Annual Report - VÃB banka

Annual Report - VÃB banka

Annual Report - VÃB banka

Create successful ePaper yourself

Turn your PDF publications into a flip-book with our unique Google optimized e-Paper software.

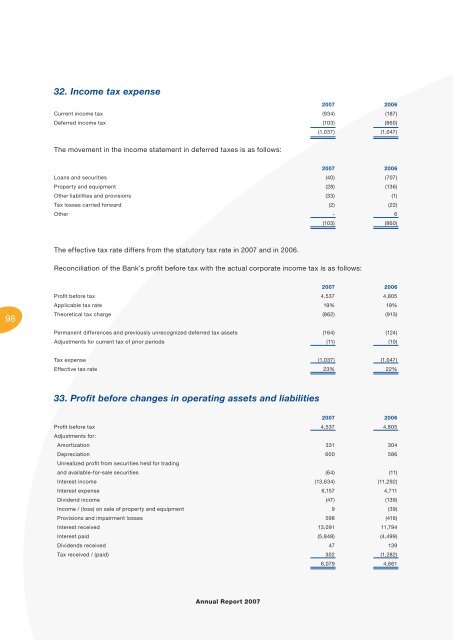

32. Income tax expense<br />

2007 2006<br />

Current income tax (934) (187)<br />

Deferred income tax (103) (860)<br />

(1,037) (1,047)<br />

The movement in the income statement in deferred taxes is as follows:<br />

2007 2006<br />

Loans and securities (40) (707)<br />

Property and equipment (28) (136)<br />

Other liabilities and provisions (33) (1)<br />

Tax losses carried forward (2) (22)<br />

Other - 6<br />

(103) (860)<br />

The effective tax rate differs from the statutory tax rate in 2007 and in 2006.<br />

Reconciliation of the Bank’s profi t before tax with the actual corporate income tax is as follows:<br />

98<br />

2007 2006<br />

Profi t before tax 4,537 4,805<br />

Applicable tax rate 19% 19%<br />

Theoretical tax charge (862) (913)<br />

Permanent differences and previously unrecognized deferred tax assets (164) (124)<br />

Adjustments for current tax of prior periods (11) (10)<br />

Tax expense (1,037) (1,047)<br />

Effective tax rate 23% 22%<br />

33. Profit before changes in operating assets and liabilities<br />

2007 2006<br />

Profi t before tax 4,537 4,805<br />

Adjustments for:<br />

Amortization 331 304<br />

Depreciation 600 586<br />

Unrealized profi t from securities held for trading<br />

and available-for-sale securities (64) (11)<br />

Interest income (13,634) (11,292)<br />

Interest expense 6,157 4,711<br />

Dividend income (47) (139)<br />

Income / (loss) on sale of property and equipment 9 (39)<br />

Provisions and impairment losses 598 (416)<br />

Interest received 13,091 11,794<br />

Interest paid (5,848) (4,499)<br />

Dividends received 47 139<br />

Tax received / (paid) 302 (1,282)<br />

6,079 4,661<br />

<strong>Annual</strong> <strong>Report</strong> 2007