CQUniversity Annual Report - Central Queensland University

CQUniversity Annual Report - Central Queensland University

CQUniversity Annual Report - Central Queensland University

Create successful ePaper yourself

Turn your PDF publications into a flip-book with our unique Google optimized e-Paper software.

<strong>CQ<strong>University</strong></strong> ANNUAL REPORT 2012<br />

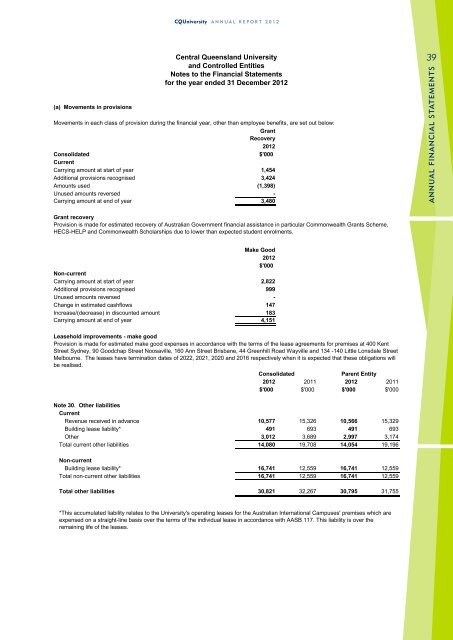

(a) Movements in provisions<br />

<strong>Central</strong> <strong>Queensland</strong> <strong>University</strong><br />

and Controlled Entities<br />

Notes to the Financial Statements<br />

for the year ended 31 December 2012<br />

Movements in each class of provision during the financial year, other than employee benefits, are set out below:<br />

Grant<br />

Recovery<br />

2012<br />

Consolidated<br />

$'000<br />

Current<br />

Carrying amount at start of year 1,454<br />

Additional provisions recognised 3,424<br />

Amounts used (1,398)<br />

Unused amounts reversed -<br />

Carrying amount at end of year 3,480<br />

39<br />

ANNUAL FINANCIAL STATEMENTS<br />

Grant recovery<br />

Provision is made for estimated recovery of Australian Government financial assistance in particular Commonwealth Grants Scheme,<br />

HECS-HELP and Commonwealth Scholarships due to lower than expected student enrolments.<br />

Make Good<br />

2012<br />

$'000<br />

Non-current<br />

Carrying amount at start of year 2,822<br />

Additional provisions recognised 999<br />

Unused amounts reversed -<br />

Change in estimated cashflows 147<br />

Increase/(decrease) in discounted amount 183<br />

Carrying amount at end of year 4,151<br />

Leasehold improvements - make good<br />

Provision is made for estimated make good expenses in accordance with the terms of the lease agreements for premises at 400 Kent<br />

Street Sydney, 90 Goodchap Street Noosaville, 160 Ann Street Brisbane, 44 Greenhill Road Wayville and 134 -140 Little Lonsdale Street<br />

Melbourne. The leases have termination dates of 2022, 2021, 2020 and 2016 respectively when it is expected that these obligations will<br />

be realised.<br />

Consolidated<br />

Parent Entity<br />

2012 2011 2012 2011<br />

$'000 $'000 $'000 $'000<br />

Note 30. Other liabilities<br />

Current<br />

Revenue received in advance 10,577 15,326 10,566 15,329<br />

Building lease liability* 491 693 491 693<br />

Other 3,012 3,689 2,997 3,174<br />

Total current other liabilities 14,080 19,708 14,054 19,196<br />

Non-current<br />

Building lease liability* 16,741 12,559 16,741 12,559<br />

Total non-current other liabilities 16,741 12,559 16,741 12,559<br />

Total other liabilities 30,821 32,267 30,795 31,755<br />

*This accumulated liability relates to the <strong>University</strong>'s operating leases for the Australian International Campuses' premises which are<br />

expensed on a straight-line basis over the terms of the individual lease in accordance with AASB 117. This liability is over the<br />

remaining life of the leases.