Annual Report - VÃB banka

Annual Report - VÃB banka

Annual Report - VÃB banka

You also want an ePaper? Increase the reach of your titles

YUMPU automatically turns print PDFs into web optimized ePapers that Google loves.

37. Financial risk management (continued)<br />

Write-off policy<br />

The VUB Group writes off a loan or security balance<br />

(and any related allowances for impairment losses)<br />

when the VUB Group determines that the loans /<br />

securities are uncollectible. As the standard, the<br />

VUB Group considers the credit balances to be uncollectible<br />

based on the past due days (180 past<br />

due days or 360 past due days depending on the<br />

type of segment or product). All credit balances are<br />

reviewed for eligibility to be written off on a monthly<br />

basis.<br />

The credit balance can be written off earlier than<br />

defi ned in conditions described above if there is<br />

evidence that the receivable cannot be collected.<br />

The write off of such receivables is subject to the<br />

approval of the Credit Risk Offi cer.<br />

The VUB Group holds collateral against loans and<br />

advances to customers in the form of mortgage interests<br />

over property, other registered securities<br />

over assets, and guarantees. Estimates of fair value<br />

are based on the value of collateral assessed at the<br />

time of borrowing and the Group updates the fair<br />

value on a regular basis.<br />

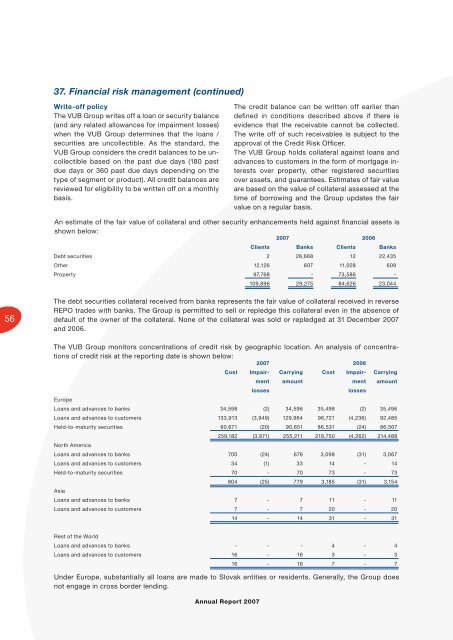

An estimate of the fair value of collateral and other security enhancements held against fi nancial assets is<br />

shown below:<br />

2007 2006<br />

Clients Banks Clients Banks<br />

Debt securities 2 28,668 12 22,435<br />

Other 12,126 607 11,028 609<br />

Property 97,768 - 73,586 -<br />

109,896 29,275 84,626 23,044<br />

56<br />

The debt securities collateral received from banks represents the fair value of collateral received in reverse<br />

REPO trades with banks. The Group is permitted to sell or repledge this collateral even in the absence of<br />

default of the owner of the collateral. None of the collateral was sold or repledged at 31 December 2007<br />

and 2006.<br />

The VUB Group monitors concentrations of credit risk by geographic location. An analysis of concentrations<br />

of credit risk at the reporting date is shown below:<br />

2007 2006<br />

Cost Impair- Carrying Cost Impair- Carrying<br />

ment amount ment amount<br />

losses<br />

losses<br />

Europe<br />

Loans and advances to banks 34,598 (2) 34,596 35,498 (2) 35,496<br />

Loans and advances to customers 133,913 (3,949) 129,964 96,721 (4,236) 92,485<br />

Held-to-maturity securities 90,671 (20) 90,651 86,531 (24) 86,507<br />

259,182 (3,971) 255,211 218,750 (4,262) 214,488<br />

North America<br />

Loans and advances to banks 700 (24) 676 3,098 (31) 3,067<br />

Loans and advances to customers 34 (1) 33 14 - 14<br />

Held-to-maturity securities 70 - 70 73 - 73<br />

804 (25) 779 3,185 (31) 3,154<br />

Asia<br />

Loans and advances to banks 7 - 7 11 - 11<br />

Loans and advances to customers 7 - 7 20 - 20<br />

14 - 14 31 - 31<br />

Rest of the World<br />

Loans and advances to banks - - - 4 - 4<br />

Loans and advances to customers 16 - 16 3 - 3<br />

<strong>Annual</strong> <strong>Report</strong> 2007<br />

16 - 16 7 - 7<br />

Under Europe, substantially all loans are made to Slovak entities or residents. Generally, the Group does<br />

not engage in cross border lending.