Annual Report - VÃB banka

Annual Report - VÃB banka

Annual Report - VÃB banka

You also want an ePaper? Increase the reach of your titles

YUMPU automatically turns print PDFs into web optimized ePapers that Google loves.

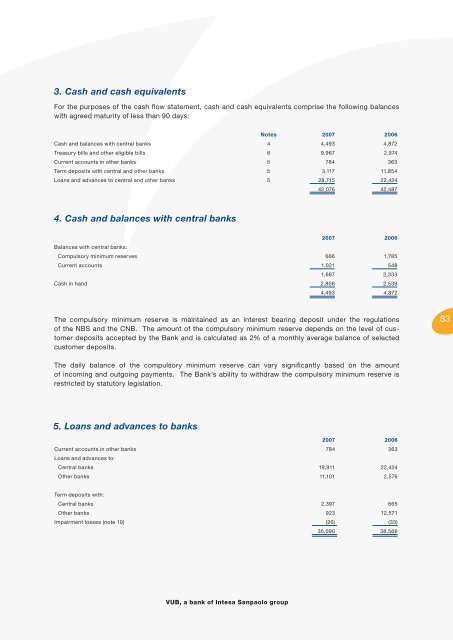

3. Cash and cash equivalents<br />

For the purposes of the cash fl ow statement, cash and cash equivalents comprise the following balances<br />

with agreed maturity of less than 90 days:<br />

Notes 2007 2006<br />

Cash and balances with central banks 4 4,493 4,872<br />

Treasury bills and other eligible bills 6 9,967 2,974<br />

Current accounts in other banks 5 784 363<br />

Term deposits with central and other banks 5 3,117 11,854<br />

Loans and advances to central and other banks 5 28,715 22,424<br />

42,076 42,487<br />

4. Cash and balances with central banks<br />

2007 2006<br />

Balances with central banks:<br />

Compulsory minimum reserves 666 1,785<br />

Current accounts 1,021 548<br />

1,687 2,333<br />

Cash in hand 2,806 2,539<br />

4,493 4,872<br />

The compulsory minimum reserve is maintained as an interest bearing deposit under the regulations<br />

of the NBS and the CNB. The amount of the compulsory minimum reserve depends on the level of customer<br />

deposits accepted by the Bank and is calculated as 2% of a monthly average balance of selected<br />

customer deposits.<br />

83<br />

The daily balance of the compulsory minimum reserve can vary signifi cantly based on the amount<br />

of incoming and outgoing payments. The Bank’s ability to withdraw the compulsory minimum reserve is<br />

restricted by statutory legislation.<br />

5. Loans and advances to banks<br />

2007 2006<br />

Current accounts in other banks 784 363<br />

Loans and advances to:<br />

Central banks 19,911 22,424<br />

Other banks 11,101 2,576<br />

Term deposits with:<br />

Central banks 2,397 665<br />

Other banks 923 12,571<br />

Impairment losses (note 10) (26) (33)<br />

35,090 38,566<br />

VUB, a bank of Intesa Sanpaolo group