Annual Report - VÃB banka

Annual Report - VÃB banka

Annual Report - VÃB banka

Create successful ePaper yourself

Turn your PDF publications into a flip-book with our unique Google optimized e-Paper software.

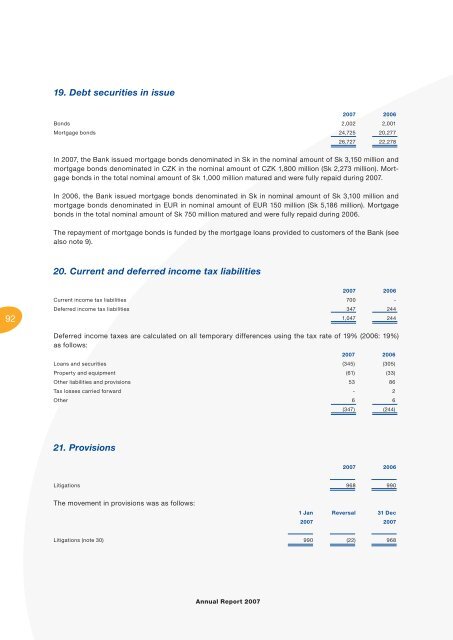

19. Debt securities in issue<br />

2007 2006<br />

Bonds 2,002 2,001<br />

Mortgage bonds 24,725 20,277<br />

26,727 22,278<br />

In 2007, the Bank issued mortgage bonds denominated in Sk in the nominal amount of Sk 3,150 million and<br />

mortgage bonds denominated in CZK in the nominal amount of CZK 1,800 million (Sk 2,273 million). Mortgage<br />

bonds in the total nominal amount of Sk 1,000 million matured and were fully repaid during 2007.<br />

In 2006, the Bank issued mortgage bonds denominated in Sk in nominal amount of Sk 3,100 million and<br />

mortgage bonds denominated in EUR in nominal amount of EUR 150 million (Sk 5,186 million). Mortgage<br />

bonds in the total nominal amount of Sk 750 million matured and were fully repaid during 2006.<br />

The repayment of mortgage bonds is funded by the mortgage loans provided to customers of the Bank (see<br />

also note 9).<br />

20. Current and deferred income tax liabilities<br />

92<br />

2007 2006<br />

Current income tax liabilities 700 -<br />

Deferred income tax liabilities 347 244<br />

1,047 244<br />

Deferred income taxes are calculated on all temporary differences using the tax rate of 19% (2006: 19%)<br />

as follows:<br />

2007 2006<br />

Loans and securities (345) (305)<br />

Property and equipment (61) (33)<br />

Other liabilities and provisions 53 86<br />

Tax losses carried forward - 2<br />

Other 6 6<br />

(347) (244)<br />

21. Provisions<br />

2007 2006<br />

Litigations 968 990<br />

The movement in provisions was as follows:<br />

1 Jan Reversal 31 Dec<br />

2007 2007<br />

Litigations (note 30) 990 (22) 968<br />

<strong>Annual</strong> <strong>Report</strong> 2007