CQUniversity Annual Report - Central Queensland University

CQUniversity Annual Report - Central Queensland University

CQUniversity Annual Report - Central Queensland University

Create successful ePaper yourself

Turn your PDF publications into a flip-book with our unique Google optimized e-Paper software.

<strong>CQ<strong>University</strong></strong> ANNUAL REPORT 2012<br />

Objectives and principal activities<br />

<strong>Central</strong> <strong>Queensland</strong> <strong>University</strong><br />

and Controlled Entities<br />

Notes to the Financial Statements<br />

for the year ended 31 December 2012<br />

The principal activities of the consolidated entity are listed in the Council Members <strong>Report</strong>.<br />

Note 1: Summary of significant accounting policies<br />

The principal accounting policies adopted in the preparation of the financial report are set out below. These policies have been<br />

consistently applied to all the years presented, unless otherwise stated.<br />

The Chancellor by signature has approved the release of the financial statements as at the date of signature.<br />

(a)<br />

Basis of preparation<br />

<strong>Central</strong> <strong>Queensland</strong> <strong>University</strong> is a statutory body established under the <strong>Central</strong> <strong>Queensland</strong> <strong>University</strong> Act 1998, and<br />

domiciled in Australia. The financial report includes separate financial statements for <strong>Central</strong> <strong>Queensland</strong> <strong>University</strong> as an<br />

individual entity and the consolidated entity consisting of <strong>Central</strong> <strong>Queensland</strong> <strong>University</strong> and the entities it controls.<br />

11<br />

ANNUAL FINANCIAL STATEMENTS<br />

The annual financial statements represent the audited general purpose financial statements of <strong>Central</strong> <strong>Queensland</strong><br />

<strong>University</strong>. They have been prepared on an accrual basis and comply with the Australian Accounting Standards.<br />

Additionally the statements have been prepared in accordance with the following statutory requirements:<br />

Higher Education Support Act 2003 (Financial Statement Guidelines)<br />

<strong>Central</strong> <strong>Queensland</strong> <strong>University</strong> Act 1998<br />

Financial and Performance Management Standard 2009 made under the Financial Accountability Act 2009<br />

With respect to compliance with Australian Accounting Standards and Interpretations, <strong>Central</strong> <strong>Queensland</strong> <strong>University</strong> has<br />

applied those requirements applicable to not-for-profit entities, as the <strong>University</strong> is a not-for-profit entity.<br />

Basis of measurement<br />

These financial statements have been prepared under the historical cost convention, except for available-for-sale financial<br />

assets, land, buildings and infrastructure, artworks, heritage collection and investment property.<br />

Critical accounting estimates<br />

The preparation of financial statements in conformity with Australian Accounting Standards requires the use of certain<br />

critical accounting estimates. It also requires management to exercise its judgment in the process of applying the Group’s<br />

accounting policies. Estimates and judgments are continually evaluated and are based on historical experience and other<br />

factors, including expectations of future events that are believed to be reasonable under the circumstances.<br />

Estimates and assumptions that have a potential significant effect are outlined in the following financial statement notes:<br />

Available for sale financial assets – Note 21<br />

Property, plant and equipment – Note 25<br />

Deferred tax assets and liabilities – Note 27<br />

Provisions – Note 29<br />

Contingencies – Note 34<br />

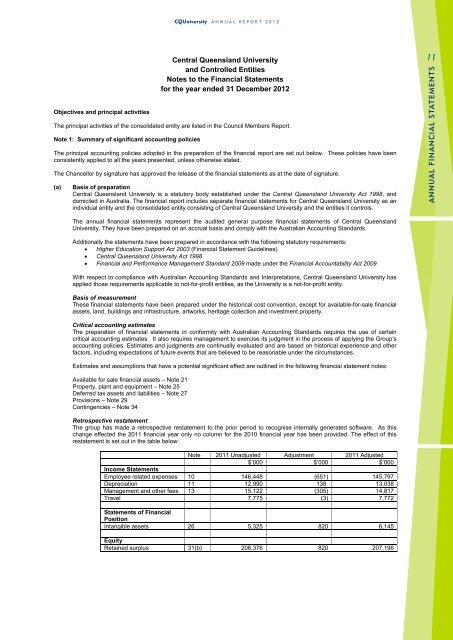

Retrospective restatement<br />

The group has made a retrospective restatement to the prior period to recognise internally generated software. As this<br />

change effected the 2011 financial year only no column for the 2010 financial year has been provided. The effect of this<br />

restatement is set out in the table below:<br />

Note 2011 Unadjusted Adjustment 2011 Adjusted<br />

$’000 $’000 $’000<br />

Income Statements<br />

Employee related expenses 10 146,448 (651) 145,797<br />

Depreciation 11 12,990 138 13,038<br />

Management and other fees 13 15,122 (305) 14,817<br />

Travel 7,775 (3) 7,772<br />

Statements of Financial<br />

Position<br />

Intangible assets 26 5,325 820 6,145<br />

Equity<br />

Retained surplus 31(b) 206,376 820 207,196