GAMMON INDIA LIMITED

GAMMON INDIA LIMITED

GAMMON INDIA LIMITED

You also want an ePaper? Increase the reach of your titles

YUMPU automatically turns print PDFs into web optimized ePapers that Google loves.

amounting to Rs. 26.80 Millions has been reversed. The effect of the change in method of depreciation<br />

for this year is Rs. 28.50 Millions. On account of this change in the method of depreciation the profit<br />

for that year was higher by Rs. 55.30 Millions.<br />

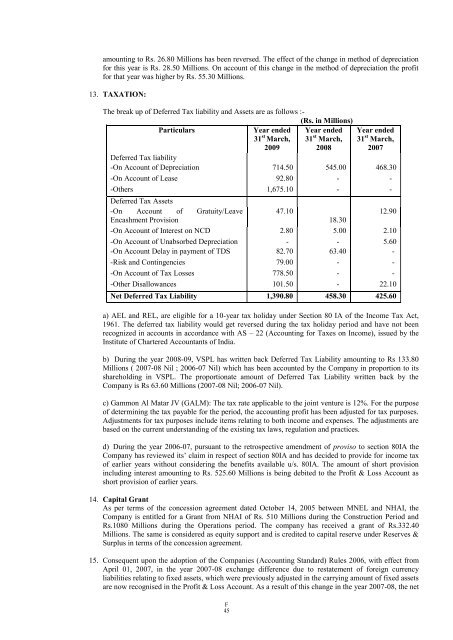

13. TAXATION:<br />

The break up of Deferred Tax liability and Assets are as follows :-<br />

(Rs. in Millions)<br />

Particulars Year ended<br />

31 st Year ended<br />

March, 31<br />

2009<br />

st Year ended<br />

March, 31<br />

2008<br />

st March,<br />

Deferred Tax liability<br />

2007<br />

-On Account of Depreciation 714.50 545.00 468.30<br />

-On Account of Lease 92.80 - -<br />

-Others 1,675.10 - -<br />

Deferred Tax Assets<br />

-On Account of Gratuity/Leave 47.10<br />

12.90<br />

Encashment Provision<br />

18.30<br />

-On Account of Interest on NCD 2.80 5.00 2.10<br />

-On Account of Unabsorbed Depreciation - - 5.60<br />

-On Account Delay in payment of TDS 82.70 63.40 -<br />

-Risk and Contingencies 79.00 - -<br />

-On Account of Tax Losses 778.50 - -<br />

-Other Disallowances 101.50 - 22.10<br />

Net Deferred Tax Liability 1,390.80 458.30 425.60<br />

a) AEL and REL, are eligible for a 10-year tax holiday under Section 80 IA of the Income Tax Act,<br />

1961. The deferred tax liability would get reversed during the tax holiday period and have not been<br />

recognized in accounts in accordance with AS – 22 (Accounting for Taxes on Income), issued by the<br />

Institute of Chartered Accountants of India.<br />

b) During the year 2008-09, VSPL has written back Deferred Tax Liability amounting to Rs 133.80<br />

Millions ( 2007-08 Nil ; 2006-07 Nil) which has been accounted by the Company in proportion to its<br />

shareholding in VSPL. The proportionate amount of Deferred Tax Liability written back by the<br />

Company is Rs 63.60 Millions (2007-08 Nil; 2006-07 Nil).<br />

c) Gammon Al Matar JV (GALM): The tax rate applicable to the joint venture is 12%. For the purpose<br />

of determining the tax payable for the period, the accounting profit has been adjusted for tax purposes.<br />

Adjustments for tax purposes include items relating to both income and expenses. The adjustments are<br />

based on the current understanding of the existing tax laws, regulation and practices.<br />

d) During the year 2006-07, pursuant to the retrospective amendment of proviso to section 80IA the<br />

Company has reviewed its‟ claim in respect of section 80IA and has decided to provide for income tax<br />

of earlier years without considering the benefits available u/s. 80IA. The amount of short provision<br />

including interest amounting to Rs. 525.60 Millions is being debited to the Profit & Loss Account as<br />

short provision of earlier years.<br />

14. Capital Grant<br />

As per terms of the concession agreement dated October 14, 2005 between MNEL and NHAI, the<br />

Company is entitled for a Grant from NHAI of Rs. 510 Millions during the Construction Period and<br />

Rs.1080 Millions during the Operations period. The company has received a grant of Rs.332.40<br />

Millions. The same is considered as equity support and is credited to capital reserve under Reserves &<br />

Surplus in terms of the concession agreement.<br />

15. Consequent upon the adoption of the Companies (Accounting Standard) Rules 2006, with effect from<br />

April 01, 2007, in the year 2007-08 exchange difference due to restatement of foreign currency<br />

liabilities relating to fixed assets, which were previously adjusted in the carrying amount of fixed assets<br />

are now recognised in the Profit & Loss Account. As a result of this change in the year 2007-08, the net<br />

F<br />

45