GAMMON INDIA LIMITED

GAMMON INDIA LIMITED

GAMMON INDIA LIMITED

Create successful ePaper yourself

Turn your PDF publications into a flip-book with our unique Google optimized e-Paper software.

the difference between outstanding loans and the termination payments receivable by the SPV<br />

from clients (in case of termination of the project due to concessionaire‟s event of default and / or<br />

force majeure events)<br />

the shortfall in payment of annuity due to non-availability of road to traffic, for annuity projects<br />

increase in O&M expenses beyond those covered in the Financing Documents, for annuity<br />

projects<br />

increase in tax payments beyond those covered in the Financing Documents, for annuity projects<br />

of REL and AEL<br />

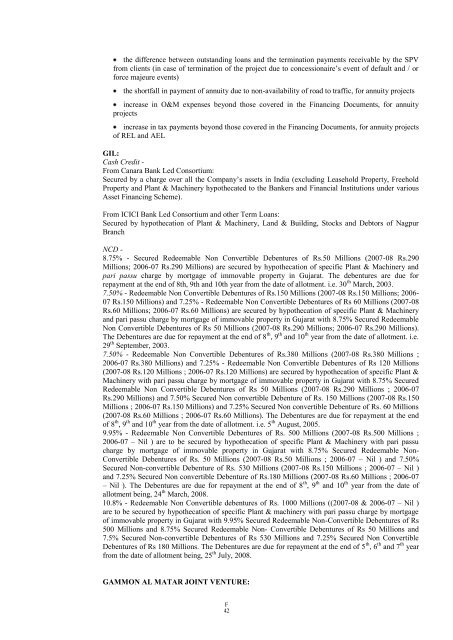

GIL:<br />

Cash Credit -<br />

From Canara Bank Led Consortium:<br />

Secured by a charge over all the Company‟s assets in India (excluding Leasehold Property, Freehold<br />

Property and Plant & Machinery hypothecated to the Bankers and Financial Institutions under various<br />

Asset Financing Scheme).<br />

From ICICI Bank Led Consortium and other Term Loans:<br />

Secured by hypothecation of Plant & Machinery, Land & Building, Stocks and Debtors of Nagpur<br />

Branch<br />

NCD -<br />

8.75% - Secured Redeemable Non Convertible Debentures of Rs.50 Millions (2007-08 Rs.290<br />

Millions; 2006-07 Rs.290 Millions) are secured by hypothecation of specific Plant & Machinery and<br />

pari passu charge by mortgage of immovable property in Gujarat. The debentures are due for<br />

repayment at the end of 8th, 9th and 10th year from the date of allotment. i.e. 30 th March, 2003.<br />

7.50% - Redeemable Non Convertible Debentures of Rs.150 Millions (2007-08 Rs.150 Millions; 2006-<br />

07 Rs.150 Millions) and 7.25% - Redeemable Non Convertible Debentures of Rs 60 Millions (2007-08<br />

Rs.60 Millions; 2006-07 Rs.60 Millions) are secured by hypothecation of specific Plant & Machinery<br />

and pari passu charge by mortgage of immovable property in Gujarat with 8.75% Secured Redeemable<br />

Non Convertible Debentures of Rs 50 Millions (2007-08 Rs.290 Millions; 2006-07 Rs.290 Millions).<br />

The Debentures are due for repayment at the end of 8 th , 9 th and 10 th year from the date of allotment. i.e.<br />

29 th September, 2003.<br />

7.50% - Redeemable Non Convertible Debentures of Rs.380 Millions (2007-08 Rs.380 Millions ;<br />

2006-07 Rs.380 Millions) and 7.25% - Redeemable Non Convertible Debentures of Rs 120 Millions<br />

(2007-08 Rs.120 Millions ; 2006-07 Rs.120 Millions) are secured by hypothecation of specific Plant &<br />

Machinery with pari passu charge by mortgage of immovable property in Gujarat with 8.75% Secured<br />

Redeemable Non Convertible Debentures of Rs 50 Millions (2007-08 Rs.290 Millions ; 2006-07<br />

Rs.290 Millions) and 7.50% Secured Non convertible Debenture of Rs. 150 Millions (2007-08 Rs.150<br />

Millions ; 2006-07 Rs.150 Millions) and 7.25% Secured Non convertible Debenture of Rs. 60 Millions<br />

(2007-08 Rs.60 Millions ; 2006-07 Rs.60 Millions). The Debentures are due for repayment at the end<br />

of 8 th , 9 th and 10 th year from the date of allotment. i.e. 5 th August, 2005.<br />

9.95% - Redeemable Non Convertible Debentures of Rs. 500 Millions (2007-08 Rs.500 Millions ;<br />

2006-07 – Nil ) are to be secured by hypothecation of specific Plant & Machinery with pari passu<br />

charge by mortgage of immovable property in Gujarat with 8.75% Secured Redeemable Non-<br />

Convertible Debentures of Rs. 50 Millions (2007-08 Rs.50 Millions ; 2006-07 – Nil ) and 7.50%<br />

Secured Non-convertible Debenture of Rs. 530 Millions (2007-08 Rs.150 Millions ; 2006-07 – Nil )<br />

and 7.25% Secured Non convertible Debenture of Rs.180 Millions (2007-08 Rs.60 Millions ; 2006-07<br />

– Nil ). The Debentures are due for repayment at the end of 8 th , 9 th and 10 th year from the date of<br />

allotment being, 24 th March, 2008.<br />

10.8% - Redeemable Non Convertible debentures of Rs. 1000 Millions ((2007-08 & 2006-07 – Nil )<br />

are to be secured by hypothecation of specific Plant & machinery with pari passu charge by mortgage<br />

of immovable property in Gujarat with 9.95% Secured Redeemable Non-Convertible Debentures of Rs<br />

500 Millions and 8.75% Secured Redeemable Non- Convertible Debentures of Rs 50 Millions and<br />

7.5% Secured Non-convertible Debentures of Rs 530 Millions and 7.25% Secured Non Convertible<br />

Debentures of Rs 180 Millions. The Debentures are due for repayment at the end of 5 th , 6 th and 7 th year<br />

from the date of allotment being, 25 th July, 2008.<br />

<strong>GAMMON</strong> AL MATAR JOINT VENTURE:<br />

F<br />

42