GAMMON INDIA LIMITED

GAMMON INDIA LIMITED

GAMMON INDIA LIMITED

Create successful ePaper yourself

Turn your PDF publications into a flip-book with our unique Google optimized e-Paper software.

is due. The periodic maintenance of 5 th and 10 th year is amortised over a period of 5 years from<br />

completion of the activity. The periodic maintenance of 15th year is written off over the balance<br />

concession period of 1 year.<br />

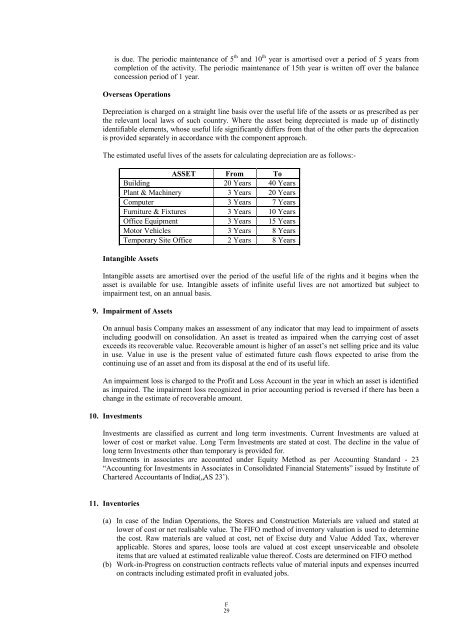

Overseas Operations<br />

Depreciation is charged on a straight line basis over the useful life of the assets or as prescribed as per<br />

the relevant local laws of such country. Where the asset being depreciated is made up of distinctly<br />

identifiable elements, whose useful life significantly differs from that of the other parts the deprecation<br />

is provided separately in accordance with the component approach.<br />

The estimated useful lives of the assets for calculating depreciation are as follows:-<br />

ASSET From To<br />

Building 20 Years 40 Years<br />

Plant & Machinery 3 Years 20 Years<br />

Computer 3 Years 7 Years<br />

Furniture & Fixtures 3 Years 10 Years<br />

Office Equipment 3 Years 15 Years<br />

Motor Vehicles<br />

3 Years 8 Years<br />

Temporary Site Office 2 Years 8 Years<br />

Intangible Assets<br />

Intangible assets are amortised over the period of the useful life of the rights and it begins when the<br />

asset is available for use. Intangible assets of infinite useful lives are not amortized but subject to<br />

impairment test, on an annual basis.<br />

9. Impairment of Assets<br />

On annual basis Company makes an assessment of any indicator that may lead to impairment of assets<br />

including goodwill on consolidation. An asset is treated as impaired when the carrying cost of asset<br />

exceeds its recoverable value. Recoverable amount is higher of an asset‟s net selling price and its value<br />

in use. Value in use is the present value of estimated future cash flows expected to arise from the<br />

continuing use of an asset and from its disposal at the end of its useful life.<br />

An impairment loss is charged to the Profit and Loss Account in the year in which an asset is identified<br />

as impaired. The impairment loss recognized in prior accounting period is reversed if there has been a<br />

change in the estimate of recoverable amount.<br />

10. Investments<br />

Investments are classified as current and long term investments. Current Investments are valued at<br />

lower of cost or market value. Long Term Investments are stated at cost. The decline in the value of<br />

long term Investments other than temporary is provided for.<br />

Investments in associates are accounted under Equity Method as per Accounting Standard - 23<br />

“Accounting for Investments in Associates in Consolidated Financial Statements” issued by Institute of<br />

Chartered Accountants of India(„AS 23‟).<br />

11. Inventories<br />

(a) In case of the Indian Operations, the Stores and Construction Materials are valued and stated at<br />

lower of cost or net realisable value. The FIFO method of inventory valuation is used to determine<br />

the cost. Raw materials are valued at cost, net of Excise duty and Value Added Tax, wherever<br />

applicable. Stores and spares, loose tools are valued at cost except unserviceable and obsolete<br />

items that are valued at estimated realizable value thereof. Costs are determined on FIFO method<br />

(b) Work-in-Progress on construction contracts reflects value of material inputs and expenses incurred<br />

on contracts including estimated profit in evaluated jobs.<br />

F<br />

29