We aim to be the most preferred non-life insurer in Thailand

We aim to be the most preferred non-life insurer in Thailand

We aim to be the most preferred non-life insurer in Thailand

Create successful ePaper yourself

Turn your PDF publications into a flip-book with our unique Google optimized e-Paper software.

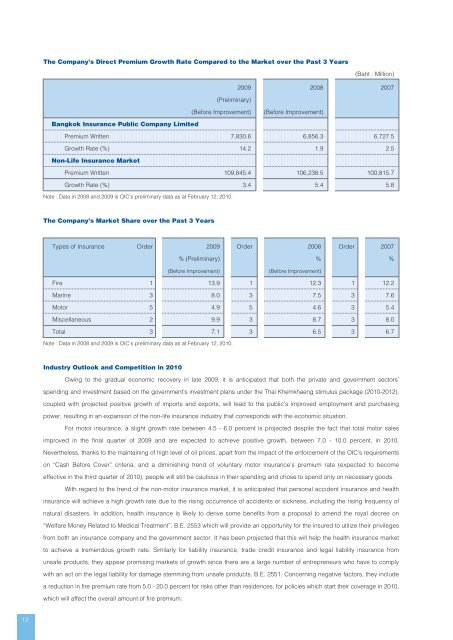

The Company’s Direct Premium Growth Rate Compared <strong>to</strong> <strong>the</strong> Market over <strong>the</strong> Past 3 Years<br />

(Baht : Million)<br />

2009 2008 2007<br />

(Prelim<strong>in</strong>ary)<br />

(Before Improvement)<br />

(Before Improvement)<br />

Bangkok Insurance Public Company Limited<br />

Premium Written 7,830.6 6,856.3 6,727.5<br />

Growth Rate (%) 14.2 1.9 2.5<br />

Non-Life Insurance Market<br />

Premium Written 109,845.4 106,238.5 100,815.7<br />

Growth Rate (%) 3.4 5.4 5.8<br />

Note : Data <strong>in</strong> 2008 and 2009 is OIC’s prelim<strong>in</strong>ary data as at February 12, 2010.<br />

The Company’s Market Share over <strong>the</strong> Past 3 Years<br />

Types of Insurance Order 2009 Order 2008 Order 2007<br />

% (Prelim<strong>in</strong>ary) % %<br />

(Before Improvement)<br />

(Before Improvement)<br />

Fire 1 13.9 1 12.3 1 12.2<br />

Mar<strong>in</strong>e 3 8.0 3 7.5 3 7.6<br />

Mo<strong>to</strong>r 5 4.9 5 4.6 3 5.4<br />

Miscellaneous 2 9.9 3 8.7 3 8.0<br />

Total 3 7.1 3 6.5 3 6.7<br />

Note : Data <strong>in</strong> 2008 and 2009 is OIC’s prelim<strong>in</strong>ary data as at February 12, 2010.<br />

Industry Outlook and Competition <strong>in</strong> 2010<br />

Ow<strong>in</strong>g <strong>to</strong> <strong>the</strong> gradual economic recovery <strong>in</strong> late 2009, it is anticipated that both <strong>the</strong> private and government sec<strong>to</strong>rs’<br />

spend<strong>in</strong>g and <strong>in</strong>vestment based on <strong>the</strong> government’s <strong>in</strong>vestment plans under <strong>the</strong> Thai Khemkhaeng stimulus package (2010-2012),<br />

coupled with projected positive growth of imports and exports, will lead <strong>to</strong> <strong>the</strong> public’s improved employment and purchas<strong>in</strong>g<br />

power, result<strong>in</strong>g <strong>in</strong> an expansion of <strong>the</strong> <strong>non</strong>-<strong>life</strong> <strong>in</strong>surance <strong>in</strong>dustry that corresponds with <strong>the</strong> economic situation.<br />

For mo<strong>to</strong>r <strong>in</strong>surance, a slight growth rate <strong>be</strong>tween 4.5 - 6.0 percent is projected despite <strong>the</strong> fact that <strong>to</strong>tal mo<strong>to</strong>r sales<br />

improved <strong>in</strong> <strong>the</strong> f<strong>in</strong>al quarter of 2009 and are expected <strong>to</strong> achieve positive growth, <strong>be</strong>tween 7.0 - 10.0 percent, <strong>in</strong> 2010.<br />

Never<strong>the</strong>less, thanks <strong>to</strong> <strong>the</strong> ma<strong>in</strong>ta<strong>in</strong><strong>in</strong>g of high level of oil prices, apart from <strong>the</strong> impact of <strong>the</strong> enforcement of <strong>the</strong> OIC’s requirements<br />

on “Cash Before Cover” criteria, and a dim<strong>in</strong>ish<strong>in</strong>g trend of voluntary mo<strong>to</strong>r <strong>in</strong>surance’s premium rate (expected <strong>to</strong> <strong>be</strong>come<br />

effective <strong>in</strong> <strong>the</strong> third quarter of 2010), people will still <strong>be</strong> cautious <strong>in</strong> <strong>the</strong>ir spend<strong>in</strong>g and chose <strong>to</strong> spend only on necessary goods.<br />

With regard <strong>to</strong> <strong>the</strong> trend of <strong>the</strong> <strong>non</strong>-mo<strong>to</strong>r <strong>in</strong>surance market, it is anticipated that personal accident <strong>in</strong>surance and health<br />

<strong>in</strong>surance will achieve a high growth rate due <strong>to</strong> <strong>the</strong> ris<strong>in</strong>g occurrence of accidents or sickness, <strong>in</strong>clud<strong>in</strong>g <strong>the</strong> ris<strong>in</strong>g frequency of<br />

natural disasters. In addition, health <strong>in</strong>surance is likely <strong>to</strong> derive some <strong>be</strong>nefits from a proposal <strong>to</strong> amend <strong>the</strong> royal decree on<br />

“<strong>We</strong>lfare Money Related <strong>to</strong> Medical Treatment”, B.E. 2553 which will provide an opportunity for <strong>the</strong> <strong>in</strong>sured <strong>to</strong> utilize <strong>the</strong>ir privileges<br />

from both an <strong>in</strong>surance company and <strong>the</strong> government sec<strong>to</strong>r. It has <strong>be</strong>en projected that this will help <strong>the</strong> health <strong>in</strong>surance market<br />

<strong>to</strong> achieve a tremendous growth rate. Similarly for liability <strong>in</strong>surance, trade credit <strong>in</strong>surance and legal liability <strong>in</strong>surance from<br />

unsafe products, <strong>the</strong>y appear promis<strong>in</strong>g markets of growth s<strong>in</strong>ce <strong>the</strong>re are a large num<strong>be</strong>r of entrepreneurs who have <strong>to</strong> comply<br />

with an act on <strong>the</strong> legal liability for damage stemm<strong>in</strong>g from unsafe products, B.E. 2551. Concern<strong>in</strong>g negative fac<strong>to</strong>rs, <strong>the</strong>y <strong>in</strong>clude<br />

a reduction <strong>in</strong> fire premium rate from 5.0 - 20.0 percent for risks o<strong>the</strong>r than residences, for policies which start <strong>the</strong>ir coverage <strong>in</strong> 2010,<br />

which will affect <strong>the</strong> overall amount of fire premium.<br />

12