Annual Report - VÃB banka

Annual Report - VÃB banka

Annual Report - VÃB banka

You also want an ePaper? Increase the reach of your titles

YUMPU automatically turns print PDFs into web optimized ePapers that Google loves.

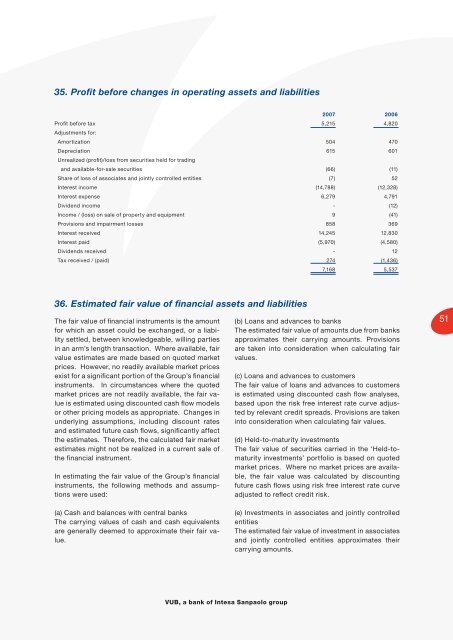

35. Profit before changes in operating assets and liabilities<br />

2007 2006<br />

Profi t before tax 5,215 4,820<br />

Adjustments for:<br />

Amortization 504 470<br />

Depreciation 615 601<br />

Unrealized (profi t)/loss from securities held for trading<br />

and available-for-sale securities (66) (11)<br />

Share of loss of associates and jointly controlled entities (7) 52<br />

Interest income (14,788) (12,328)<br />

Interest expense 6,279 4,791<br />

Dividend income - (12)<br />

Income / (loss) on sale of property and equipment 9 (41)<br />

Provisions and impairment losses 858 369<br />

Interest received 14,245 12,830<br />

Interest paid (5,970) (4,580)<br />

Dividends received - 12<br />

Tax received / (paid) 274 (1,436)<br />

7,168 5,537<br />

36. Estimated fair value of financial assets and liabilities<br />

The fair value of fi nancial instruments is the amount<br />

for which an asset could be exchanged, or a liability<br />

settled, between knowledgeable, willing parties<br />

in an arm’s length transaction. Where available, fair<br />

value estimates are made based on quoted market<br />

prices. However, no readily available market prices<br />

exist for a signifi cant portion of the Group’s fi nancial<br />

instruments. In circumstances where the quoted<br />

market prices are not readily available, the fair value<br />

is estimated using discounted cash fl ow models<br />

or other pricing models as appropriate. Changes in<br />

underlying assumptions, including discount rates<br />

and estimated future cash fl ows, signifi cantly affect<br />

the estimates. Therefore, the calculated fair market<br />

estimates might not be realized in a current sale of<br />

the fi nancial instrument.<br />

In estimating the fair value of the Group’s fi nancial<br />

instruments, the following methods and assumptions<br />

were used:<br />

(b) Loans and advances to banks<br />

The estimated fair value of amounts due from banks<br />

approximates their carrying amounts. Provisions<br />

are taken into consideration when calculating fair<br />

values.<br />

(c) Loans and advances to customers<br />

The fair value of loans and advances to customers<br />

is estimated using discounted cash fl ow analyses,<br />

based upon the risk free interest rate curve adjusted<br />

by relevant credit spreads. Provisions are taken<br />

into consideration when calculating fair values.<br />

(d) Held-to-maturity investments<br />

The fair value of securities carried in the ‘Held-tomaturity<br />

investments’ portfolio is based on quoted<br />

market prices. Where no market prices are available,<br />

the fair value was calculated by discounting<br />

future cash fl ows using risk free interest rate curve<br />

adjusted to refl ect credit risk.<br />

51<br />

(a) Cash and balances with central banks<br />

The carrying values of cash and cash equivalents<br />

are generally deemed to approximate their fair value.<br />

(e) Investments in associates and jointly controlled<br />

entities<br />

The estimated fair value of investment in associates<br />

and jointly controlled entities approximates their<br />

carrying amounts.<br />

VUB, a bank of Intesa Sanpaolo group