We aim to be the most preferred non-life insurer in Thailand

We aim to be the most preferred non-life insurer in Thailand

We aim to be the most preferred non-life insurer in Thailand

Create successful ePaper yourself

Turn your PDF publications into a flip-book with our unique Google optimized e-Paper software.

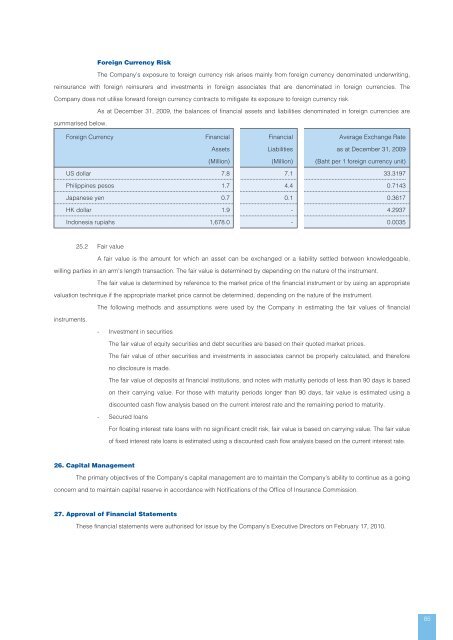

Foreign Currency Risk<br />

The Company’s exposure <strong>to</strong> foreign currency risk arises ma<strong>in</strong>ly from foreign currency denom<strong>in</strong>ated underwrit<strong>in</strong>g,<br />

re<strong>in</strong>surance with foreign re<strong><strong>in</strong>surer</strong>s and <strong>in</strong>vestments <strong>in</strong> foreign associates that are denom<strong>in</strong>ated <strong>in</strong> foreign currencies. The<br />

Company does not utilise forward foreign currency contracts <strong>to</strong> mitigate its exposure <strong>to</strong> foreign currency risk.<br />

As at Decem<strong>be</strong>r 31, 2009, <strong>the</strong> balances of f<strong>in</strong>ancial assets and liabilities denom<strong>in</strong>ated <strong>in</strong> foreign currencies are<br />

summarised <strong>be</strong>low.<br />

Foreign Currency F<strong>in</strong>ancial F<strong>in</strong>ancial Average Exchange Rate<br />

Assets Liabilities as at Decem<strong>be</strong>r 31, 2009<br />

(Million) (Million) (Baht per 1 foreign currency unit)<br />

US dollar 7.8 7.1 33.3197<br />

Philipp<strong>in</strong>es pesos 1.7 4.4 0.7143<br />

Japanese yen 0.7 0.1 0.3617<br />

HK dollar 1.9 - 4.2937<br />

Indonesia rupiahs 1,678.0 - 0.0035<br />

25.2 Fair value<br />

A fair value is <strong>the</strong> amount for which an asset can <strong>be</strong> exchanged or a liability settled <strong>be</strong>tween knowledgeable,<br />

will<strong>in</strong>g parties <strong>in</strong> an arm’s length transaction. The fair value is determ<strong>in</strong>ed by depend<strong>in</strong>g on <strong>the</strong> nature of <strong>the</strong> <strong>in</strong>strument.<br />

The fair value is determ<strong>in</strong>ed by reference <strong>to</strong> <strong>the</strong> market price of <strong>the</strong> f<strong>in</strong>ancial <strong>in</strong>strument or by us<strong>in</strong>g an appropriate<br />

valuation technique if <strong>the</strong> appropriate market price cannot <strong>be</strong> determ<strong>in</strong>ed, depend<strong>in</strong>g on <strong>the</strong> nature of <strong>the</strong> <strong>in</strong>strument.<br />

The follow<strong>in</strong>g methods and assumptions were used by <strong>the</strong> Company <strong>in</strong> estimat<strong>in</strong>g <strong>the</strong> fair values of f<strong>in</strong>ancial<br />

<strong>in</strong>struments.<br />

- Investment <strong>in</strong> securities<br />

The fair value of equity securities and debt securities are based on <strong>the</strong>ir quoted market prices.<br />

The fair value of o<strong>the</strong>r securities and <strong>in</strong>vestments <strong>in</strong> associates cannot <strong>be</strong> properly calculated, and <strong>the</strong>refore<br />

no disclosure is made.<br />

The fair value of deposits at f<strong>in</strong>ancial <strong>in</strong>stitutions, and notes with maturity periods of less than 90 days is based<br />

on <strong>the</strong>ir carry<strong>in</strong>g value. For those with maturity periods longer than 90 days, fair value is estimated us<strong>in</strong>g a<br />

discounted cash flow analysis based on <strong>the</strong> current <strong>in</strong>terest rate and <strong>the</strong> rema<strong>in</strong><strong>in</strong>g period <strong>to</strong> maturity.<br />

- Secured loans<br />

For float<strong>in</strong>g <strong>in</strong>terest rate loans with no significant credit risk, fair value is based on carry<strong>in</strong>g value. The fair value<br />

of fixed <strong>in</strong>terest rate loans is estimated us<strong>in</strong>g a discounted cash flow analysis based on <strong>the</strong> current <strong>in</strong>terest rate.<br />

26. Capital Management<br />

The primary objectives of <strong>the</strong> Company’s capital management are <strong>to</strong> ma<strong>in</strong>ta<strong>in</strong> <strong>the</strong> Company’s ability <strong>to</strong> cont<strong>in</strong>ue as a go<strong>in</strong>g<br />

concern and <strong>to</strong> ma<strong>in</strong>ta<strong>in</strong> capital reserve <strong>in</strong> accordance with Notifications of <strong>the</strong> Office of Insurance Commission.<br />

27. Approval of F<strong>in</strong>ancial Statements<br />

These f<strong>in</strong>ancial statements were authorised for issue by <strong>the</strong> Company’s Executive Direc<strong>to</strong>rs on February 17, 2010.<br />

85