2012 Integrated report - Sappi

2012 Integrated report - Sappi

2012 Integrated report - Sappi

Create successful ePaper yourself

Turn your PDF publications into a flip-book with our unique Google optimized e-Paper software.

competitive<br />

The policy on fatalities at work serves as a guiding principle to<br />

the compensation committee when faced with this decision.<br />

The performance measures for 2013 will therefore be:<br />

Operating Profit (60%)<br />

Working Capital (30%)<br />

Safety (10%)<br />

It is the company’s intention to move from Operating Profit as<br />

a performance criteria to Net Profit once the group’s financial<br />

turnaround has delivered Net Profit consistently for at least<br />

three consecutive years.<br />

> From 2013 onwards, executive directors and executive<br />

committee members will receive their annual bonus<br />

determined in accordance with the 2013 management<br />

incentive scheme rules in cash and have voluntarily offered<br />

to purchase <strong>Sappi</strong> shares with a portion of their cash bonus.<br />

The CEO has volunteered to utilise 40% of his after-tax cash<br />

bonus to purchase <strong>Sappi</strong> shares. Other executive committee<br />

members have volunteered to utilise 30% of their after-tax<br />

cash bonus to purchase <strong>Sappi</strong> shares.<br />

Shares will be held in trust on behalf of participants.<br />

Participants will be entitled to all rights in respect of the shares,<br />

including dividends and voting rights.<br />

In addition, if a participant is still in the employ of <strong>Sappi</strong> 36<br />

months after purchasing the shares and none of the shares<br />

have been sold or encumbered during the 36-month period,<br />

then participants will receive a cash amount based on the then<br />

current market value of <strong>Sappi</strong> shares on the JSE Limited of<br />

20% of the original number of shares purchased, which<br />

amount will be grossed up for tax as applicable.<br />

The terms and conditions of the annual management incentive<br />

scheme for executive directors and group executive committee<br />

members afford the company the right to seek redress and<br />

recoup from an individual(s) where the board determines within<br />

a 12-month period of such payment, that the performance<br />

goals (whether for the individual participant or for the group)<br />

were in fact not achieved following a restatement of financial<br />

results or otherwise.<br />

Long term incentives<br />

During <strong>2012</strong>, the company operated two long term incentive<br />

plans, namely the <strong>Sappi</strong> Limited Share Incentive Trust (‘Scheme’)<br />

and the <strong>Sappi</strong> Limited Performance Incentive Trust (‘Plan’).<br />

Executive directors and other key senior managers (approximately<br />

40 participants) received a grant from the ‘Plan’ and all other<br />

participants received a grant from the ‘Scheme’ (approximately<br />

500 participants). From 2013 onwards, all eligible participants<br />

will receive grants in terms of the ‘Plan’ and ‘Scheme’ grants will<br />

be discontinued altogether.<br />

Performance plan share awards<br />

Shares granted to participants under the Performance Plan Share<br />

are conditional grants subject to performance conditions<br />

measured over a four year period. These awards will only vest if<br />

<strong>Sappi</strong>’s performance relative to a peer group of 14 other industry<br />

related companies is ranked at median or above the median.<br />

The performance criteria are Total Shareholder Return (TSR) and<br />

Cash Flow Return on Net Assets (CFRONA) weighted 50:50.<br />

The peer group consisted of the following companies:<br />

Resolute Forest Products (formerly Abitibi Bowater)<br />

UPM-Kymmene OYJ<br />

Holmen AB<br />

Stora Enso OYJ<br />

Mondi plc<br />

MeadWestvaco<br />

Fibria Celulose SA<br />

Nippon Paper Group<br />

International Paper<br />

Weyerhauser<br />

Metsä Board (formerly M-real OYJ)<br />

Norkse Skogindustria<br />

Oji Holdings<br />

Domtar<br />

For the four year period ending September 2011 and a vesting<br />

date of December 2011, <strong>Sappi</strong> performance to the peer group<br />

measured on TSR was ranked 12th place, which resulted in no<br />

shares vesting.<br />

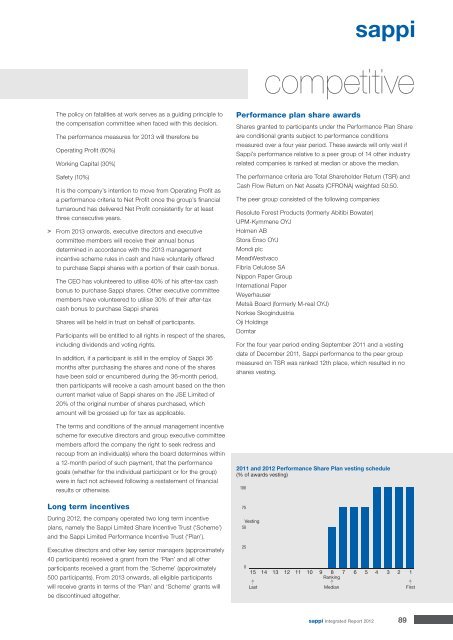

2011 and <strong>2012</strong> Performance Share Plan vesting schedule<br />

(% of awards vesting)<br />

100<br />

75<br />

Vesting<br />

50<br />

25<br />

0<br />

15 14 13 12 11 10 9 8 7 6 5 4 3 2 1<br />

Ranking<br />

Last Median First<br />

sappi <strong>Integrated</strong> Report <strong>2012</strong> 89