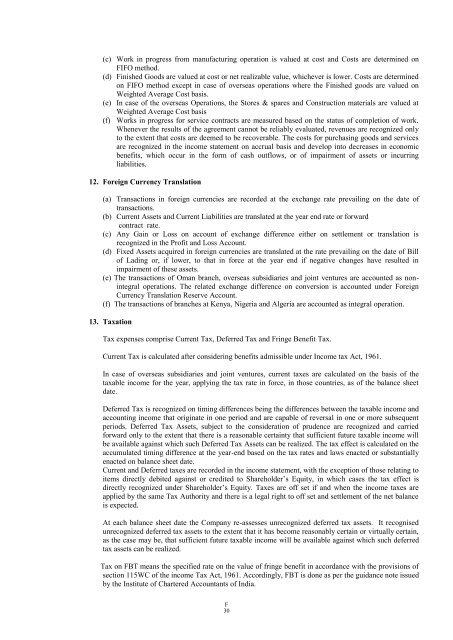

(c) Work in progress from manufacturing operation is valued at cost and Costs are determined on<br />

FIFO method.<br />

(d) Finished Goods are valued at cost or net realizable value, whichever is lower. Costs are determined<br />

on FIFO method except in case of overseas operations where the Finished goods are valued on<br />

Weighted Average Cost basis.<br />

(e) In case of the overseas Operations, the Stores & spares and Construction materials are valued at<br />

Weighted Average Cost basis<br />

(f) Works in progress for service contracts are measured based on the status of completion of work.<br />

Whenever the results of the agreement cannot be reliably evaluated, revenues are recognized only<br />

to the extent that costs are deemed to be recoverable. The costs for purchasing goods and services<br />

are recognized in the income statement on accrual basis and develop into decreases in economic<br />

benefits, which occur in the form of cash outflows, or of impairment of assets or incurring<br />

liabilities.<br />

12. Foreign Currency Translation<br />

(a) Transactions in foreign currencies are recorded at the exchange rate prevailing on the date of<br />

transactions.<br />

(b) Current Assets and Current Liabilities are translated at the year end rate or forward<br />

contract rate.<br />

(c) Any Gain or Loss on account of exchange difference either on settlement or translation is<br />

recognized in the Profit and Loss Account.<br />

(d) Fixed Assets acquired in foreign currencies are translated at the rate prevailing on the date of Bill<br />

of Lading or, if lower, to that in force at the year end if negative changes have resulted in<br />

impairment of these assets.<br />

(e) The transactions of Oman branch, overseas subsidiaries and joint ventures are accounted as nonintegral<br />

operations. The related exchange difference on conversion is accounted under Foreign<br />

Currency Translation Reserve Account.<br />

(f) The transactions of branches at Kenya, Nigeria and Algeria are accounted as integral operation.<br />

13. Taxation<br />

Tax expenses comprise Current Tax, Deferred Tax and Fringe Benefit Tax.<br />

Current Tax is calculated after considering benefits admissible under Income tax Act, 1961.<br />

In case of overseas subsidiaries and joint ventures, current taxes are calculated on the basis of the<br />

taxable income for the year, applying the tax rate in force, in those countries, as of the balance sheet<br />

date.<br />

Deferred Tax is recognized on timing differences being the differences between the taxable income and<br />

accounting income that originate in one period and are capable of reversal in one or more subsequent<br />

periods. Deferred Tax Assets, subject to the consideration of prudence are recognized and carried<br />

forward only to the extent that there is a reasonable certainty that sufficient future taxable income will<br />

be available against which such Deferred Tax Assets can be realized. The tax effect is calculated on the<br />

accumulated timing difference at the year-end based on the tax rates and laws enacted or substantially<br />

enacted on balance sheet date.<br />

Current and Deferred taxes are recorded in the income statement, with the exception of those relating to<br />

items directly debited against or credited to Shareholder‟s Equity, in which cases the tax effect is<br />

directly recognized under Shareholder‟s Equity. Taxes are off set if and when the income taxes are<br />

applied by the same Tax Authority and there is a legal right to off set and settlement of the net balance<br />

is expected.<br />

At each balance sheet date the Company re-assesses unrecognized deferred tax assets. It recognised<br />

unrecognized deferred tax assets to the extent that it has become reasonably certain or virtually certain,<br />

as the case may be, that sufficient future taxable income will be available against which such deferred<br />

tax assets can be realized.<br />

Tax on FBT means the specified rate on the value of fringe benefit in accordance with the provisions of<br />

section 115WC of the income Tax Act, 1961. Accordingly, FBT is done as per the guidance note issued<br />

by the Institute of Chartered Accountants of India.<br />

F<br />

30