CQUniversity Annual Report - Central Queensland University

CQUniversity Annual Report - Central Queensland University

CQUniversity Annual Report - Central Queensland University

You also want an ePaper? Increase the reach of your titles

YUMPU automatically turns print PDFs into web optimized ePapers that Google loves.

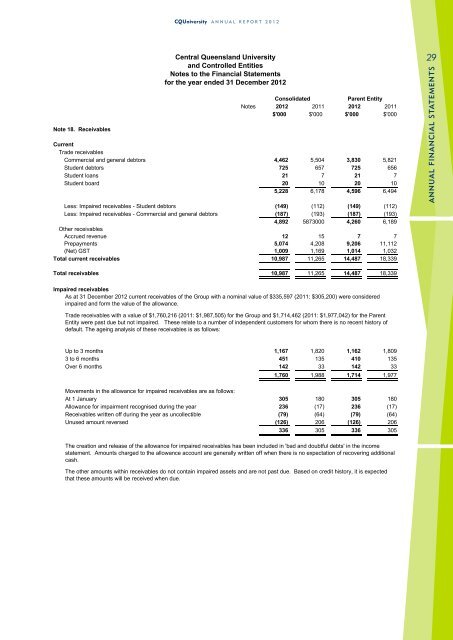

<strong>CQ<strong>University</strong></strong> ANNUAL REPORT 2012<br />

Note 18. Receivables<br />

<strong>Central</strong> <strong>Queensland</strong> <strong>University</strong><br />

and Controlled Entities<br />

Notes to the Financial Statements<br />

for the year ended 31 December 2012<br />

Consolidated<br />

Parent Entity<br />

Notes 2012 2011 2012 2011<br />

$'000 $'000 $'000 $'000<br />

Current<br />

Trade receivables<br />

Commercial and general debtors 4,462 5,504 3,830 5,821<br />

Student debtors 725 657 725 656<br />

Student loans 21 7 21 7<br />

Student board 20 10 20 10<br />

5,228 6,178 4,596 6,494<br />

Less: Impaired receivables - Student debtors (149) (112) (149) (112)<br />

Less: Impaired receivables - Commercial and general debtors (187) (193) (187) (193)<br />

4,892 5873000 4,260 6,189<br />

Other receivables<br />

Accrued revenue 12 15 7 7<br />

Prepayments 5,074 4,208 9,206 11,112<br />

(Net) GST 1,009 1,169 1,014 1,032<br />

Total current receivables 10,987 11,265 14,487 18,339<br />

29<br />

ANNUAL FINANCIAL STATEMENTS<br />

Total receivables 10,987 11,265 14,487 18,339<br />

Impaired receivables<br />

As at 31 December 2012 current receivables of the Group with a nominal value of $335,597 (2011: $305,200) were considered<br />

impaired and form the value of the allowance.<br />

Trade receivables with a value of $1,760,216 (2011: $1,987,505) for the Group and $1,714,462 (2011: $1,977,042) for the Parent<br />

Entity were past due but not impaired. These relate to a number of independent customers for whom there is no recent history of<br />

default. The ageing analysis of these receivables is as follows:<br />

Up to 3 months<br />

3 to 6 months<br />

Over 6 months<br />

Movements in the allowance for impaired receivables are as follows:<br />

At 1 January<br />

Allowance for impairment recognised during the year<br />

Receivables written off during the year as uncollectible<br />

Unused amount reversed<br />

1,167 1,820 1,162 1,809<br />

451 135 410 135<br />

142 33 142 33<br />

1,760 1,988 1,714 1,977<br />

305 180 305 180<br />

236 (17) 236 (17)<br />

(79) (64) (79) (64)<br />

(126) 206 (126) 206<br />

336 305 336 305<br />

The creation and release of the allowance for impaired receivables has been included in 'bad and doubtful debts' in the income<br />

statement. Amounts charged to the allowance account are generally written off when there is no expectation of recovering additional<br />

cash.<br />

The other amounts within receivables do not contain impaired assets and are not past due. Based on credit history, it is expected<br />

that these amounts will be received when due.