We aim to be the most preferred non-life insurer in Thailand

We aim to be the most preferred non-life insurer in Thailand

We aim to be the most preferred non-life insurer in Thailand

Create successful ePaper yourself

Turn your PDF publications into a flip-book with our unique Google optimized e-Paper software.

(b)<br />

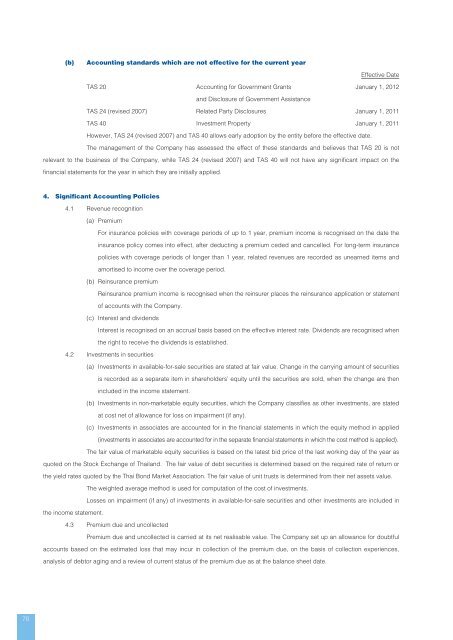

Account<strong>in</strong>g standards which are not effective for <strong>the</strong> current year<br />

Effective Date<br />

TAS 20 Account<strong>in</strong>g for Government Grants January 1, 2012<br />

and Disclosure of Government Assistance<br />

TAS 24 (revised 2007) Related Party Disclosures January 1, 2011<br />

TAS 40 Investment Property January 1, 2011<br />

However, TAS 24 (revised 2007) and TAS 40 allows early adoption by <strong>the</strong> entity <strong>be</strong>fore <strong>the</strong> effective date.<br />

The management of <strong>the</strong> Company has assessed <strong>the</strong> effect of <strong>the</strong>se standards and <strong>be</strong>lieves that TAS 20 is not<br />

relevant <strong>to</strong> <strong>the</strong> bus<strong>in</strong>ess of <strong>the</strong> Company, while TAS 24 (revised 2007) and TAS 40 will not have any significant impact on <strong>the</strong><br />

f<strong>in</strong>ancial statements for <strong>the</strong> year <strong>in</strong> which <strong>the</strong>y are <strong>in</strong>itially applied.<br />

4. Significant Account<strong>in</strong>g Policies<br />

4.1 Revenue recognition<br />

(a) Premium<br />

For <strong>in</strong>surance policies with coverage periods of up <strong>to</strong> 1 year, premium <strong>in</strong>come is recognised on <strong>the</strong> date <strong>the</strong><br />

<strong>in</strong>surance policy comes <strong>in</strong><strong>to</strong> effect, after deduct<strong>in</strong>g a premium ceded and cancelled. For long-term <strong>in</strong>surance<br />

policies with coverage periods of longer than 1 year, related revenues are recorded as unearned items and<br />

amortised <strong>to</strong> <strong>in</strong>come over <strong>the</strong> coverage period.<br />

(b) Re<strong>in</strong>surance premium<br />

Re<strong>in</strong>surance premium <strong>in</strong>come is recognised when <strong>the</strong> re<strong><strong>in</strong>surer</strong> places <strong>the</strong> re<strong>in</strong>surance application or statement<br />

of accounts with <strong>the</strong> Company.<br />

(c) Interest and dividends<br />

Interest is recognised on an accrual basis based on <strong>the</strong> effective <strong>in</strong>terest rate. Dividends are recognised when<br />

<strong>the</strong> right <strong>to</strong> receive <strong>the</strong> dividends is established.<br />

4.2 Investments <strong>in</strong> securities<br />

(a) Investments <strong>in</strong> available-for-sale securities are stated at fair value. Change <strong>in</strong> <strong>the</strong> carry<strong>in</strong>g amount of securities<br />

is recorded as a separate item <strong>in</strong> shareholders’ equity until <strong>the</strong> securities are sold, when <strong>the</strong> change are <strong>the</strong>n<br />

<strong>in</strong>cluded <strong>in</strong> <strong>the</strong> <strong>in</strong>come statement.<br />

(b) Investments <strong>in</strong> <strong>non</strong>-marketable equity securities, which <strong>the</strong> Company classifies as o<strong>the</strong>r <strong>in</strong>vestments, are stated<br />

at cost net of allowance for loss on impairment (if any).<br />

(c) Investments <strong>in</strong> associates are accounted for <strong>in</strong> <strong>the</strong> f<strong>in</strong>ancial statements <strong>in</strong> which <strong>the</strong> equity method <strong>in</strong> applied<br />

(<strong>in</strong>vestments <strong>in</strong> associates are accounted for <strong>in</strong> <strong>the</strong> separate f<strong>in</strong>ancial statements <strong>in</strong> which <strong>the</strong> cost method is applied).<br />

The fair value of marketable equity securities is based on <strong>the</strong> latest bid price of <strong>the</strong> last work<strong>in</strong>g day of <strong>the</strong> year as<br />

quoted on <strong>the</strong> S<strong>to</strong>ck Exchange of <strong>Thailand</strong>. The fair value of debt securities is determ<strong>in</strong>ed based on <strong>the</strong> required rate of return or<br />

<strong>the</strong> yield rates quoted by <strong>the</strong> Thai Bond Market Association. The fair value of unit trusts is determ<strong>in</strong>ed from <strong>the</strong>ir net assets value.<br />

The weighted average method is used for computation of <strong>the</strong> cost of <strong>in</strong>vestments.<br />

Losses on impairment (if any) of <strong>in</strong>vestments <strong>in</strong> available-for-sale securities and o<strong>the</strong>r <strong>in</strong>vestments are <strong>in</strong>cluded <strong>in</strong><br />

<strong>the</strong> <strong>in</strong>come statement.<br />

4.3 Premium due and uncollected<br />

Premium due and uncollected is carried at its net realisable value. The Company set up an allowance for doubtful<br />

accounts based on <strong>the</strong> estimated loss that may <strong>in</strong>cur <strong>in</strong> collection of <strong>the</strong> premium due, on <strong>the</strong> basis of collection experiences,<br />

analysis of deb<strong>to</strong>r ag<strong>in</strong>g and a review of current status of <strong>the</strong> premium due as at <strong>the</strong> balance sheet date.<br />

70