Annual Report - VÃB banka

Annual Report - VÃB banka

Annual Report - VÃB banka

Create successful ePaper yourself

Turn your PDF publications into a flip-book with our unique Google optimized e-Paper software.

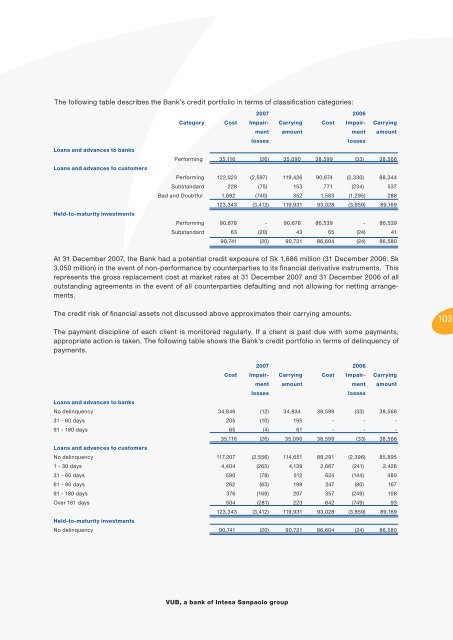

The following table describes the Bank’s credit portfolio in terms of classifi cation categories:<br />

Loans and advances to banks<br />

Loans and advances to customers<br />

Held-to-maturity investments<br />

2007 2006<br />

Category Cost Impair- Carrying Cost Impair- Carrying<br />

ment amount ment amount<br />

losses<br />

losses<br />

Performing 35,116 (26) 35,090 38,599 (33) 38,566<br />

Performing 122,023 (2,597) 119,426 90,674 (2,330) 88,344<br />

Substandard 228 (75) 153 771 (234) 537<br />

Bad and Doubtful 1,092 (740) 352 1,583 (1,295) 288<br />

123,343 (3,412) 119,931 93,028 (3,859) 89,169<br />

Performing 90,678 - 90,678 86,539 - 86,539<br />

Substandard 63 (20) 43 65 (24) 41<br />

90,741 (20) 90,721 86,604 (24) 86,580<br />

At 31 December 2007, the Bank had a potential credit exposure of Sk 1,686 million (31 December 2006: Sk<br />

3,050 million) in the event of non-performance by counterparties to its fi nancial derivative instruments. This<br />

represents the gross replacement cost at market rates at 31 December 2007 and 31 December 2006 of all<br />

outstanding agreements in the event of all counterparties defaulting and not allowing for netting arrangements.<br />

The credit risk of fi nancial assets not discussed above approximates their carrying amounts.<br />

The payment discipline of each client is monitored regularly. If a client is past due with some payments,<br />

appropriate action is taken. The following table shows the Bank’s credit portfolio in terms of delinquency of<br />

payments.<br />

103<br />

2007 2006<br />

Cost Impair- Carrying Cost Impair- Carrying<br />

ment amount ment amount<br />

losses<br />

losses<br />

Loans and advances to banks<br />

No delinquency 34,846 (12) 34,834 38,599 (33) 38,566<br />

31 - 60 days 205 (10) 195 - - -<br />

91 - 180 days 65 (4) 61 - - -<br />

35,116 (26) 35,090 38,599 (33) 38,566<br />

Loans and advances to customers<br />

No delinquency 117,207 (2,556) 114,651 88,291 (2,396) 85,895<br />

1 - 30 days 4,404 (265) 4,139 2,667 (241) 2,426<br />

31 - 60 days 590 (78) 512 624 (144) 480<br />

61 - 90 days 262 (63) 199 247 (80) 167<br />

91 - 180 days 376 (169) 207 357 (249) 108<br />

Over 181 days 504 (281) 223 842 (749) 93<br />

123,343 (3,412) 119,931 93,028 (3,859) 89,169<br />

Held-to-maturity investments<br />

No delinquency 90,741 (20) 90,721 86,604 (24) 86,580<br />

VUB, a bank of Intesa Sanpaolo group