CQUniversity Annual Report - Central Queensland University

CQUniversity Annual Report - Central Queensland University

CQUniversity Annual Report - Central Queensland University

You also want an ePaper? Increase the reach of your titles

YUMPU automatically turns print PDFs into web optimized ePapers that Google loves.

66<br />

<strong>Central</strong> <strong>Queensland</strong> <strong>University</strong><br />

and Controlled Entities<br />

Notes to the Financial Statements<br />

for the year ended 31 December 2012<br />

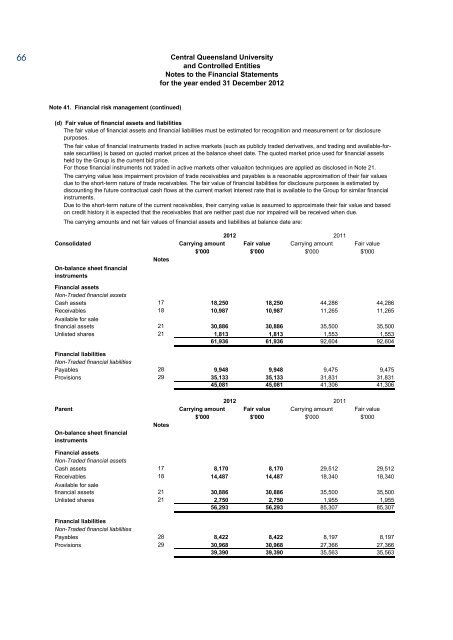

Note 41. Financial risk management (continued)<br />

(d) Fair value of financial assets and liabilities<br />

The fair value of financial assets and financial liabilities must be estimated for recognition and measurement or for disclosure<br />

purposes.<br />

The fair value of financial instruments traded in active markets (such as publicly traded derivatives, and trading and available-forsale<br />

securities) is based on quoted market prices at the balance sheet date. The quoted market price used for financial assets<br />

held by the Group is the current bid price.<br />

For those financial instruments not traded in active markets other valuaiton techniques are applied as disclosed in Note 21.<br />

The carrying value less impairment provision of trade receivables and payables is a resonable approximation of their fair values<br />

due to the short-term nature of trade receivables. The fair value of financial liabilities for disclosure purposes is estimated by<br />

discounting the future contractual cash flows at the current market interest rate that is available to the Group for similar financial<br />

instruments.<br />

Due to the short-term nature of the current receivables, their carrying value is assumed to approximate their fair value and based<br />

on credit history it is expected that the receivables that are neither past due nor impaired will be received when due.<br />

The carrying amounts and net fair values of financial assets and liabilities at balance date are:<br />

Consolidated<br />

On-balance sheet financial<br />

instruments<br />

Notes<br />

2012 2011<br />

Carrying amount Fair value Carrying amount Fair value<br />

$'000 $'000 $'000 $'000<br />

Financial assets<br />

Non-Traded financial assets<br />

Cash assets 17<br />

18,250 18,250 44,286 44,286<br />

Receivables<br />

Available for sale<br />

18<br />

10,987 10,987 11,265 11,265<br />

financial assets 21<br />

30,886 30,886 35,500 35,500<br />

Unlisted shares 21<br />

1,813 1,813 1,553 1,553<br />

61,936 61,936 92,604 92,604<br />

Financial liabilities<br />

Non-Traded financial liabilities<br />

Payables 28<br />

Provisions 29<br />

9,948 9,948 9,475 9,475<br />

35,133 35,133 31,831 31,831<br />

45,081 45,081 41,306 41,306<br />

Parent<br />

On-balance sheet financial<br />

instruments<br />

Notes<br />

2012 2011<br />

Carrying amount Fair value Carrying amount Fair value<br />

$'000 $'000 $'000 $'000<br />

Financial assets<br />

Non-Traded financial assets<br />

Cash assets 17<br />

Receivables 18<br />

Available for sale<br />

21<br />

Unlisted shares 21<br />

8,170 8,170 29,512 29,512<br />

14,487 14,487 18,340 18,340<br />

financial assets 30,886 30,886 35,500 35,500<br />

2,750 2,750 1,955 1,955<br />

56,293 56,293 85,307 85,307<br />

Financial liabilities<br />

Non-Traded financial liabilities<br />

Payables 28<br />

8,422 8,422 8,197 8,197<br />

Provisions 29 30,968 30,968 27,366 27,366<br />

39,390 39,390 35,563 35,563