Global Steel Trade; Structural Problems and Future Solutions

Global Steel Trade; Structural Problems and Future Solutions

Global Steel Trade; Structural Problems and Future Solutions

You also want an ePaper? Increase the reach of your titles

YUMPU automatically turns print PDFs into web optimized ePapers that Google loves.

at a loss. The rationale for pricing so aggressively in the U.S. market had to stem from the very significant<br />

declines in Japanese exports to Asia as a result of the Asia crisis, which caused a decline of 2 million MT<br />

of Japanese exports to the region from 1997 to 1998.<br />

While marginal cost pricing might be expected in periods of downturn, especially for a high fixed cost<br />

industry such as steel, the ability to sell at marginal cost for a long period cannot be sustained. Japanese<br />

producers may have an advantage over U.S. firms in that they are able to sell at marginal cost for longer<br />

periods. The reason for this lies in part in the noncompetitive nature of the domestic Japanese steel market,<br />

which tends to allow prices for domestic sales of steel to remain constant <strong>and</strong> relatively high. In a more<br />

competitive domestic environment, Japanese producers would have competed for domestic market share,<br />

not just foreign market share, <strong>and</strong> this would have driven down domestic prices <strong>and</strong> affected the producers’<br />

cash flow.<br />

Price-cutting on key products such as hot-rolled steel <strong>and</strong> structural shapes during the export surge are<br />

particularly illustrative.<br />

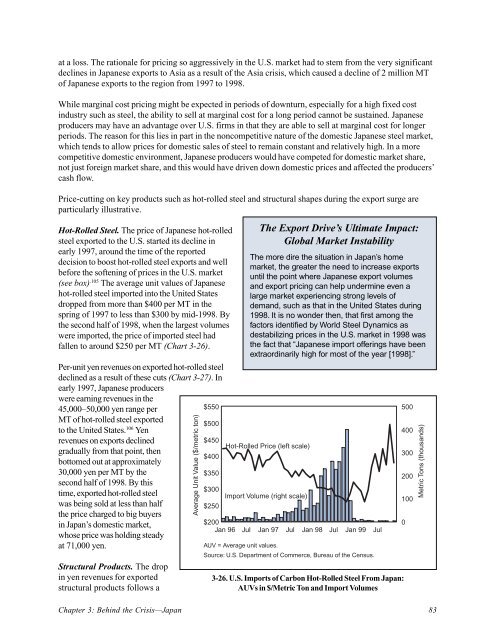

Hot-Rolled <strong>Steel</strong>. The price of Japanese hot-rolled<br />

steel exported to the U.S. started its decline in<br />

early 1997, around the time of the reported<br />

decision to boost hot-rolled steel exports <strong>and</strong> well<br />

before the softening of prices in the U.S. market<br />

(see box) .105 The average unit values of Japanese<br />

hot-rolled steel imported into the United States<br />

dropped from more than $400 per MT in the<br />

spring of 1997 to less than $300 by mid-1998. By<br />

the second half of 1998, when the largest volumes<br />

were imported, the price of imported steel had<br />

fallen to around $250 per MT (Chart 3-26).<br />

Per-unit yen revenues on exported hot-rolled steel<br />

declined as a result of these cuts (Chart 3-27). In<br />

early 1997, Japanese producers<br />

were earning revenues in the<br />

45,000–50,000 yen range per<br />

MT of hot-rolled steel exported<br />

to the United States. 106 Yen<br />

revenues on exports declined<br />

gradually from that point, then<br />

bottomed out at approximately<br />

30,000 yen per MT by the<br />

second half of 1998. By this<br />

time, exported hot-rolled steel<br />

was being sold at less than half<br />

the price charged to big buyers<br />

in Japan’s domestic market,<br />

whose price was holding steady<br />

at 71,000 yen.<br />

<strong>Structural</strong> Products. The drop<br />

in yen revenues for exported<br />

structural products follows a<br />

Average Unit Value ($/metric ton)<br />

$550<br />

$500<br />

$450<br />

$400<br />

$350<br />

$300<br />

$250<br />

Hot-Rolled Price (left scale)<br />

Import Volume (right scale)<br />

$200<br />

Jan 96 Jul Jan 97 Jul Jan 98 Jul Jan 99 Jul<br />

AUV = Average unit values.<br />

The Export Drive’s Ultimate Impact:<br />

<strong>Global</strong> Market Instability<br />

The more dire the situation in Japan’s home<br />

market, the greater the need to increase exports<br />

until the point where Japanese export volumes<br />

<strong>and</strong> export pricing can help undermine even a<br />

large market experiencing strong levels of<br />

dem<strong>and</strong>, such as that in the United States during<br />

1998. It is no wonder then, that first among the<br />

factors identified by World <strong>Steel</strong> Dynamics as<br />

destabilizing prices in the U.S. market in 1998 was<br />

the fact that “Japanese import offerings have been<br />

extraordinarily high for most of the year [1998].”<br />

Source: U.S. Department of Commerce, Bureau of the Census.<br />

3-26. U.S. Imports of Carbon Hot-Rolled <strong>Steel</strong> From Japan:<br />

AUVs in $/Metric Ton <strong>and</strong> Import Volumes<br />

Chapter 3: Behind the Crisis—Japan 83<br />

500<br />

400<br />

300<br />

200<br />

100<br />

0<br />

Metric Tons (thous<strong>and</strong>s)