Annual Report - VÃB banka

Annual Report - VÃB banka

Annual Report - VÃB banka

You also want an ePaper? Increase the reach of your titles

YUMPU automatically turns print PDFs into web optimized ePapers that Google loves.

(b) Market risk<br />

Market risk is the risk that changes in market prices,<br />

such as interest rate, equity prices, foreign exchange<br />

rate will affect the Group’s income or the<br />

value of its holdings of fi nancial instruments. The<br />

objective of market risk management is to manage<br />

and control market risk exposures within acceptable<br />

parameters, while optimizing the return on risk.<br />

Management of market risk<br />

The Bank separates its exposures to market risk<br />

between trading and non-trading portfolios. Trading<br />

portfolios are held by the Trading department<br />

and include positions arising from market-making<br />

and proprietary position taking. All foreign exchange<br />

risk within the Bank is transferred each day to<br />

the Trading department and forms part of the trading<br />

portfolio for risk management purposes. The<br />

non-trading portfolios are managed by the ALM department,<br />

and include all positions, which are not<br />

intended for trading.<br />

Overall authority for market risk is vested in ALCO.<br />

The Risk Management Division is responsible for<br />

the development of detailed risk management policies<br />

(subject to review and approval by ALCO) and<br />

for their implementation and day-to-day risk monitoring<br />

and reporting.<br />

Exposure to market risk – trading portfolios<br />

The principal tool used to measure and control market<br />

risk exposure within the Bank’s trading portfolio<br />

is Value at Risk (VaR). The VaR of a trading portfolio<br />

is the estimated loss that will arise on the portfolio<br />

over a specifi ed period of time (holding period)<br />

from an adverse market movement with a specifi ed<br />

probability (confi dence level). The VaR model used<br />

by the Bank is based upon a 99 percent confi dence<br />

level and assumes a 1-day holding period. The VaR<br />

model used is based on historical simulation. Taking<br />

account of market data from the previous year,<br />

and observed relationships between different markets<br />

and prices, the model generates a wide range<br />

of plausible future scenarios for market price movements.<br />

The model was approved by the NBS as<br />

a basis for the calculation of the capital charge for<br />

market risk of the trading book.<br />

The VUB Group uses VaR limits for total market risk<br />

in the trading book, foreign exchange risk and interest<br />

rate risk. The overall structure of VaR limits is<br />

subject to review and approval by ALCO and Intesa<br />

Sanpaolo. VaR is measured on a daily basis. Daily<br />

reports of utilization of VaR limits are submitted to<br />

the trading unit, the head of the Risk Management<br />

division and the head of the Finance and Capital<br />

Markets division. Regular summaries are submitted<br />

to Intesa Sanpaolo and ALCO.<br />

57<br />

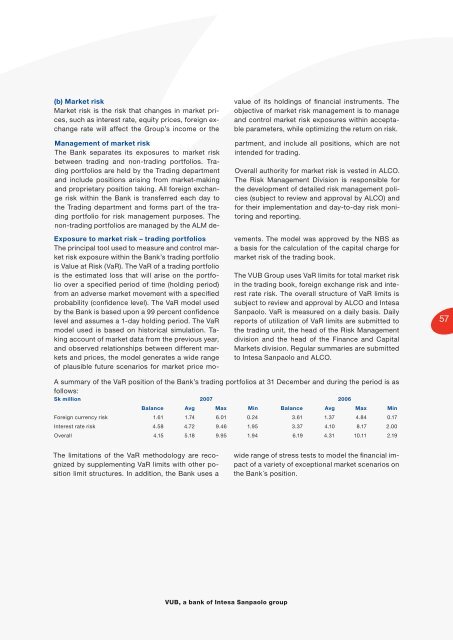

A summary of the VaR position of the Bank’s trading portfolios at 31 December and during the period is as<br />

follows:<br />

Sk million 2007 2006<br />

Balance Avg Max Min Balance Avg Max Min<br />

Foreign currency risk 1.61 1.74 6.01 0.24 3.61 1.37 4.84 0.17<br />

Interest rate risk 4.58 4.72 9.46 1.95 3.37 4.10 8.17 2.00<br />

Overall 4.15 5.18 9.95 1.94 6.19 4.31 10.11 2.19<br />

The limitations of the VaR methodology are recognized<br />

by supplementing VaR limits with other position<br />

limit structures. In addition, the Bank uses a<br />

wide range of stress tests to model the fi nancial impact<br />

of a variety of exceptional market scenarios on<br />

the Bank´s position.<br />

VUB, a bank of Intesa Sanpaolo group