Global Steel Trade; Structural Problems and Future Solutions

Global Steel Trade; Structural Problems and Future Solutions

Global Steel Trade; Structural Problems and Future Solutions

You also want an ePaper? Increase the reach of your titles

YUMPU automatically turns print PDFs into web optimized ePapers that Google loves.

from Brazil, Japan, <strong>and</strong><br />

Russia. 58 A countervailing duty<br />

petition on imports of these<br />

products from Brazil was filed<br />

at the same time.<br />

• Imports of hot-rolled steel<br />

were found to have been<br />

dumped at substantial<br />

margins in all three<br />

investigations: from 41 to 43<br />

percent for Brazil, 18 to 67<br />

percent for Japan, <strong>and</strong> 74 to<br />

185 percent for Russia. 59<br />

• The dumped imports of hotrolled<br />

steel were also found<br />

to have injured the U.S.<br />

industry. In its final<br />

affirmative injury<br />

US$ Per Metric Ton<br />

$500<br />

$400<br />

$300<br />

$200<br />

Russia<br />

$100<br />

Jan ’97 Apr Jul Oct Jan ’98 Apr Jul Oct<br />

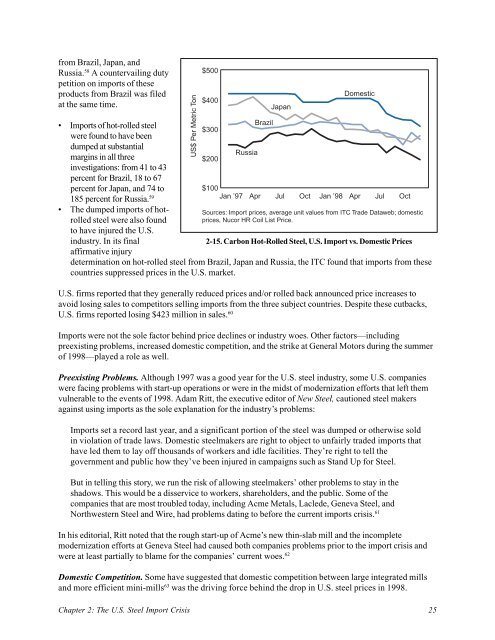

2-15. Carbon Hot-Rolled <strong>Steel</strong>, U.S. Import vs. Domestic Prices<br />

determination on hot-rolled steel from Brazil, Japan <strong>and</strong> Russia, the ITC found that imports from these<br />

countries suppressed prices in the U.S. market.<br />

U.S. firms reported that they generally reduced prices <strong>and</strong>/or rolled back announced price increases to<br />

avoid losing sales to competitors selling imports from the three subject countries. Despite these cutbacks,<br />

U.S. firms reported losing $423 million in sales. 60<br />

Imports were not the sole factor behind price declines or industry woes. Other factors—including<br />

preexisting problems, increased domestic competition, <strong>and</strong> the strike at General Motors during the summer<br />

of 1998—played a role as well.<br />

Preexisting <strong>Problems</strong>. Although 1997 was a good year for the U.S. steel industry, some U.S. companies<br />

were facing problems with start-up operations or were in the midst of modernization efforts that left them<br />

vulnerable to the events of 1998. Adam Ritt, the executive editor of New <strong>Steel</strong>, cautioned steel makers<br />

against using imports as the sole explanation for the industry’s problems:<br />

Imports set a record last year, <strong>and</strong> a significant portion of the steel was dumped or otherwise sold<br />

in violation of trade laws. Domestic steelmakers are right to object to unfairly traded imports that<br />

have led them to lay off thous<strong>and</strong>s of workers <strong>and</strong> idle facilities. They’re right to tell the<br />

government <strong>and</strong> public how they’ve been injured in campaigns such as St<strong>and</strong> Up for <strong>Steel</strong>.<br />

But in telling this story, we run the risk of allowing steelmakers’ other problems to stay in the<br />

shadows. This would be a disservice to workers, shareholders, <strong>and</strong> the public. Some of the<br />

companies that are most troubled today, including Acme Metals, Laclede, Geneva <strong>Steel</strong>, <strong>and</strong><br />

Northwestern <strong>Steel</strong> <strong>and</strong> Wire, had problems dating to before the current imports crisis. 61<br />

In his editorial, Ritt noted that the rough start-up of Acme’s new thin-slab mill <strong>and</strong> the incomplete<br />

modernization efforts at Geneva <strong>Steel</strong> had caused both companies problems prior to the import crisis <strong>and</strong><br />

were at least partially to blame for the companies’ current woes. 62<br />

Domestic Competition. Some have suggested that domestic competition between large integrated mills<br />

<strong>and</strong> more efficient mini-mills 63 was the driving force behind the drop in U.S. steel prices in 1998.<br />

Chapter 2: The U.S. <strong>Steel</strong> Import Crisis 25<br />

Brazil<br />

Japan<br />

Domestic<br />

Sources: Import prices, average unit values from ITC <strong>Trade</strong> Dataweb; domestic<br />

prices, Nucor HR Coil List Price.