Annual Report - VÃB banka

Annual Report - VÃB banka

Annual Report - VÃB banka

Create successful ePaper yourself

Turn your PDF publications into a flip-book with our unique Google optimized e-Paper software.

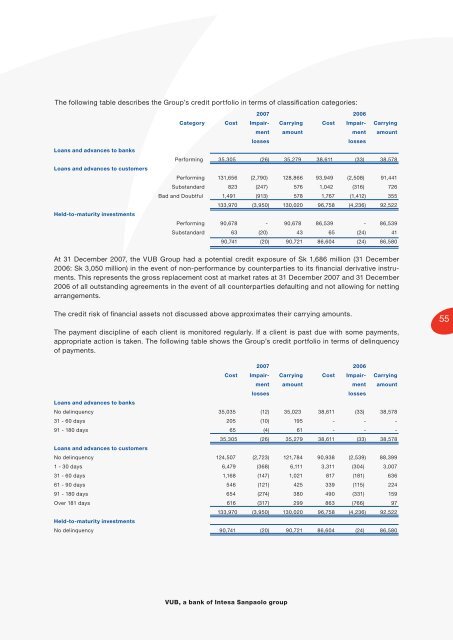

The following table describes the Group’s credit portfolio in terms of classifi cation categories:<br />

Loans and advances to banks<br />

Loans and advances to customers<br />

Held-to-maturity investments<br />

2007 2006<br />

Category Cost Impair- Carrying Cost Impair- Carrying<br />

ment amount ment amount<br />

losses<br />

losses<br />

Performing 35,305 (26) 35,279 38,611 (33) 38,578<br />

Performing 131,656 (2,790) 128,866 93,949 (2,508) 91,441<br />

Substandard 823 (247) 576 1,042 (316) 726<br />

Bad and Doubtful 1,491 (913) 578 1,767 (1,412) 355<br />

133,970 (3,950) 130,020 96,758 (4,236) 92,522<br />

Performing 90,678 - 90,678 86,539 - 86,539<br />

Substandard 63 (20) 43 65 (24) 41<br />

90,741 (20) 90,721 86,604 (24) 86,580<br />

At 31 December 2007, the VUB Group had a potential credit exposure of Sk 1,686 million (31 December<br />

2006: Sk 3,050 million) in the event of non-performance by counterparties to its fi nancial derivative instruments.<br />

This represents the gross replacement cost at market rates at 31 December 2007 and 31 December<br />

2006 of all outstanding agreements in the event of all counterparties defaulting and not allowing for netting<br />

arrangements.<br />

The credit risk of fi nancial assets not discussed above approximates their carrying amounts.<br />

The payment discipline of each client is monitored regularly. If a client is past due with some payments,<br />

appropriate action is taken. The following table shows the Group’s credit portfolio in terms of delinquency<br />

of payments.<br />

55<br />

2007 2006<br />

Cost Impair- Carrying Cost Impair- Carrying<br />

ment amount ment amount<br />

losses<br />

losses<br />

Loans and advances to banks<br />

No delinquency 35,035 (12) 35,023 38,611 (33) 38,578<br />

31 - 60 days 205 (10) 195 - - -<br />

91 - 180 days 65 (4) 61 - - -<br />

35,305 (26) 35,279 38,611 (33) 38,578<br />

Loans and advances to customers<br />

No delinquency 124,507 (2,723) 121,784 90,938 (2,539) 88,399<br />

1 - 30 days 6,479 (368) 6,111 3,311 (304) 3,007<br />

31 - 60 days 1,168 (147) 1,021 817 (181) 636<br />

61 - 90 days 546 (121) 425 339 (115) 224<br />

91 - 180 days 654 (274) 380 490 (331) 159<br />

Over 181 days 616 (317) 299 863 (766) 97<br />

133,970 (3,950) 130,020 96,758 (4,236) 92,522<br />

Held-to-maturity investments<br />

No delinquency 90,741 (20) 90,721 86,604 (24) 86,580<br />

VUB, a bank of Intesa Sanpaolo group