CQUniversity Annual Report - Central Queensland University

CQUniversity Annual Report - Central Queensland University

CQUniversity Annual Report - Central Queensland University

Create successful ePaper yourself

Turn your PDF publications into a flip-book with our unique Google optimized e-Paper software.

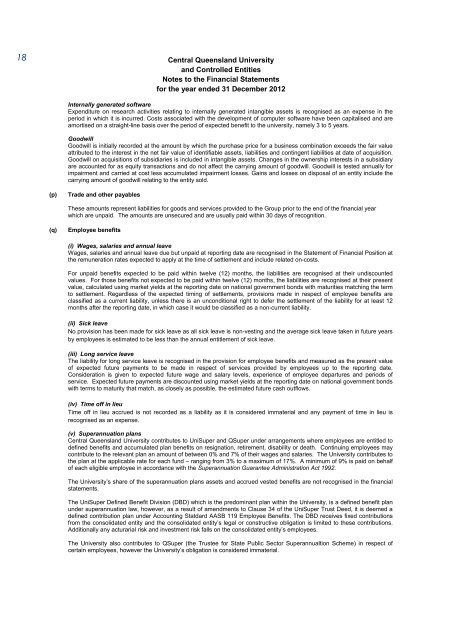

18<br />

<strong>Central</strong> <strong>Queensland</strong> <strong>University</strong><br />

and Controlled Entities<br />

Notes to the Financial Statements<br />

for the year ended 31 December 2012<br />

Internally generated software<br />

Expenditure on research activities relating to internally generated intangible assets is recognised as an expense in the<br />

period in which it is incurred. Costs associated with the development of computer software have been capitalised and are<br />

amortised on a straight-line basis over the period of expected benefit to the university, namely 3 to 5 years.<br />

Goodwill<br />

Goodwill is initially recorded at the amount by which the purchase price for a business combination exceeds the fair value<br />

attributed to the interest in the net fair value of identifiable assets, liabilities and contingent liabilities at date of acquisition.<br />

Goodwill on acquisitions of subsidiaries is included in intangible assets. Changes in the ownership interests in a subsidiary<br />

are accounted for as equity transactions and do not affect the carrying amount of goodwill. Goodwill is tested annually for<br />

impairment and carried at cost less accumulated impairment losses. Gains and losses on disposal of an entity include the<br />

carrying amount of goodwill relating to the entity sold.<br />

(p)<br />

Trade and other payables<br />

These amounts represent liabilities for goods and services provided to the Group prior to the end of the financial year<br />

which are unpaid. The amounts are unsecured and are usually paid within 30 days of recognition.<br />

(q)<br />

Employee benefits<br />

(i) Wages, salaries and annual leave<br />

Wages, salaries and annual leave due but unpaid at reporting date are recognised in the Statement of Financial Position at<br />

the remuneration rates expected to apply at the time of settlement and include related on-costs.<br />

For unpaid benefits expected to be paid within twelve (12) months, the liabilities are recognised at their undiscounted<br />

values. For those benefits not expected to be paid within twelve (12) months, the liabilities are recognised at their present<br />

value, calculated using market yields at the reporting date on national government bonds with maturities matching the term<br />

to settlement. Regardless of the expected timing of settlements, provisions made in respect of employee benefits are<br />

classified as a current liability, unless there is an unconditional right to defer the settlement of the liability for at least 12<br />

months after the reporting date, in which case it would be classified as a non-current liability.<br />

(ii) Sick leave<br />

No provision has been made for sick leave as all sick leave is non-vesting and the average sick leave taken in future years<br />

by employees is estimated to be less than the annual entitlement of sick leave.<br />

(iii) Long service leave<br />

The liability for long service leave is recognised in the provision for employee benefits and measured as the present value<br />

of expected future payments to be made in respect of services provided by employees up to the reporting date.<br />

Consideration is given to expected future wage and salary levels, experience of employee departures and periods of<br />

service. Expected future payments are discounted using market yields at the reporting date on national government bonds<br />

with terms to maturity that match, as closely as possible, the estimated future cash outflows.<br />

(iv) Time off in lieu<br />

Time off in lieu accrued is not recorded as a liability as it is considered immaterial and any payment of time in lieu is<br />

recognised as an expense.<br />

(v) Superannuation plans<br />

<strong>Central</strong> <strong>Queensland</strong> <strong>University</strong> contributes to UniSuper and QSuper under arrangements where employees are entitled to<br />

defined benefits and accumulated plan benefits on resignation, retirement, disability or death. Continuing employees may<br />

contribute to the relevant plan an amount of between 0% and 7% of their wages and salaries. The <strong>University</strong> contributes to<br />

the plan at the applicable rate for each fund – ranging from 3% to a maximum of 17%. A minimum of 9% is paid on behalf<br />

of each eligible employee in accordance with the Superannuation Guarantee Administration Act 1992.<br />

The <strong>University</strong>’s share of the superannuation plans assets and accrued vested benefits are not recognised in the financial<br />

statements.<br />

The UniSuper Defined Benefit Division (DBD) which is the predominant plan within the <strong>University</strong>, is a defined benefit plan<br />

under superannuation law, however, as a result of amendments to Clause 34 of the UniSuper Trust Deed, it is deemed a<br />

defined contribution plan under Accounting Statdard AASB 119 Employee Benefits. The DBD receives fixed contributions<br />

from the consolidated entity and the consolidated entity’s legal or constructive obligation is limited to these contributions.<br />

Additionally any acturarial risk and investment risk falls on the consolidated entity’s employees.<br />

The <strong>University</strong> also contributes to QSuper (the Trustee for State Public Sector Superannualtion Scheme) in respect of<br />

certain employees, however the <strong>University</strong>’s obligation is considered immaterial.