CQUniversity Annual Report - Central Queensland University

CQUniversity Annual Report - Central Queensland University

CQUniversity Annual Report - Central Queensland University

Create successful ePaper yourself

Turn your PDF publications into a flip-book with our unique Google optimized e-Paper software.

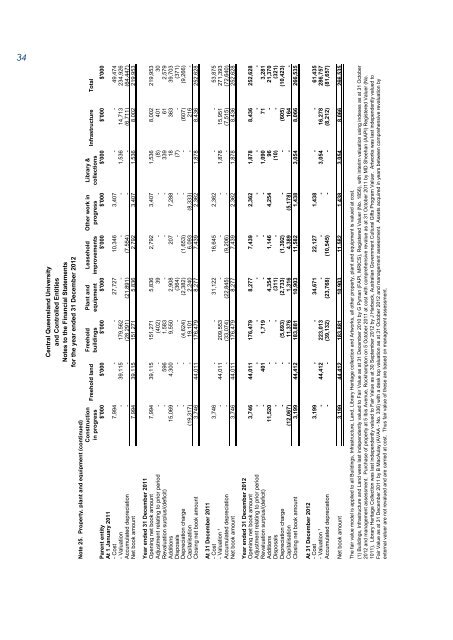

34<br />

Note 25. Property, plant and equipment (continued)<br />

Construction<br />

in progress<br />

Freehold land<br />

<strong>Central</strong> <strong>Queensland</strong> <strong>University</strong><br />

and Controlled Entities<br />

Notes to the Financial Statements<br />

for the year ended 31 December 2012<br />

Freehold<br />

buildings<br />

Plant and<br />

equipment<br />

Leasehold<br />

improvements<br />

Other work in<br />

progress<br />

Library &<br />

collections<br />

Infrastructure Total<br />

Parent entity $'000 $'000 $'000 $'000 $'000 $'000 $'000 $'000 $'000<br />

At 1 January 2011<br />

- Cost 7,994 - - 27,727 10,346 3,407 - - 49,474<br />

- Valuation - 39,115 179,562 - - - 1,536 14,713 234,926<br />

Accumulated depreciation - - (28,291) (21,891) (7,554) - - (6,711) (64,447)<br />

Net book amount 7,994 39,115 151,271 5,836 2,792 3,407 1,536 8,002 219,953<br />

Year ended 31 December 2011<br />

Opening net book amount 7,994 39,115 151,271 5,836 2,792 3,407 1,536 8,002 219,953<br />

Adjustment relating to prior period - - (402) 39 - - (8) 401 30<br />

Revaluation surplus/(deficit) - 596 1,583 - - - 339 61 2,579<br />

Additions 15,069 4,300 9,550 2,908 207 7,288 18 363 39,703<br />

Disposals - - - (364) - - (7) - (371)<br />

Depreciation charge<br />

- - (4,624) (2,382) (1,653) - - (607) (9,266)<br />

Capitalisation (19,317) - 19,101 2,240 6,093 (8,333) - 216 -<br />

Closing net book amount 3,746 44,011 176,479 8,277 7,439 2,362 1,878 8,436 252,628<br />

At 31 December 2011<br />

- Cost 3,746 - - 31,122 16,645 2,362 - - 53,875<br />

- Valuation ¹<br />

- 44,011 209,553 - - - 1,878 15,951 271,393<br />

Accumulated depreciation - - (33,074) (22,845) (9,206) - - (7,515) (72,640)<br />

Net book amount 3,746 44,011 176,479 8,277 7,439 2,362 1,878 8,436 252,628<br />

Year ended 31 December 2012<br />

Opening net book amount 3,746 44,011 176,479 8,277 7,439 2,362 1,878 8,436 252,628<br />

Adjustment relating to prior period - - - - - - - - -<br />

Revaluation surplus/(deficit) - 401 1,719 - - - 1,090 71 3,281<br />

Additions 11,520 - - 4,354 1,146 4,254 96 - 21,370<br />

Disposals - - - (311) - (10) - (321)<br />

Depreciation charge - - (5,693) (2,733) (1,392) - - (605) (10,423)<br />

Capitalisation (12,067) - 11,376 1,316 4,389 (5,178) - 164 -<br />

Closing net book amount 3,199 44,412 183,881 10,903 11,582 1,438 3,054 8,066 266,535<br />

At 31 December 2012<br />

- Cost<br />

3,199 - - 34,671 22,127 1,438 - - 61,435<br />

- Valuation ¹<br />

- 44,412 223,013 - - - 3,054 16,278 286,757<br />

Accumulated depreciation - - (39,132) (23,768) (10,545) - - (8,212) (81,657)<br />

Net book amount 3,199 44,412 183,881 10,903 11,582 1,438 3,054 8,066 266,535<br />

The fair value model is applied to all Buildings, Infrastructure, Land, Library Heritage collection and Artworks, all other property, plant and equipment is valued at cost.<br />

(1) Buildings, Infrastructure and Land were last independently valued to Fair Value as at 31 December 2010 by G Pyman (FAPI, MRICS), Registered Valuer (No. 1856), with interim valuation using indexes as at 31 October<br />

2012 and management assessment. Purchase of property at 5 Ibis Avenue, Rockhampton on 5 October 2011 at cost with comprehensive revalue as at 31 October 2011 by MD Sheehan (AAPI) Registered Valuer (No.<br />

1011). Library Heritage Collection was last independently valued to Fair Value as at 30 September 2012 by J Harbeck, Australian Government Cultural Gifts Program Valuer. Artworks was last independently valued to<br />

Fair Value as at 31 December 2011 by B MacAulay (AVAA - No. 336) with a desk top valuation as at 31 October 2012 and management assessment. Assets acquired in years between comprehensive revaluation by<br />

external valuer are not revalued and are carried at cost. Thus fair value of these are based on management assessment.