GAMMON INDIA LIMITED

GAMMON INDIA LIMITED

GAMMON INDIA LIMITED

You also want an ePaper? Increase the reach of your titles

YUMPU automatically turns print PDFs into web optimized ePapers that Google loves.

foreign exchange loss of Rs. 11.20 Millions is not adjusted in Fixed Assets and is debited to Profit &<br />

Loss Account due to which the profit before tax of the year is lower by Rs. 11.20 Millions.<br />

16. Cochin Bridge Infrastructure Company Limited (CBICL) depreciates its BOT project assets being the<br />

Bridge over the concession period in its books. However, the depreciation as per the Income Tax Act<br />

does not fully cover the costs over the concession period. The difference in the charge of depreciation<br />

is a permanent difference and hence not recognized in calculation of the deferred tax liability/ asset.<br />

17. Up to the year 2006-07 the Company was following the policy of amortising the goodwill on<br />

consolidation over a period of 5 years. Accordingly in the accounts drawn up to September 30, 2007,<br />

the Company has amortised the goodwill for 6 months. On review of its policy of amortising the<br />

goodwill, extant accounting standards and generally accepted accounting principles followed, the<br />

Company has decided to adopt the policy of not amortising the goodwill but testing the same for<br />

impairment on the said balance sheet date. On account of the change in the method of amortising<br />

goodwill, the goodwill amortisation for the year ended March 31, 2008 of Rs 137.10 Millions has not<br />

been carried out. The management has reviewed any possible impairment and has concluded that there<br />

is no impairment in the goodwill on acquisition of shares. On account of this change the consolidated<br />

profit before tax for the year 2007-08 is higher by Rs 137.10 Millions.<br />

18. During the year 2007-08, the Gammon Infrastructure Projects Ltd. (GIPL) made an Initial Public Offer<br />

(„IPO‟) of 16,550,000 equity shares of Rs 10/- each at a premium of Rs 157 per share. The equity<br />

shares pursuant to the offer were allotted on March 27, 2008.<br />

19. Significant Accounting Policies followed by the Company are attached with the Standalone Financial<br />

Statements. Due to inherent diversities in the legal and regulatory environment governing accounting<br />

principles, the accounting policies would be better understood when referred from the individual<br />

Financial Statements. However, the following are instances of diverse accounting policies followed by<br />

the subsidiaries, which may materially vary with these Consolidated Financial Statements.<br />

a) In respect of new acquisitions in 2008-09, inventory of certain overseas JV‟s and Subsidiaries are<br />

valued at weighted average method as against FIFO method followed by the company and the<br />

other subsidiaries. The inventory of the JV‟s and Subsidiaries constitutes 13.38 % of the total<br />

inventory.<br />

b) In case of SAE the Work-in-progress has been recorded on the basis of the criterion of the<br />

completion or the status of progress; the revenues and the job margin are recognized according to<br />

the progress of the productive activity as against the method of computing the percentage of work<br />

completed as determined by the expenditure incurred on the job till each review date to total<br />

expenditure of the job.<br />

c) In the year 2008-09 in the absence of disclosures made in the accounts of one of the joint venture<br />

regarding effect of acquisition and disposal of subsidiaries, no such disclosure is possible to be<br />

made in the consolidated accounts.<br />

d) Disclosures relating to the employee benefits for the overseas components have not been given in<br />

the absence of data in the required format.<br />

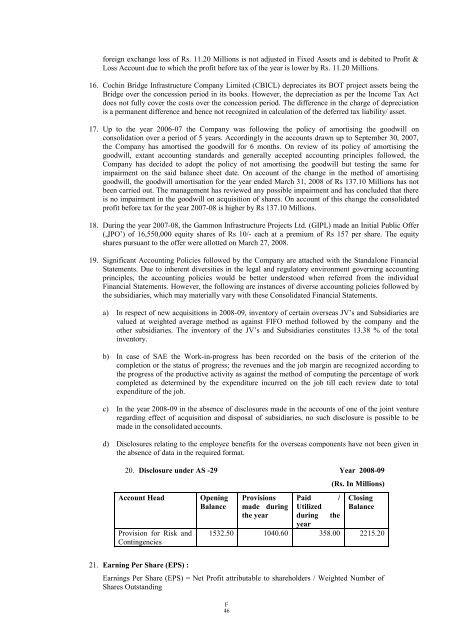

20. Disclosure under AS -29 Year 2008-09<br />

Account Head Opening<br />

Balance<br />

Provision for Risk and<br />

Contingencies<br />

21. Earning Per Share (EPS) :<br />

Provisions<br />

made during<br />

the year<br />

Paid /<br />

Utilized<br />

during the<br />

year<br />

(Rs. In Millions)<br />

Closing<br />

Balance<br />

1532.50 1040.60 358.00 2215.20<br />

Earnings Per Share (EPS) = Net Profit attributable to shareholders / Weighted Number of<br />

Shares Outstanding<br />

F<br />

46