CQUniversity Annual Report - Central Queensland University

CQUniversity Annual Report - Central Queensland University

CQUniversity Annual Report - Central Queensland University

You also want an ePaper? Increase the reach of your titles

YUMPU automatically turns print PDFs into web optimized ePapers that Google loves.

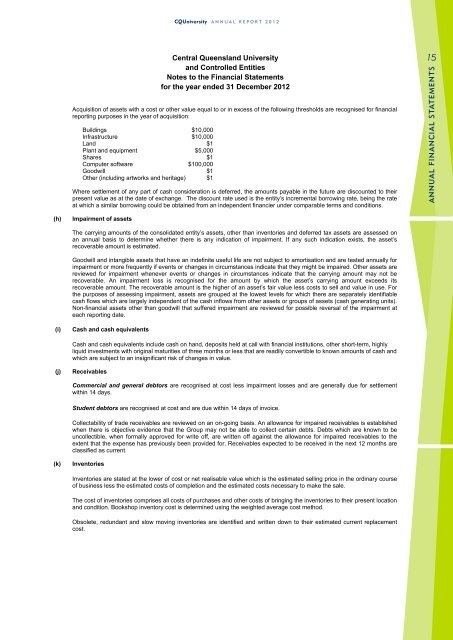

<strong>CQ<strong>University</strong></strong> ANNUAL REPORT 2012<br />

<strong>Central</strong> <strong>Queensland</strong> <strong>University</strong><br />

and Controlled Entities<br />

Notes to the Financial Statements<br />

for the year ended 31 December 2012<br />

Acquisition of assets with a cost or other value equal to or in excess of the following thresholds are recognised for financial<br />

reporting purposes in the year of acquisition:<br />

Buildings $10,000<br />

Infrastructure $10,000<br />

Land $1<br />

Plant and equipment $5,000<br />

Shares $1<br />

Computer software $100,000<br />

Goodwill $1<br />

Other (including artworks and heritage) $1<br />

Where settlement of any part of cash consideration is deferred, the amounts payable in the future are discounted to their<br />

present value as at the date of exchange. The discount rate used is the entity’s incremental borrowing rate, being the rate<br />

at which a similar borrowing could be obtained from an independent financier under comparable terms and conditions.<br />

15<br />

ANNUAL FINANCIAL STATEMENTS<br />

(h)<br />

Impairment of assets<br />

The carrying amounts of the consolidated entity’s assets, other than inventories and deferred tax assets are assessed on<br />

an annual basis to determine whether there is any indication of impairment. If any such indication exists, the asset’s<br />

recoverable amount is estimated.<br />

Goodwill and intangible assets that have an indefinite useful life are not subject to amortisation and are tested annually for<br />

impairment or more frequently if events or changes in circumstances indicate that they might be impaired. Other assets are<br />

reviewed for impairment whenever events or changes in circumstances indicate that the carrying amount may not be<br />

recoverable. An impairment loss is recognised for the amount by which the asset’s carrying amount exceeds its<br />

recoverable amount. The recoverable amount is the higher of an asset’s fair value less costs to sell and value in use. For<br />

the purposes of assessing impairment, assets are grouped at the lowest levels for which there are separately identifiable<br />

cash flows which are largely independent of the cash inflows from other assets or groups of assets (cash generating units).<br />

Non-financial assets other than goodwill that suffered impairment are reviewed for possible reversal of the impairment at<br />

each reporting date.<br />

(i)<br />

Cash and cash equivalents<br />

Cash and cash equivalents include cash on hand, deposits held at call with financial institutions, other short-term, highly<br />

liquid investments with original maturities of three months or less that are readily convertible to known amounts of cash and<br />

which are subject to an insignificant risk of changes in value.<br />

(j)<br />

Receivables<br />

Commercial and general debtors are recognised at cost less impairment losses and are generally due for settlement<br />

within 14 days.<br />

Student debtors are recognised at cost and are due within 14 days of invoice.<br />

Collectability of trade receivables are reviewed on an on-going basis. An allowance for impaired receivables is established<br />

when there is objective evidence that the Group may not be able to collect certain debts. Debts which are known to be<br />

uncollectible, when formally approved for write off, are written off against the allowance for impaired receivables to the<br />

extent that the expense has previously been provided for. Receivables expected to be received in the next 12 months are<br />

classified as current.<br />

(k)<br />

Inventories<br />

Inventories are stated at the lower of cost or net realisable value which is the estimated selling price in the ordinary course<br />

of business less the estimated costs of completion and the estimated costs necessary to make the sale.<br />

The cost of inventories comprises all costs of purchases and other costs of bringing the inventories to their present location<br />

and condition. Bookshop inventory cost is determined using the weighted average cost method.<br />

Obsolete, redundant and slow moving inventories are identified and written down to their estimated current replacement<br />

cost.