Annual Report - VÃB banka

Annual Report - VÃB banka

Annual Report - VÃB banka

You also want an ePaper? Increase the reach of your titles

YUMPU automatically turns print PDFs into web optimized ePapers that Google loves.

3. Summary of significant accounting policies<br />

3.1 Basis of preparation<br />

The consolidated fi nancial statements of the VUB<br />

Group (‘the fi nancial statements’) have been prepared<br />

in accordance with International Financial<br />

<strong>Report</strong>ing Standards (‘IFRS’) issued by the International<br />

Accounting Standards Board (‘IASB’) and<br />

with interpretations issued by the International Financial<br />

<strong>Report</strong>ing Interpretations Committee of the<br />

IASB (‘IFRIC’) as approved by the Commission of<br />

European Union in accordance with the Regulation<br />

of European Parliament and Council of European<br />

Union and in accordance with the Act No. 431/2002<br />

Collection on Accounting.<br />

The Group decided to apply IFRS 8 Operating Segments<br />

for the accounting period beginning on 1<br />

January 2007 as permitted by the Standard.<br />

The fi nancial statements have been prepared under<br />

the historical cost convention, as modifi ed by the<br />

revaluation of available-for-sale fi nancial assets,<br />

fi nancial assets held for trading and all derivative<br />

fi nancial instruments to fair value.<br />

The fi nancial statements are presented in millions of<br />

Slovak crowns (‘Sk’), unless indicated otherwise.<br />

Negative values are presented in brackets.<br />

20<br />

3.2 Changes in accounting policies<br />

The principal accounting policies applied in the<br />

preparation of these consolidated fi nancial statements<br />

are set out below. The accounting policies<br />

adopted are consistent with those of the previous<br />

fi n a n c i a l y e a r.<br />

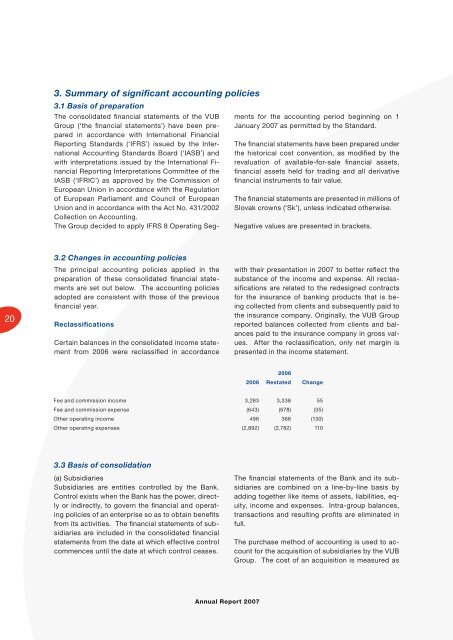

Reclassifications<br />

Certain balances in the consolidated income statement<br />

from 2006 were reclassifi ed in accordance<br />

with their presentation in 2007 to better refl ect the<br />

substance of the income and expense. All reclassifi<br />

cations are related to the redesigned contracts<br />

for the insurance of banking products that is being<br />

collected from clients and subsequently paid to<br />

the insurance company. Originally, the VUB Group<br />

reported balances collected from clients and balances<br />

paid to the insurance company in gross values.<br />

After the reclassifi cation, only net margin is<br />

presented in the income statement.<br />

2006<br />

2006 Restated Change<br />

Fee and commission income 3,283 3,338 55<br />

Fee and commission expense (643) (678) (35)<br />

Other operating income 496 366 (130)<br />

Other operating expenses (2,892) (2,782) 110<br />

3.3 Basis of consolidation<br />

(a) Subsidiaries<br />

Subsidiaries are entities controlled by the Bank.<br />

Control exists when the Bank has the power, directly<br />

or indirectly, to govern the fi nancial and operating<br />

policies of an enterprise so as to obtain benefi ts<br />

from its activities. The fi nancial statements of subsidiaries<br />

are included in the consolidated fi nancial<br />

statements from the date at which effective control<br />

commences until the date at which control ceases.<br />

The fi nancial statements of the Bank and its subsidiaries<br />

are combined on a line-by-line basis by<br />

adding together like items of assets, liabilities, equity,<br />

income and expenses. Intra-group balances,<br />

transactions and resulting profi ts are eliminated in<br />

full.<br />

The purchase method of accounting is used to account<br />

for the acquisition of subsidiaries by the VUB<br />

Group. The cost of an acquisition is measured as<br />

<strong>Annual</strong> <strong>Report</strong> 2007