- Page 1 and 2:

GAMMON INDIA LIMITED (Incorporated

- Page 3 and 4:

NOTICE TO INVESTORS The Company acc

- Page 5 and 6:

usiness strategies and environment

- Page 7 and 8:

epresentation, warranty or statemen

- Page 9 and 10:

SEBI nor any other regulatory autho

- Page 11 and 12:

FORWARD LOOKING STATEMENTS All stat

- Page 13 and 14:

Term Description Company in consult

- Page 15 and 16:

Term Description NH National Highwa

- Page 17 and 18:

Lock-up The Company will not, for a

- Page 19 and 20:

ased in Italy that is engaged in th

- Page 21 and 22:

for our short-term commercial paper

- Page 23 and 24:

Sr. No. SUMMARY FINANCIAL INFORMATI

- Page 25 and 26:

REFORMATTED CONSOLIDATED BALANCE SH

- Page 27 and 28:

REFORMATTED CONSOLIDATED PROFIT AND

- Page 29 and 30:

REFORMATTED CONSOLIDATED CASH FLOW

- Page 31 and 32:

RISK FACTORS An investment in equit

- Page 33 and 34:

affect on the profit margins that w

- Page 35 and 36:

As the revenue structure for the SP

- Page 37 and 38:

of actual traffic volume. Adverse d

- Page 39 and 40:

esult in decreased sales of our pro

- Page 41 and 42:

in two or three years) of interest

- Page 43 and 44:

If our subsidiaries or SPVs default

- Page 45 and 46:

Our inability to obtain, renew or m

- Page 47 and 48:

As of March 31, 2009, our contingen

- Page 49 and 50:

on which such additional financing

- Page 51 and 52:

The Equity Shares are being offered

- Page 53 and 54:

market for our equity shares will n

- Page 55 and 56:

(of sale proceeds), a no objection/

- Page 57 and 58:

Date National Stock Exchange of Ind

- Page 59 and 60:

USE OF PROCEEDS The total proceeds

- Page 61 and 62:

Vesting Date No. Of Options Exercis

- Page 63 and 64:

EXCHANGE RATE INFORMATION The follo

- Page 65 and 66:

development phase. GIPL also offers

- Page 67 and 68:

during summer months and during the

- Page 69 and 70:

c) Revenues from providing services

- Page 71 and 72:

Intangible assets are amortized ove

- Page 73 and 74:

Guidelines, 1999 issued by Securiti

- Page 75 and 76:

and tax credit, if any, and compute

- Page 77 and 78:

Profit After Tax. Our profit after

- Page 79 and 80:

primarily by trade payables and wor

- Page 81 and 82:

and components are fluctuating base

- Page 83 and 84:

Development Authorities, Metro Rail

- Page 85 and 86:

Indian Road Network Kilometers (app

- Page 87 and 88:

plan will soon be presented to the

- Page 89 and 90:

The Airports Sector in India Indian

- Page 91 and 92:

An investment of about Rs.720,600.0

- Page 93 and 94:

China’s electricity consumption h

- Page 95 and 96:

Source Central State Private Total

- Page 97 and 98:

Overview BUSINESS We are the flagsh

- Page 99 and 100:

** formerly Bedi Seaport Limited GA

- Page 101 and 102:

flue chimneys, nuclear containment

- Page 103 and 104:

For certain large construction or i

- Page 105 and 106:

oriented services. In addition, we

- Page 107 and 108:

Kalwakruthy Stage-3-Lift Irrigation

- Page 109 and 110:

Name of SPV Revenue Model MNEL KBIC

- Page 111 and 112:

Ansaldo Oseberg D Offshore Platfor

- Page 113 and 114:

ACCAM S.p.A. Incinerator Plant: Eur

- Page 115 and 116:

Our Company, with its joint venture

- Page 117 and 118:

Board of Directors BOARD OF DIRECTO

- Page 119 and 120:

Name, Designation, DIN and Address

- Page 121 and 122:

Name, Designation, DIN and Address

- Page 123 and 124:

Mr. Parvez Umrigar, is a B. Com., A

- Page 125 and 126:

Mr. Himanshu Parikh Pursuant to a s

- Page 127 and 128:

Organisation Chart 98

- Page 129 and 130:

Name Number of Equity Shareholding

- Page 131 and 132:

Shareholding Pattern PRINCIPAL SHAR

- Page 133 and 134:

Sl. No. Name of the Shareholder Lim

- Page 135 and 136:

Equity Shares allotted to a QIB pur

- Page 137 and 138:

FIIs are permitted to participate t

- Page 139 and 140:

The submission of an Application Fo

- Page 141 and 142:

ank). The QIB will be required to d

- Page 143 and 144:

Placement Agreement PLACEMENT The J

- Page 145 and 146:

SELLING RESTRICTIONS The distributi

- Page 147 and 148:

the shares, debentures and units of

- Page 149 and 150:

TRANSFER RESTRICTIONS Purchasers of

- Page 151 and 152:

The exceptions to this rule are for

- Page 153 and 154:

equirement to publish un-audited fi

- Page 155 and 156:

shares are listed). Further, any pe

- Page 157 and 158:

agreement, within the time period m

- Page 159 and 160:

for compulsory dematerialised tradi

- Page 161 and 162:

. by crediting shares of the Compan

- Page 163 and 164:

(including a corporation or company

- Page 165 and 166:

TAXATION The information provided b

- Page 167 and 168:

to be income chargeable under the h

- Page 169 and 170:

8. As per Section 74 Short-term cap

- Page 171 and 172:

long-term capital gains. Balance lo

- Page 173 and 174:

