GAMMON INDIA LIMITED

GAMMON INDIA LIMITED

GAMMON INDIA LIMITED

Create successful ePaper yourself

Turn your PDF publications into a flip-book with our unique Google optimized e-Paper software.

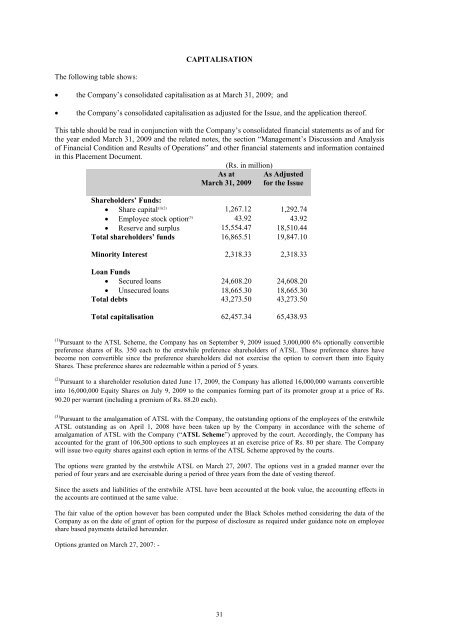

The following table shows:<br />

CAPITALISATION<br />

the Company’s consolidated capitalisation as at March 31, 2009; and<br />

the Company’s consolidated capitalisation as adjusted for the Issue, and the application thereof.<br />

This table should be read in conjunction with the Company’s consolidated financial statements as of and for<br />

the year ended March 31, 2009 and the related notes, the section “Management’s Discussion and Analysis<br />

of Financial Condition and Results of Operations” and other financial statements and information contained<br />

in this Placement Document.<br />

31<br />

(Rs. in million)<br />

As at<br />

March 31, 2009<br />

As Adjusted<br />

for the Issue<br />

Shareholders’ Funds:<br />

Share capital (1)(2) 1,267.12 1,292.74<br />

Employee stock option (3) 43.92 43.92<br />

Reserve and surplus 15,554.47 18,510.44<br />

Total shareholders’ funds 16,865.51 19,847.10<br />

Minority Interest 2,318.33 2,318.33<br />

Loan Funds<br />

Secured loans 24,608.20 24,608.20<br />

Unsecured loans 18,665.30 18,665.30<br />

Total debts 43,273.50 43,273.50<br />

Total capitalisation 62,457.34 65,438.93<br />

(1) Pursuant to the ATSL Scheme, the Company has on September 9, 2009 issued 3,000,000 6% optionally convertible<br />

preference shares of Rs. 350 each to the erstwhile preference shareholders of ATSL. These preference shares have<br />

become non convertible since the preference shareholders did not exercise the option to convert them into Equity<br />

Shares. These preference shares are redeemable within a period of 5 years.<br />

(2)Pursuant to a shareholder resolution dated June 17, 2009, the Company has allotted 16,000,000 warrants convertible<br />

into 16,000,000 Equity Shares on July 9, 2009 to the companies forming part of its promoter group at a price of Rs.<br />

90.20 per warrant (including a premium of Rs. 88.20 each).<br />

(3) Pursuant to the amalgamation of ATSL with the Company, the outstanding options of the employees of the erstwhile<br />

ATSL outstanding as on April 1, 2008 have been taken up by the Company in accordance with the scheme of<br />

amalgamation of ATSL with the Company (“ATSL Scheme”) approved by the court. Accordingly, the Company has<br />

accounted for the grant of 106,300 options to such employees at an exercise price of Rs. 80 per share. The Company<br />

will issue two equity shares against each option in terms of the ATSL Scheme approved by the courts.<br />

The options were granted by the erstwhile ATSL on March 27, 2007. The options vest in a graded manner over the<br />

period of four years and are exercisable during a period of three years from the date of vesting thereof.<br />

Since the assets and liabilities of the erstwhile ATSL have been accounted at the book value, the accounting effects in<br />

the accounts are continued at the same value.<br />

The fair value of the option however has been computed under the Black Scholes method considering the data of the<br />

Company as on the date of grant of option for the purpose of disclosure as required under guidance note on employee<br />

share based payments detailed hereunder.<br />

Options granted on March 27, 2007: -