Annual Report - VÃB banka

Annual Report - VÃB banka

Annual Report - VÃB banka

You also want an ePaper? Increase the reach of your titles

YUMPU automatically turns print PDFs into web optimized ePapers that Google loves.

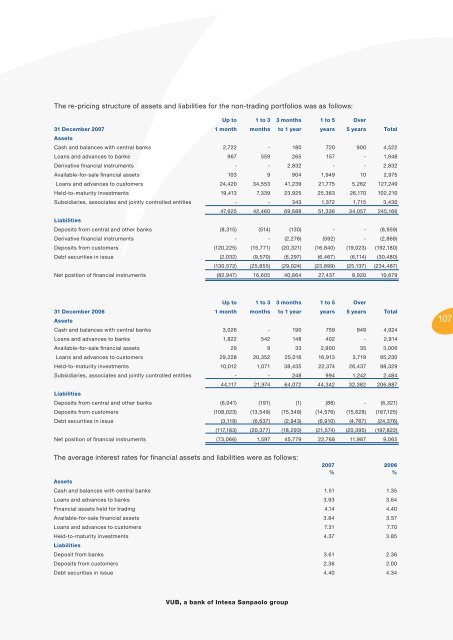

The re-pricing structure of assets and liabilities for the non-trading portfolios was as follows:<br />

Up to 1 to 3 3 months 1 to 5 Over<br />

31 December 2007 1 month months to 1 year years 5 years Total<br />

Assets<br />

Cash and balances with central banks 2,722 - 180 720 900 4,522<br />

Loans and advances to banks 967 559 265 157 - 1,948<br />

Derivative fi nancial instruments - - 2,832 - - 2,832<br />

Available-for-sale fi nancial assets 103 9 904 1,949 10 2,975<br />

Loans and advances to customers 24,420 34,553 41,239 21,775 5,262 127,249<br />

Held-to-maturity investments 19,413 7,339 23,925 25,363 26,170 102,210<br />

Subsidiaries, associates and jointly controlled entities - - 343 1,372 1,715 3,430<br />

47,625 42,460 69,688 51,336 34,057 245,166<br />

Liabilities<br />

Deposits from central and other banks (8,315) (514) (130) - - (8,959)<br />

Derivative fi nancial instruments - - (2,276) (592) - (2,868)<br />

Deposits from customers (120,225) (15,771) (20,321) (16,840) (19,023) (192,180)<br />

Debt securities in issue (2,032) (9,570) (6,297) (6,467) (6,114) (30,480)<br />

(130,572) (25,855) (29,024) (23,899) (25,137) (234,487)<br />

Net position of fi nancial instruments (82,947) 16,605 40,664 27,437 8,920 10,679<br />

Up to 1 to 3 3 months 1 to 5 Over<br />

31 December 2006 1 month months to 1 year years 5 years Total<br />

Assets<br />

Cash and balances with central banks 3,026 - 190 759 949 4,924<br />

Loans and advances to banks 1,822 542 148 402 - 2,914<br />

Available-for-sale fi nancial assets 29 9 33 2,900 35 3,006<br />

Loans and advances to customers 29,228 20,352 25,018 16,913 3,719 95,230<br />

Held-to-maturity investments 10,012 1,071 38,435 22,374 26,437 98,329<br />

Subsidiaries, associates and jointly controlled entities - - 248 994 1,242 2,484<br />

44,117 21,974 64,072 44,342 32,382 206,887<br />

Liabilities<br />

Deposits from central and other banks (6,041) (191) (1) (88) - (6,321)<br />

Deposits from customers (108,023) (13,549) (15,349) (14,576) (15,628) (167,125)<br />

Debt securities in issue (3,119) (6,637) (2,943) (6,910) (4,767) (24,376)<br />

(117,183) (20,377) (18,293) (21,574) (20,395) (197,822)<br />

Net position of fi nancial instruments (73,066) 1,597 45,779 22,768 11,987 9,065<br />

107<br />

The average interest rates for fi nancial assets and liabilities were as follows:<br />

Assets<br />

2007 2006<br />

% %<br />

Cash and balances with central banks 1.51 1.35<br />

Loans and advances to banks 3.93 3.64<br />

Financial assets held for trading 4.14 4.40<br />

Available-for-sale fi nancial assets 3.84 3.57<br />

Loans and advances to customers 7.31 7.70<br />

Held-to-maturity investments 4.37 3.85<br />

Liabilities<br />

Deposit from banks 3.61 2.36<br />

Deposits from customers 2.36 2.00<br />

Debt securities in issue 4.40 4.34<br />

VUB, a bank of Intesa Sanpaolo group