LEGAL PROCEEDINGS Save as described

- Page 175 and 176: lack list GIL and also its allied/s

- Page 177 and 178: Index to financial statements: FINA

- Page 179 and 180: Sr. No. UNAUDITED FINANCIAL RESULTS

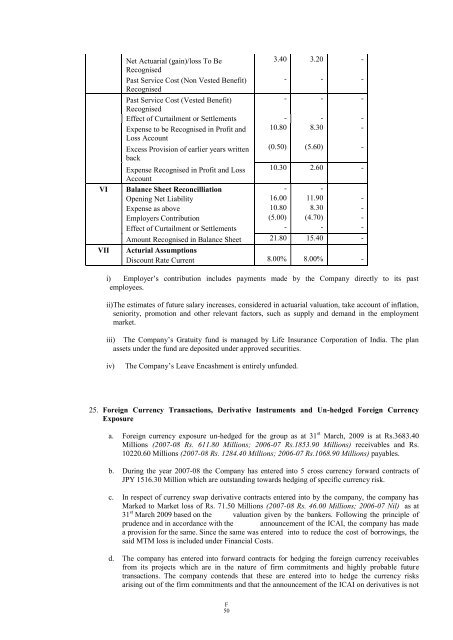

- Page 181 and 182: from the foreign currency receivabl

- Page 183 and 184: 5. The financial statements of cert

- Page 185 and 186: REFORMATTED CONSOLIDATED BALANCE SH

- Page 187 and 188: GAMMON INDIA LIMITED REFORMATTED CO

- Page 189 and 190: GAMMON INDIA LIMITED REFORMATTED CO

- Page 191 and 192: GAMMON INDIA LIMITED SCHEDULES FORM

- Page 193 and 194: GAMMON INDIA LIMITED SCHEDULES FORM

- Page 195 and 196: GAMMON INDIA LIMITED SCHEDULES FORM

- Page 197 and 198: 31.03.09 31.03.08 31.03.07 Rs.inMil

- Page 199 and 200: GAMMON INDIA LIMITED SCHEDULES FORM

- Page 201 and 202: SCHEDULE 15A SUNDRY EXPENSES INCLUD

- Page 203 and 204: SCHEDULE 18 SIGNIFICANT ACCOUNTING

- Page 205 and 206: 5. Research and Development Expense

- Page 207 and 208: (c) Work in progress from manufactu

- Page 209 and 210: Basic Earning Per Share is calculat

- Page 211 and 212: For the Year 2008- 09 For the Year

- Page 213 and 214: interest and voting rights in respe

- Page 215 and 216: y Busi Group. By an Agreement dated

- Page 217 and 218: Maritime Services Pvt. Ltd* Modern

- Page 219 and 220: the difference between outstanding

- Page 221 and 222: PVAN: Term Loans from ICICI Bank ar

- Page 223 and 224: foreign exchange loss of Rs. 11.20

- Page 225: In respect of some road projects co

- Page 229 and 230: Further, during the year 2008-09, t

- Page 231 and 232: 30 Gammon Sadelmi (Power Plant in S

- Page 233 and 234: (c) Transactions of Oman Branch and

- Page 235 and 236: 11 Gammon Rizzani Gammon Rizzani Ga

- Page 237 and 238: Nature of Transactions / relationsh

- Page 239 and 240: Nature of Transactions / relationsh

- Page 241 and 242: Nature of Transactions / relationsh

- Page 243 and 244: Current liabilities Bank overdrafts

- Page 245 and 246: Statement of recognised income and

- Page 247 and 248: 5. We have estimated and checked th

- Page 249 and 250: 4. As fully described by directors

- Page 251 and 252: Franco Tosi Meccanica S.p.A. INTROD

- Page 253 and 254: Franco Tosi Meccanica S.p.A. 2. INC

- Page 255 and 256: Franco Tosi Meccanica S.p.A. 4. FOR

- Page 257 and 258: Franco Tosi Meccanica S.p.A. The bo

- Page 259 and 260: Franco Tosi Meccanica S.p.A. Revenu

- Page 261 and 262: Franco Tosi Meccanica S.p.A. Servic

- Page 263 and 264: Franco Tosi Meccanica S.p.A. 31.12.

- Page 265 and 266: Franco Tosi Meccanica S.p.A. Note 5

- Page 267 and 268: Franco Tosi Meccanica S.p.A. Note 9

- Page 269 and 270: Franco Tosi Meccanica S.p.A. Nota 1

- Page 271 and 272: Franco Tosi Meccanica S.p.A. Note 1

- Page 273 and 274: Franco Tosi Meccanica S.p.A. As pre

- Page 275 and 276: Franco Tosi Meccanica S.p.A. Deprec

- Page 277 and 278:

To the Shareholders of Sae Power Li

- Page 279 and 280:

SAE POWER LINES S.R.L. Società uni

- Page 281 and 282:

SAE POWER LINES S.R.L. IV. Liquid a

- Page 283 and 284:

SAE POWER LINES S.R.L. Profit and l

- Page 285 and 286:

SAE POWER LINES S.R.L. Company with

- Page 287 and 288:

underlying formal aspects. Fixed as

- Page 289 and 290:

Italian Exchange Rates Office (U.I.

- Page 291 and 292:

Description Value Monetary revaluat

- Page 293 and 294:

Accounts receivable by geographical

- Page 295 and 296:

This item can be broken down as fol

- Page 297 and 298:

Description 31/12/2007 Additions De

- Page 299 and 300:

Accounts payable by geographical ar

- Page 301 and 302:

Description 31/12/2008 31/12/2007 C

- Page 303 and 304:

Taxes Value at 31/12/2008 Value at

- Page 305 and 306:

the reasonable certainty that in fu

- Page 307:

ISSUER Gammon India Limited REGISTE