2012 Integrated report - Sappi

2012 Integrated report - Sappi

2012 Integrated report - Sappi

You also want an ePaper? Increase the reach of your titles

YUMPU automatically turns print PDFs into web optimized ePapers that Google loves.

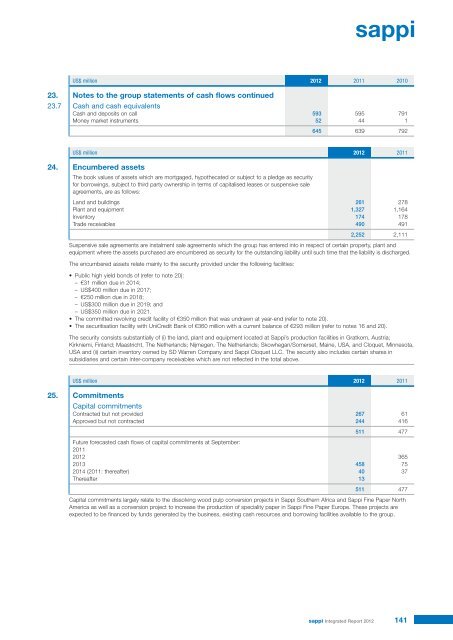

US$ million <strong>2012</strong> 2011 2010<br />

23. Notes to the group statements of cash flows continued<br />

23.7 Cash and cash equivalents<br />

Cash and deposits on call 593 595 791<br />

Money market instruments 52 44 1<br />

645 639 792<br />

US$ million <strong>2012</strong> 2011<br />

24. Encumbered assets<br />

The book values of assets which are mortgaged, hypothecated or subject to a pledge as security<br />

for borrowings, subject to third party ownership in terms of capitalised leases or suspensive sale<br />

agreements, are as follows:<br />

Land and buildings 261 278<br />

Plant and equipment 1,327 1,164<br />

Inventory 174 178<br />

Trade receivables 490 491<br />

2,252 2,111<br />

Suspensive sale agreements are instalment sale agreements which the group has entered into in respect of certain property, plant and<br />

equipment where the assets purchased are encumbered as security for the outstanding liability until such time that the liability is discharged.<br />

The encumbered assets relate mainly to the security provided under the following facilities:<br />

• Public high yield bonds of (refer to note 20):<br />

– €31 million due in 2014;<br />

– US$400 million due in 2017;<br />

– €250 million due in 2018;<br />

– US$300 million due in 2019; and<br />

– US$350 million due in 2021.<br />

• The committed revolving credit facility of €350 million that was undrawn at year-end (refer to note 20).<br />

• The securitisation facility with UniCredit Bank of €360 million with a current balance of €293 million (refer to notes 16 and 20).<br />

The security consists substantially of (i) the land, plant and equipment located at <strong>Sappi</strong>’s production facilities in Gratkorn, Austria;<br />

Kirkniemi, Finland; Maastricht, The Netherlands; Nijmegen, The Netherlands; Skowhegan/Somerset, Maine, USA, and Cloquet, Minnesota,<br />

USA and (ii) certain inventory owned by SD Warren Company and <strong>Sappi</strong> Cloquet LLC. The security also includes certain shares in<br />

subsidiaries and certain inter-company receivables which are not reflected in the total above.<br />

US$ million <strong>2012</strong> 2011<br />

25. Commitments<br />

Capital commitments<br />

Contracted but not provided 267 61<br />

Approved but not contracted 244 416<br />

511 477<br />

Future forecasted cash flows of capital commitments at September:<br />

2011<br />

<strong>2012</strong> 365<br />

2013 458 75<br />

2014 (2011: thereafter) 40 37<br />

Thereafter 13<br />

511 477<br />

Capital commitments largely relate to the dissolving wood pulp conversion projects in <strong>Sappi</strong> Southern Africa and <strong>Sappi</strong> Fine Paper North<br />

America as well as a conversion project to increase the production of speciality paper in <strong>Sappi</strong> Fine Paper Europe. These projects are<br />

expected to be financed by funds generated by the business, existing cash resources and borrowing facilities available to the group.<br />

sappi <strong>Integrated</strong> Report <strong>2012</strong> 141