2012 Integrated report - Sappi

2012 Integrated report - Sappi

2012 Integrated report - Sappi

You also want an ePaper? Increase the reach of your titles

YUMPU automatically turns print PDFs into web optimized ePapers that Google loves.

Notes to the group annual financial statements<br />

for the year ended September <strong>2012</strong><br />

reclassified to profit or loss on disposal of the foreign operation,<br />

using the step-by-step consolidation method in terms of IFRIC 16<br />

Hedges of a Net Investment in a Foreign Operation.<br />

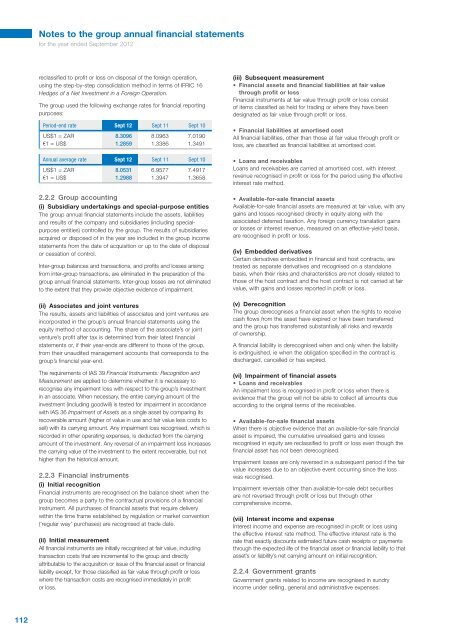

The group used the following exchange rates for financial <strong>report</strong>ing<br />

purposes:<br />

Period-end rate Sept 12 Sept 11 Sept 10<br />

US$1 = ZAR 8.3096 8.0963 7.0190<br />

e1 = US$ 1.2859 1.3386 1.3491<br />

Annual average rate Sept 12 Sept 11 Sept 10<br />

US$1 = ZAR 8.0531 6.9577 7.4917<br />

e1 = US$ 1.2988 1.3947 1.3658<br />

2.2.2 Group accounting<br />

(i) Subsidiary undertakings and special-purpose entities<br />

The group annual financial statements include the assets, liabilities<br />

and results of the company and subsidiaries (including specialpurpose<br />

entities) controlled by the group. The results of subsidiaries<br />

acquired or disposed of in the year are included in the group income<br />

statements from the date of acquisition or up to the date of disposal<br />

or cessation of control.<br />

Inter-group balances and transactions, and profits and losses arising<br />

from inter-group transactions, are eliminated in the preparation of the<br />

group annual financial statements. Inter-group losses are not eliminated<br />

to the extent that they provide objective evidence of impairment.<br />

(ii) Associates and joint ventures<br />

The results, assets and liabilities of associates and joint ventures are<br />

incorporated in the group’s annual financial statements using the<br />

equity method of accounting. The share of the associate’s or joint<br />

venture’s profit after tax is determined from their latest financial<br />

statements or, if their year-ends are different to those of the group,<br />

from their unaudited management accounts that corresponds to the<br />

group’s financial year-end.<br />

The requirements of IAS 39 Financial Instruments: Recognition and<br />

Measurement are applied to determine whether it is necessary to<br />

recognise any impairment loss with respect to the group’s investment<br />

in an associate. When necessary, the entire carrying amount of the<br />

investment (including goodwill) is tested for impairment in accordance<br />

with IAS 36 Impairment of Assets as a single asset by comparing its<br />

recoverable amount (higher of value in use and fair value less costs to<br />

sell) with its carrying amount. Any impairment loss recognised, which is<br />

recorded in other operating expenses, is deducted from the carrying<br />

amount of the investment. Any reversal of an impairment loss increases<br />

the carrying value of the investment to the extent recoverable, but not<br />

higher than the historical amount.<br />

2.2.3 Financial instruments<br />

(i) Initial recognition<br />

Financial instruments are recognised on the balance sheet when the<br />

group becomes a party to the contractual provisions of a financial<br />

instrument. All purchases of financial assets that require delivery<br />

within the time frame established by regulation or market convention<br />

(‘regular way’ purchases) are recognised at trade date.<br />

(ii) Initial measurement<br />

All financial instruments are initially recognised at fair value, including<br />

transaction costs that are incremental to the group and directly<br />

attributable to the acquisition or issue of the financial asset or financial<br />

liability except, for those classified as fair value through profit or loss<br />

where the transaction costs are recognised immediately in profit<br />

or loss.<br />

(iii) Subsequent measurement<br />

• Financial assets and financial liabilities at fair value<br />

through profit or loss<br />

Financial instruments at fair value through profit or loss consist<br />

of items classified as held for trading or where they have been<br />

designated as fair value through profit or loss.<br />

• Financial liabilities at amortised cost<br />

All financial liabilities, other than those at fair value through profit or<br />

loss, are classified as financial liabilities at amortised cost.<br />

• Loans and receivables<br />

Loans and receivables are carried at amortised cost, with interest<br />

revenue recognised in profit or loss for the period using the effective<br />

interest rate method.<br />

• Available-for-sale financial assets<br />

Available-for-sale financial assets are measured at fair value, with any<br />

gains and losses recognised directly in equity along with the<br />

associated deferred taxation. Any foreign currency translation gains<br />

or losses or interest revenue, measured on an effective-yield basis,<br />

are recognised in profit or loss.<br />

(iv) Embedded derivatives<br />

Certain derivatives embedded in financial and host contracts, are<br />

treated as separate derivatives and recognised on a standalone<br />

basis, when their risks and characteristics are not closely related to<br />

those of the host contract and the host contract is not carried at fair<br />

value, with gains and losses <strong>report</strong>ed in profit or loss.<br />

(v) Derecognition<br />

The group derecognises a financial asset when the rights to receive<br />

cash flows from the asset have expired or have been transferred<br />

and the group has transferred substantially all risks and rewards<br />

of ownership.<br />

A financial liability is derecognised when and only when the liability<br />

is extinguished, ie when the obligation specified in the contract is<br />

discharged, cancelled or has expired.<br />

(vi) Impairment of financial assets<br />

• Loans and receivables<br />

An impairment loss is recognised in profit or loss when there is<br />

evidence that the group will not be able to collect all amounts due<br />

according to the original terms of the receivables.<br />

• Available-for-sale financial assets<br />

When there is objective evidence that an available-for-sale financial<br />

asset is impaired, the cumulative unrealised gains and losses<br />

recognised in equity are reclassified to profit or loss even though the<br />

financial asset has not been derecognised.<br />

Impairment losses are only reversed in a subsequent period if the fair<br />

value increases due to an objective event occurring since the loss<br />

was recognised.<br />

Impairment reversals other than available-for-sale debt securities<br />

are not reversed through profit or loss but through other<br />

comprehensive income.<br />

(vii) Interest income and expense<br />

Interest income and expense are recognised in profit or loss using<br />

the effective interest rate method. The effective interest rate is the<br />

rate that exactly discounts estimated future cash receipts or payments<br />

through the expected life of the financial asset or financial liability to that<br />

asset’s or liability’s net carrying amount on initial recognition.<br />

2.2.4 Government grants<br />

Government grants related to income are recognised in sundry<br />

income under selling, general and administrative expenses.<br />

112