CQUniversity Annual Report - Central Queensland University

CQUniversity Annual Report - Central Queensland University

CQUniversity Annual Report - Central Queensland University

You also want an ePaper? Increase the reach of your titles

YUMPU automatically turns print PDFs into web optimized ePapers that Google loves.

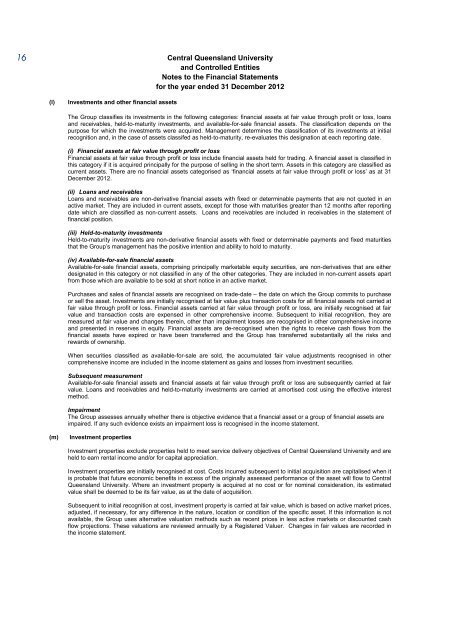

16<br />

<strong>Central</strong> <strong>Queensland</strong> <strong>University</strong><br />

and Controlled Entities<br />

Notes to the Financial Statements<br />

for the year ended 31 December 2012<br />

(l)<br />

Investments and other financial assets<br />

The Group classifies its investments in the following categories: financial assets at fair value through profit or loss, loans<br />

and receivables, held-to-maturity investments, and available-for-sale financial assets. The classification depends on the<br />

purpose for which the investments were acquired. Management determines the classification of its investments at initial<br />

recognition and, in the case of assets classifed as held-to-maturity, re-evaluates this designation at each reporting date.<br />

(i) Financial assets at fair value through profit or loss<br />

Financial assets at fair value through profit or loss include financial assets held for trading. A financial asset is classified in<br />

this category if it is acquired principally for the purpose of selling in the short term. Assets in this category are classified as<br />

current assets. There are no financial assets categorised as ‘financial assets at fair value through profit or loss’ as at 31<br />

December 2012.<br />

(ii) Loans and receivables<br />

Loans and receivables are non-derivative financial assets with fixed or determinable payments that are not quoted in an<br />

active market. They are included in current assets, except for those with maturities greater than 12 months after reporting<br />

date which are classified as non-current assets. Loans and receivables are included in receivables in the statement of<br />

financial position.<br />

(iii) Held-to-maturity investments<br />

Held-to-maturity investments are non-derivative financial assets with fixed or determinable payments and fixed maturities<br />

that the Group’s management has the positive intention and ability to hold to maturity.<br />

(iv) Available-for-sale financial assets<br />

Available-for-sale financial assets, comprising principally marketable equity securities, are non-derivatives that are either<br />

designated in this category or not classified in any of the other categories. They are included in non-current assets apart<br />

from those which are available to be sold at short notice in an active market.<br />

Purchases and sales of financial assets are recognised on trade-date – the date on which the Group commits to purchase<br />

or sell the asset. Investments are initially recognised at fair value plus transaction costs for all financial assets not carried at<br />

fair value through profit or loss. Financial assets carried at fair value through profit or loss, are initially recognised at fair<br />

value and transaction costs are expensed in other comprehensive income. Subsequent to initial recognition, they are<br />

measured at fair value and changes therein, other than impairment losses are recognised in other comprehensive income<br />

and presented in reserves in equity. Financial assets are de-recognised when the rights to receive cash flows from the<br />

financial assets have expired or have been transferred and the Group has transferred substantially all the risks and<br />

rewards of ownership.<br />

When securities classified as available-for-sale are sold, the accumulated fair value adjustments recognised in other<br />

comprehensive income are included in the income statement as gains and losses from investment securities.<br />

Subsequent measurement<br />

Available-for-sale financial assets and financial assets at fair value through profit or loss are subsequently carried at fair<br />

value. Loans and receivables and held-to-maturity investments are carried at amortised cost using the effective interest<br />

method.<br />

Impairment<br />

The Group assesses annually whether there is objective evidence that a financial asset or a group of financial assets are<br />

impaired. If any such evidence exists an impairment loss is recognised in the income statement.<br />

(m)<br />

Investment properties<br />

Investment properties exclude properties held to meet service delivery objectives of <strong>Central</strong> <strong>Queensland</strong> <strong>University</strong> and are<br />

held to earn rental income and/or for capital appreciation.<br />

Investment properties are initially recognised at cost. Costs incurred subsequent to initial acquisition are capitalised when it<br />

is probable that future economic benefits in excess of the originally assessed performance of the asset will flow to <strong>Central</strong><br />

<strong>Queensland</strong> <strong>University</strong>. Where an investment property is acquired at no cost or for nominal consideration, its estimated<br />

value shall be deemed to be its fair value, as at the date of acquisition.<br />

Subsequent to initial recognition at cost, investment property is carried at fair value, which is based on active market prices,<br />

adjusted, if necessary, for any difference in the nature, location or condition of the specific asset. If this information is not<br />

available, the Group uses alternative valuation methods such as recent prices in less active markets or discounted cash<br />

flow projections. These valuations are reviewed annually by a Registered Valuer. Changes in fair values are recorded in<br />

the income statement.